Ideal Pepsico Financial Performance

FINANCAIL PERFORMANCE Performance is used to indicate firms success conditions and compliance.

Pepsico financial performance. Combined Circular to Pioneer Foods Shareholders. The company is forecasting. What You Should Know.

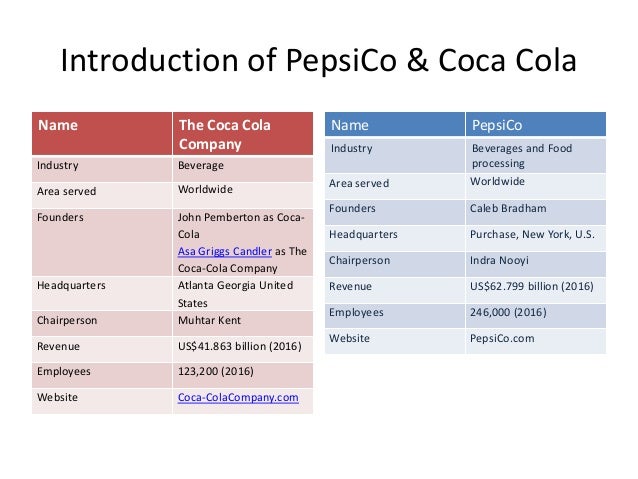

Rating as of Jul 13 2021. During a period from transactions and other events and circumstances from non-owners sources. As a global company PepsiCo must address the issues shown in this SWOT analysis to minimize barriers to its global performance.

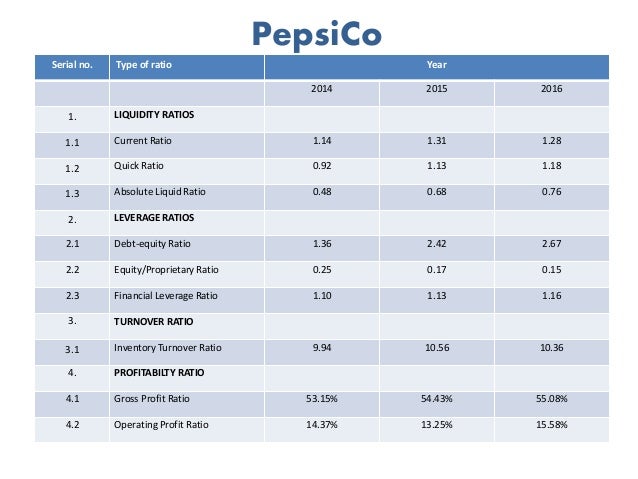

The average ratios for this industry are slightly better than the averages for all industries. PepsiCo s SWOT analysis presents major challenges in the areas of competition changing consumer behaviors and product development. Net revenue growth and productivity savings contributed to operating profit performance and were partially offset by certain operating cost increases an 8-percentage-point impact.

Activision Blizzard Inc ATVI Gains But Lags Market. Financial performance refers to the act of performing financial activity. Combined Circular to Pioneer Foods Shareholders.

