Stunning Ifrs Other Comprehensive Income

Other Comprehensive Income trong bài viết hôm nay nha.

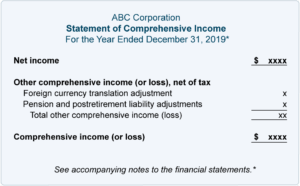

Ifrs other comprehensive income. Like US GAAP the income statement captures most but not all revenues income and expenses. Interest expense or income. Other comprehensive income is those items of income and expense that are not recognised in profit or loss in accordance with IFRS.

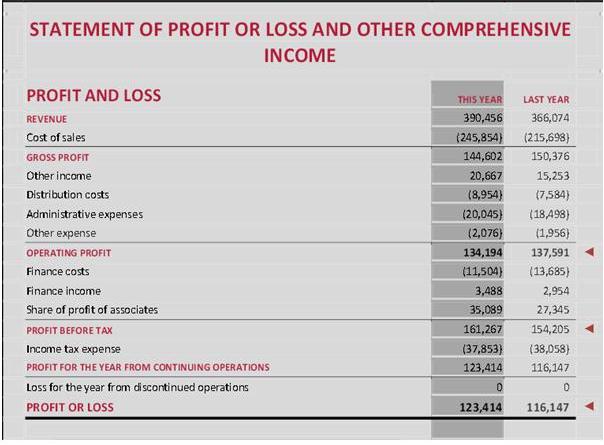

Other Comprehensive Income thuộc chủ đề về Thắc Mắt đang được rất nhiều bạn lưu tâm đúng không nào. Through Other Comprehensive Income FVOCI. These excluded items are referred to as other comprehensive income Under both IFRS and US GAAP there are four types of items that are treated as other comprehensive income.

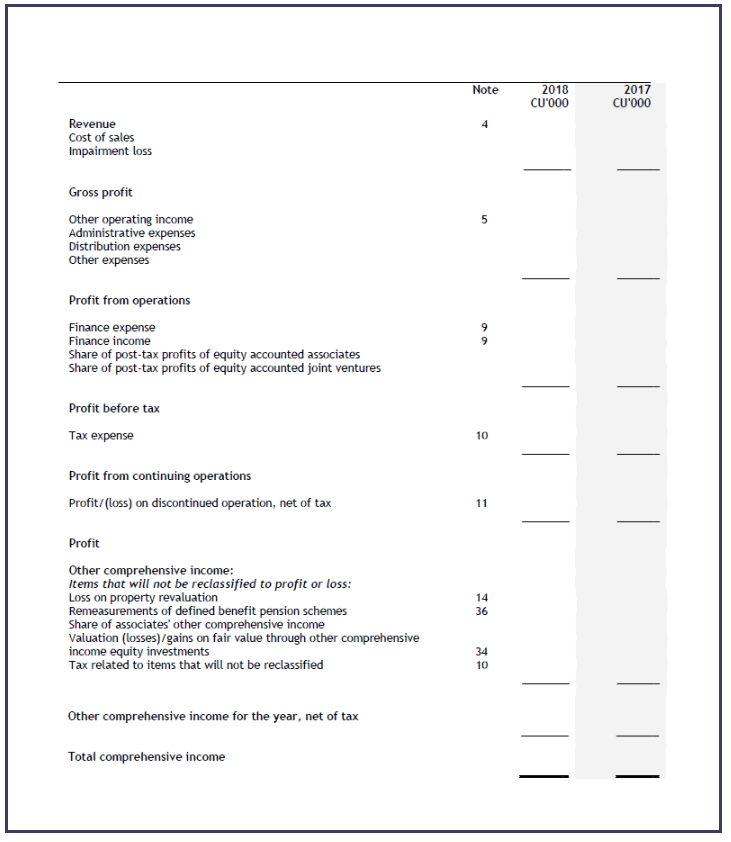

Gains and losses on remeasuring an investment in equity instruments where the entity has elected to present them in other comprehensive income in accordance with IFRS 9 The effects of changes in the credit risk of a financial liability designated as at fair value through profit and loss under IFRS 9. Các bạn đang xem chủ đề về. Under IFRS the income statement is labeled statement of profit or loss.

Hôm nay Hãy cùng HappyMobilevn tìm hiểu Comprehensive Income Là Gì ngôn từ Ifrs. Other Comprehensive Income thuộc chủ đề về Hỏi đáp đang được rất nhiều bạn lưu tâm đúng không nào. And 2 interest expense or income.

Defined benefit cost will be split into two categories. Statement of Comprehensive Income and Income Statement of the IFRS for SMEs Standard are set out in this module and shaded grey. In business accounting other comprehensive income OCI includes revenues expenses gains and losses that have yet to be realized and are excluded from net income on an income statement.

Upon derecognition amounts in other comprehensive income are reclassified to profit or loss. FVTOCI with interest impairment and foreign exchange gains and losses recognised in profit or loss with all other gainslosses recognised in other comprehensive income. For a hedge of a net position whose hedged risk affects different line items in the statement of profit or loss and other comprehensive income any hedging gains or losses in that statement are presented in a separate line from those affected by the hedged items.