Unbelievable Cash Flow Statement Indirect And Direct Method

However both the approaches have the arguments pros and cons.

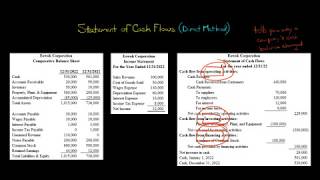

Cash flow statement indirect and direct method. The statement starts with the operating activities section. In the Indirect method of cash flow statement the net profit or loss is adjusted for the effects of the below type of transactions. The indirect method is less favored by the standard-setting bodies since it does not give a clear view of how cash flows through a business.

While the indirect method is easy to do most banks prefer a cash flow statement prepared using direct method as it contains more information. Information for indirect cash flow is simple to compile as it comes directly from the income statement and balance sheet. In the direct method the cash flow from operating activities is computed directly as the net sum of all operating cash flows.

Both methods of cash flow analysis yield the same total cash flow amount but the way the information is presented is different. The main difference between the direct method and the indirect method of preparing cash flow statements involves the cash flows from operating expenses. Indirect Method Statement Format.

Under the direct method you present the cash flow from operating activities as actual cash outflows and inflows on a cash basis without beginning from net income on an accrued basis. Either the direct or indirect method may be used to report net cash flow from operating activates. We are now ready to prepare the statement of cash flows.

We will look at both methods with the same. Ordinarily this information is readily available through your accounting system. Direct and indirect are the two different methods used for the preparation of the cash flow statement of the companies with the main difference relates to the cash flows from the operating activities where in case of direct cash flow method changes in the cash receipts and the cash payments are reported in cash flows from the operating activities section whereas in case of indirect cash flow method changes in assets and liabilities accounts is adjusted in the net income to arrive cash flows.

The statement of cash flows under indirect method for Tax Consultation Inc. Items of income or expense associated with investing or financing cash flows. The direct method the income statement is reformulated on a cash basis rather than an accrual basis from the top of the statement the income part to the bottom the expense part.