Sensational Adidas Financial Ratios

According to Forbes 2015 Adidas brand value is m ore than 171 billion.

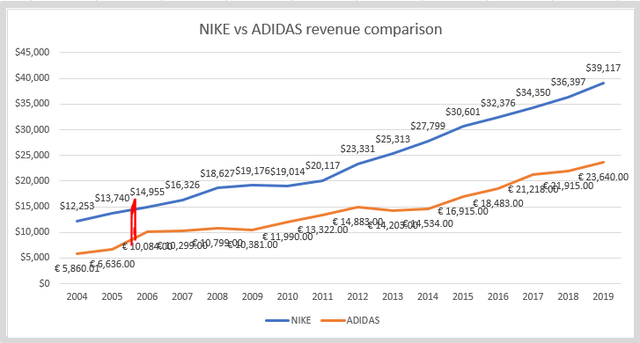

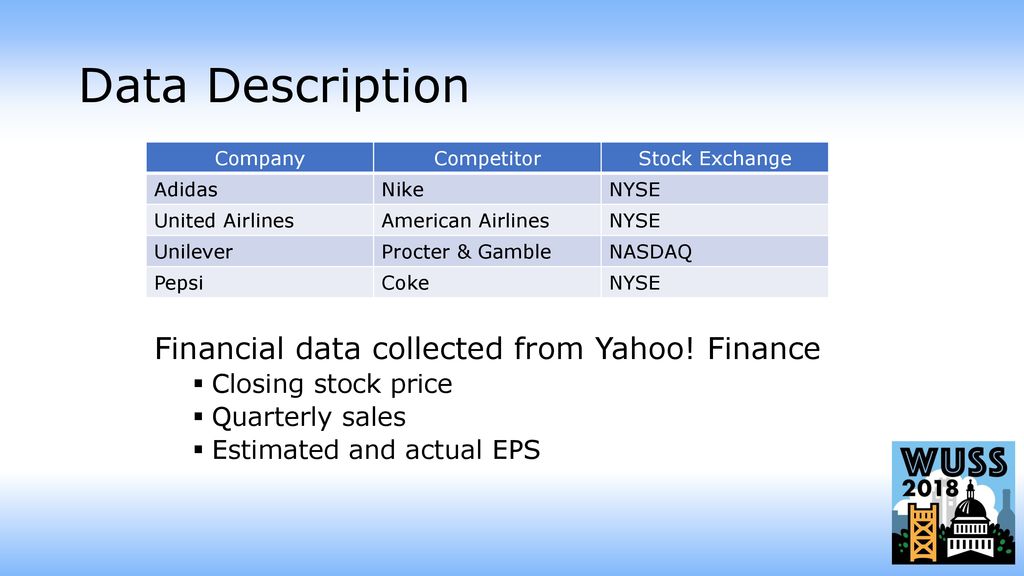

Adidas financial ratios. Financial Publications In our Download Center you find all publications related to our quarterly and full year results. With the Annual Report 2019 adidas communicates financial and non-financial information in a combined publication. Nikes net income is triple Adidass and Nikes revenue is 15 times Adidass.

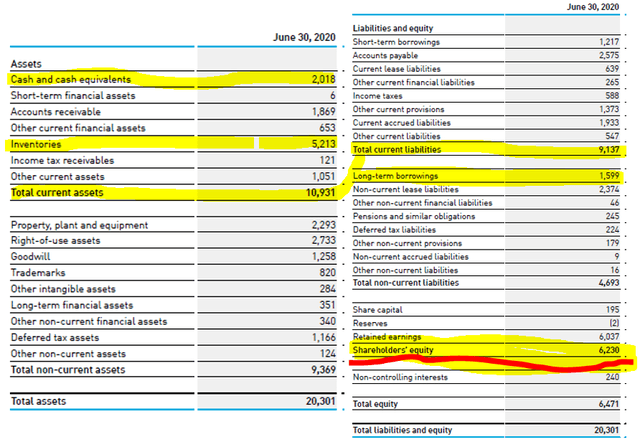

The report provides a comprehensive overview of the financial environmental and social performance of adidas in the 2019 financial year. To day Adidas has 1746 concept stores 779 factor y outlets and 316 concession corners and other around the world. It is calculated as a companys Total Current Assets divides by its Total Current Liabilities.

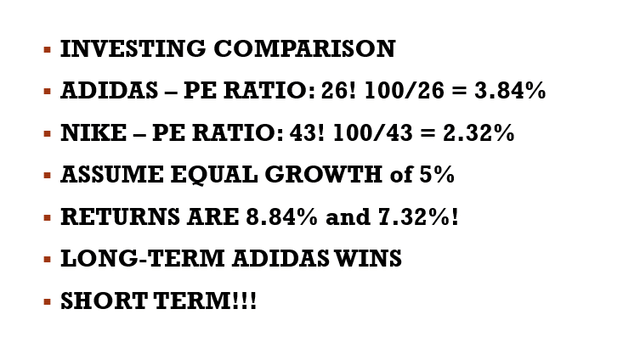

PE Ratio TTM 6394. It generally indicates good short-term financial strength. 1542 billion.

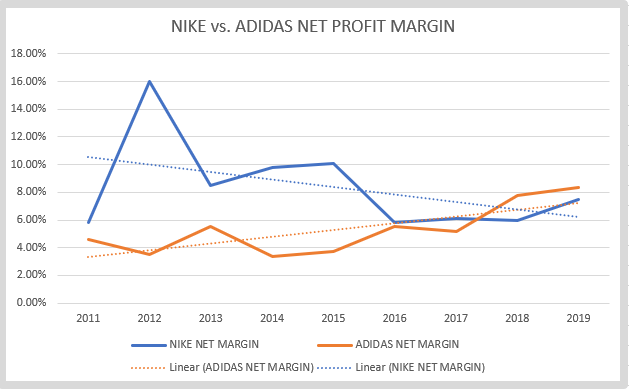

PE Ratio wo extraordinary items 13458. Recommendation Profitability Net Profit Margin KEY FINANCIAL RATIOS Liquidity Current Ratio Liquidity Debt-to-Equity Ratio Profitability Return on Equity Days in Inventory DUPONT-ANALYSIS DuPont-Analysis for Nike Adidas and Puma 2004-2008 PRO-FORMA ANALYSIS Pro Forma Analysis Total Current Assets Pro Forma Analysis Gross Profit Pro. Nikes owners equity liabilities but Adidass liabilities owners equity.

Price to Book Ratio 900. The EVEBITDA NTM ratio of adidas AG is significantly higher than the average of its sector Footwear. Nike sales grew 5 and Adidas grew 14 in sales.

Adidas AGs current ratio for the quarter that ended in Mar. Find out all the key statistics for ADIDAS AG ADDYY including valuation measures fiscal year financial statistics trading record share statistics and more. Enterprise Value to.