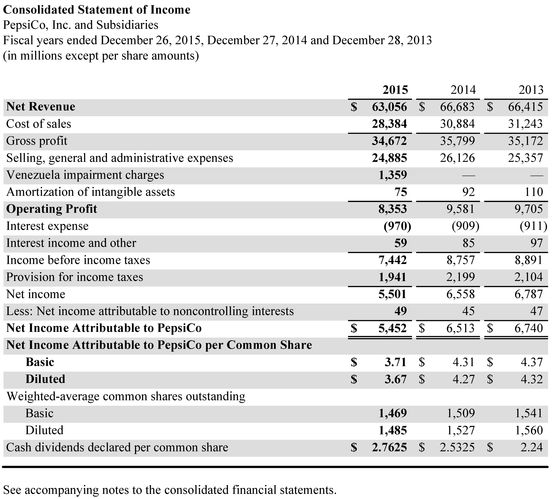

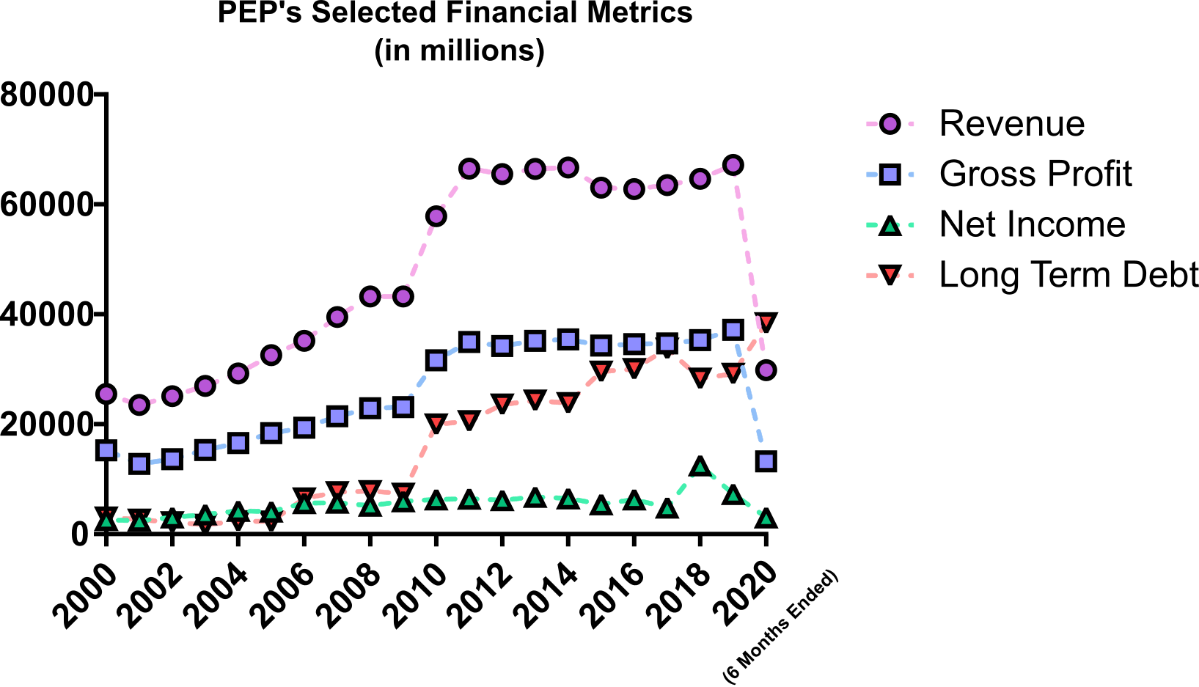

Cash Tender. Income statements balance sheets cash flow statements and key ratios. It was the third straight quarter.

