Heartwarming Bmw Ratio Analysis

- The Key ratio of BMW Industries Ltd.

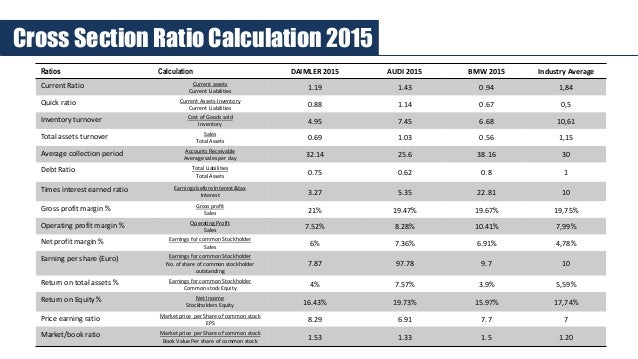

Bmw ratio analysis. Financial Ratio Analysis The financial ratio analysis shows that Audi is performing better and being managed better than BMW. A more conservative ratio would be a current ratio of more than 2 times. Based on Table 6 below the various liquidity ratios such as quick ratio and current ratio are shown.

There isnt necesarily an optimum PE ratio since different industries will have different ranges of PE Ratios. This metric is considered a valuation metric that confirms whether the earnings of a company justifies the stock price. Overall the liquidity position of BMW is marginally satisfactory as the current and quick ratio fall around the range of 1.

The balance sheets evolution 6. PriceEarning Currently 24th Jan 2014 PE Ratio 1067 years Interpretation The PE ratio for BMW as of 24th January 2014 is 1067 years. Long term analysis 5.

We can conclude that every year BMW is generating more profit related to each share and. In 2019 BMW haditsinventory ratio peak followed by 2018 2017 then 2016. It It meansthatitis in a good position for growthsinceits sales are improvingeveryyear.

Company including debt equity ratio turnover ratio etc. For most companies the ratio is usually between 15-2. Financial Ratios Analysis of BMW Industries Ltd.

Third part pages 45 to 68. This table contains critical financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others based on. BMW strategies are conceived on a long-term basis and are.