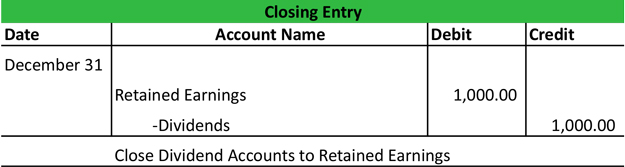

Formidable Closing Entry For Dividends

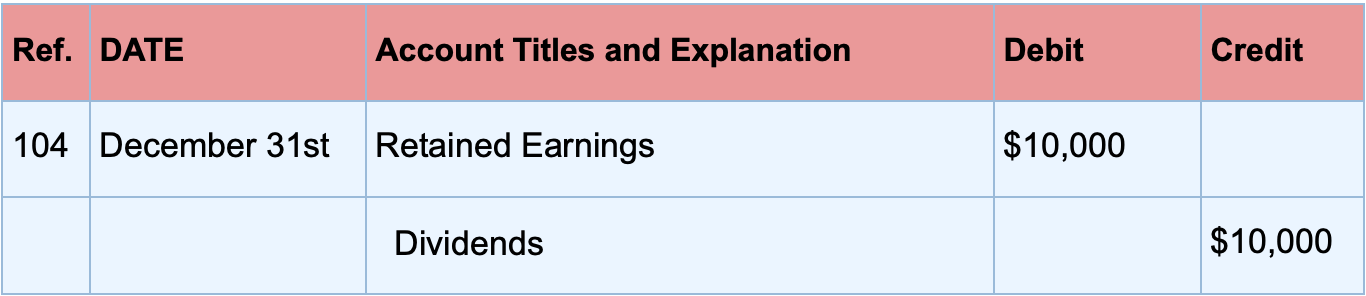

The debit is a charge against the retained earnings of the business and represents a distribution of the retained earnings to the shareholders.

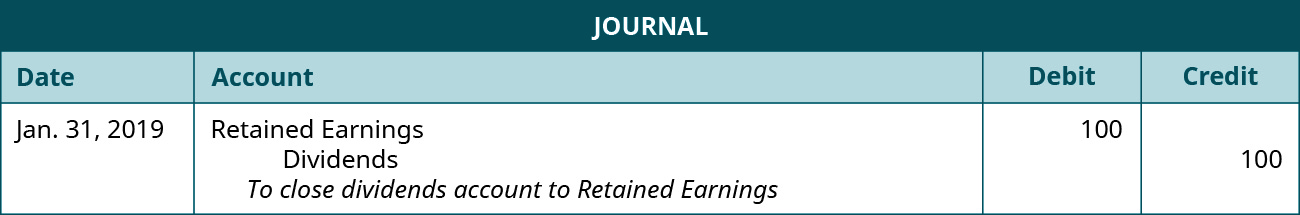

Closing entry for dividends. Dividends Declared Journal Entry Bookkeeping Explained. Write the date when the closing entry is recorded in the general journal. Enter the day and month when the company closes the dividend account for the period.

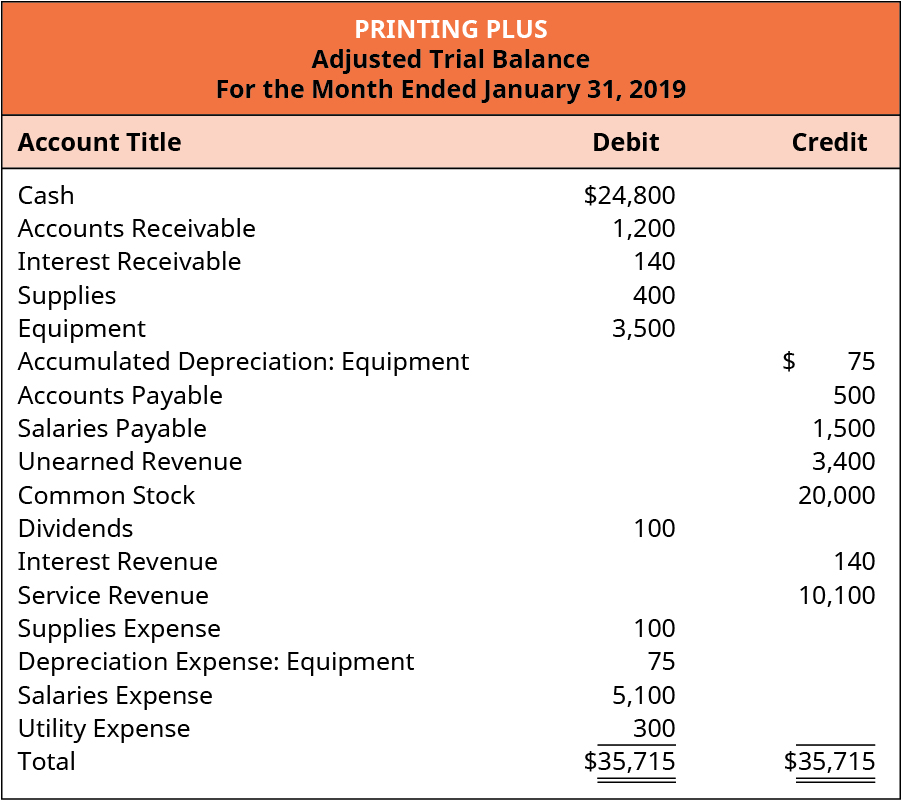

In other words temporary accounts are reset for the recording of transactions for the next accounting period. When dividends are declared by corporations they are usually recorded by debiting Dividends Payable and crediting Retained Earnings. These journal entries condense your accounts so you can determine your retained earnings or the amount your business has after paying expenses and dividends.

Instead declaring and paying dividends is a method utilized by corporations to return part of the profits generated by the company to the owners of the companyin this case its shareholders. Note that by doing this it is already deducted from Retained Earnings a capital account hence will not require a closing entry. Business Accounting Closing entries The entry to close dividends would include a debit to.

Debit Net income for 1022 million 08. A company that lacks sufficient cash for a cash dividend may declare a stock dividend to satisfy its shareholders. The Accounting Cycle And Closing Process.

The fourth entry requires Dividends to close to the Retained Earnings account. The closing process reduces revenue expense and dividends account balances temporary accounts to zero so they are ready to receive data for the next accounting period. Closing entries are journal entries created at the end of an accounting period to transfer your temporary account balances into one permanent account.

Closing entries are manual journal entries at the end of an accounting cycle to close out all the temporary accounts and shift their balances to permanent accounts. Accountants may perform the closing process monthly or annually. Credit Cash for 1022 million b.