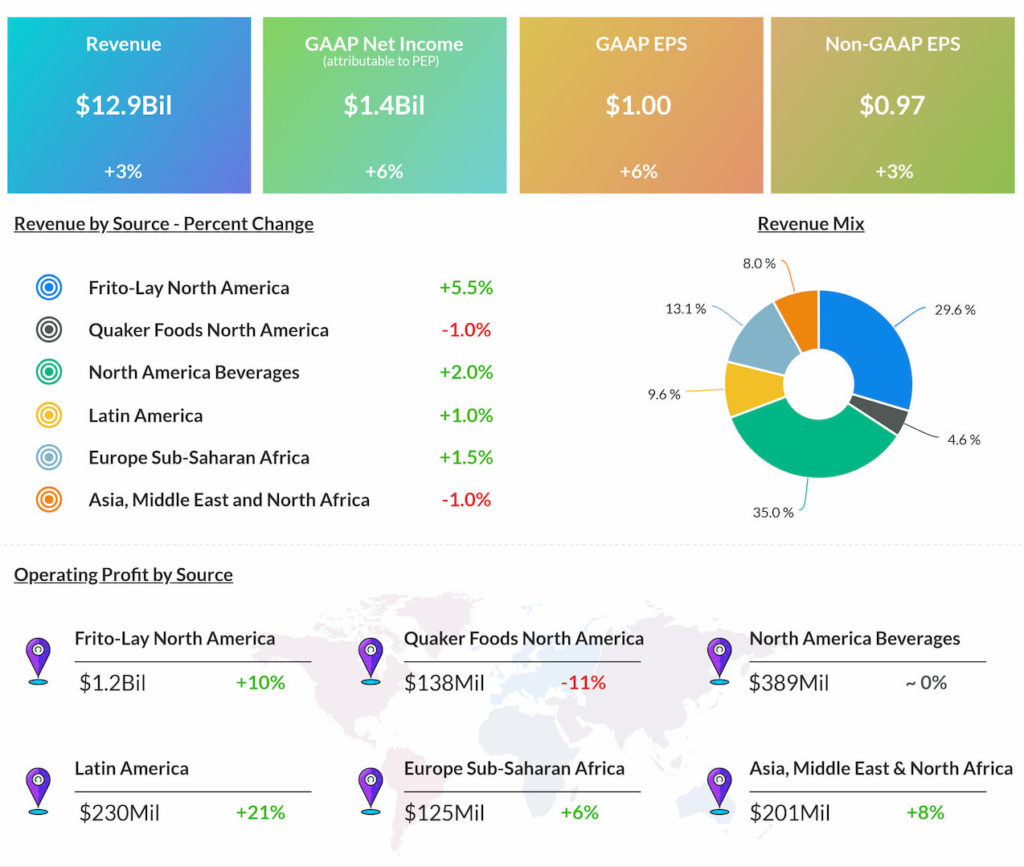

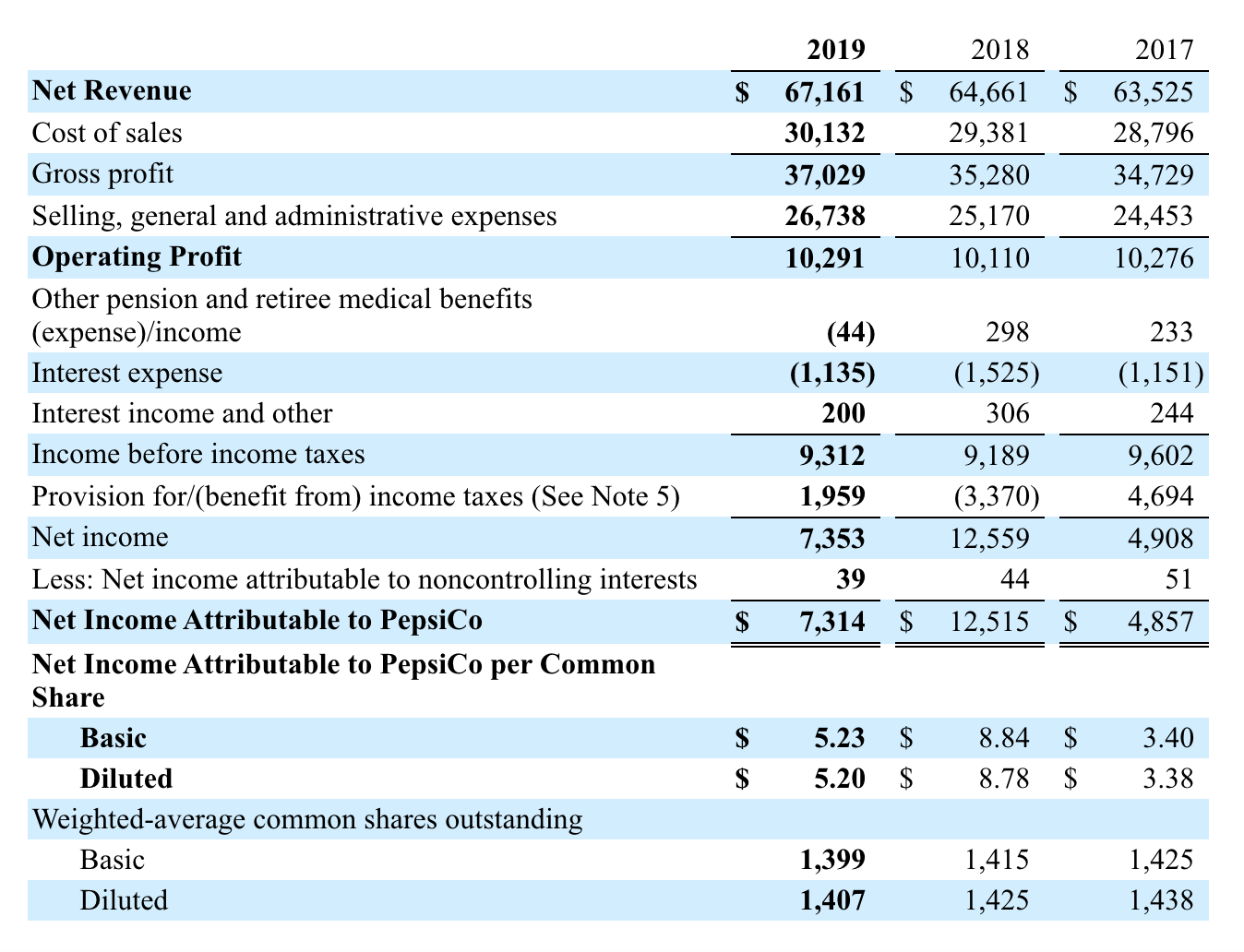

In 2020 Pepsi expects 4 organic revenue growth and 7 earnings per share growth after stripping out currency fluctuations. Quote Stock Analysis News Price vs Fair Value Sustainability Trailing Returns Financials Valuation Operating. Provides 2021 Financial Outlook Reported GAAP Fourth Quarter and Full-Year 2020 Results Fourth Quarter Full-Year Net revenue growth 88 48 Foreign exchange impact on net revenue 2 2 Earnings per share EPS 133 512 EPS change 5 2 Foreign exchange impact on EPS 2 2.