Looking Good Forecast Income Statement Deferred Tax Computation Example

For example income profit before tax of ABC Ltd.

Forecast income statement deferred tax computation example. Financial modeling deferred tax is an important step in the calculation of free cash flow Free Cash Flow FCF Free Cash Flow FCF measures a companys ability to produce what investors care most about. Temporary difference leading to a deferred tax liability DTL Below is an example of the creation of a deferred tax liability. Company buys a 30 piece of equipment PP.

Cover some of the more complex areas of preparation of a deferred tax computation for example the calculation of deferred tax balances arising from business combinations. The first step in our cash flow forecast is to forecast cash flows from operating activities which can be derived from the balance sheet and the income statement. The sections of the guide are as follows.

Deferred tax calculation example in sri lanka. Any number of people could be using your income statement forecasts to make decisions about your business. The tax rate is 30.

Deferred Income Tax Definition. Deferred Tax Published 15 November 2017 last updated 5 March 2018 5 Illustrative example. Income Tax Benefit on income statement is 35.

A miscalculation or faulty estimation can be amplified drastically causing a vastly different forecasted amount of income. Deferred Tax Asset Value on balance sheet is. This would result in a deferred tax asset of 300 ie.

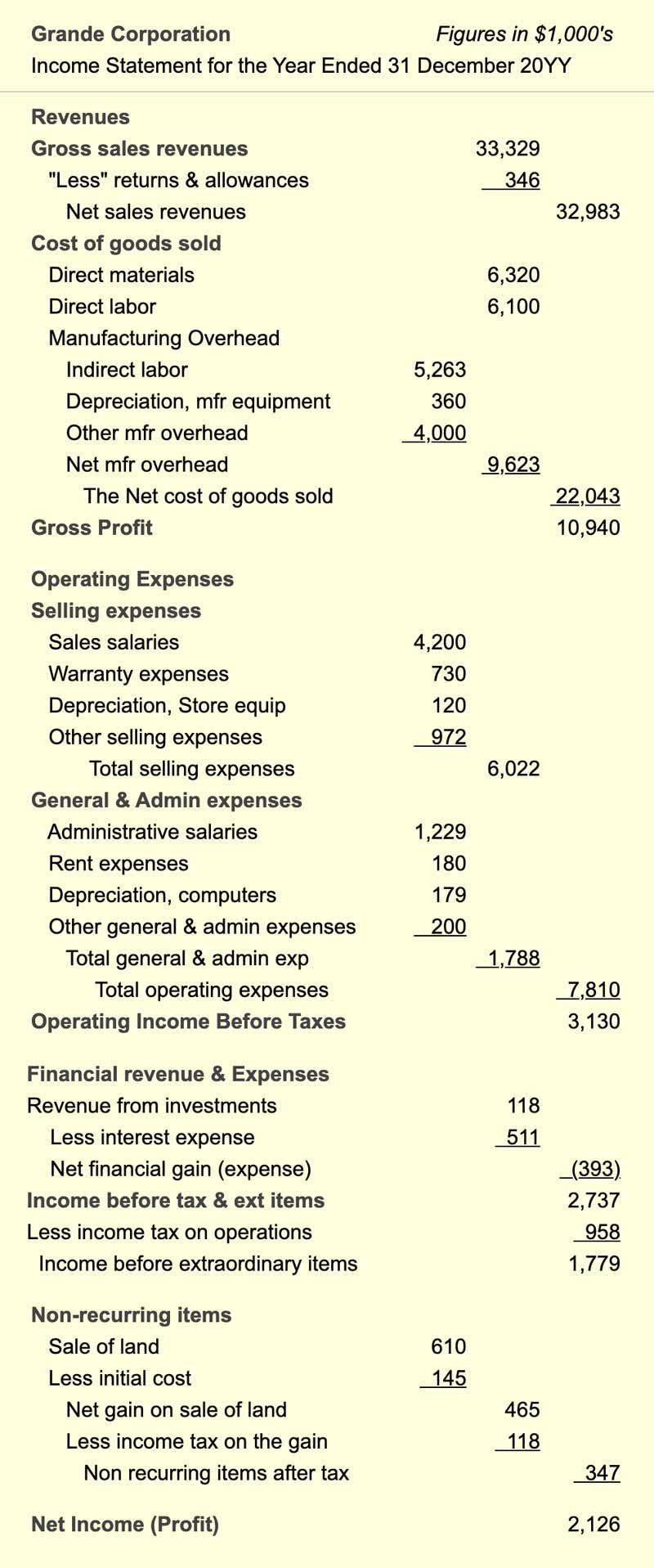

To understand deferred tax it shall be noted at the outset that as per the accounting standards followed by companies there are two different financial reports which an organisation prepares every fiscal year an income statement and a tax statement. Financial Modeling of Deferred Tax. Income Tax Expense on the income statement is 0.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)