Outstanding Pro Forma Financial Statements Are Used For

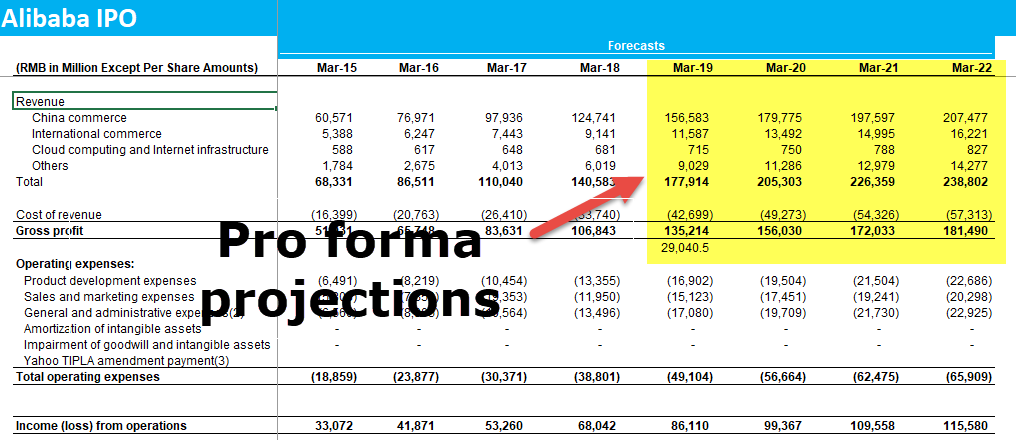

Pro forma financial statements focus on the future using the past information as a guideline.

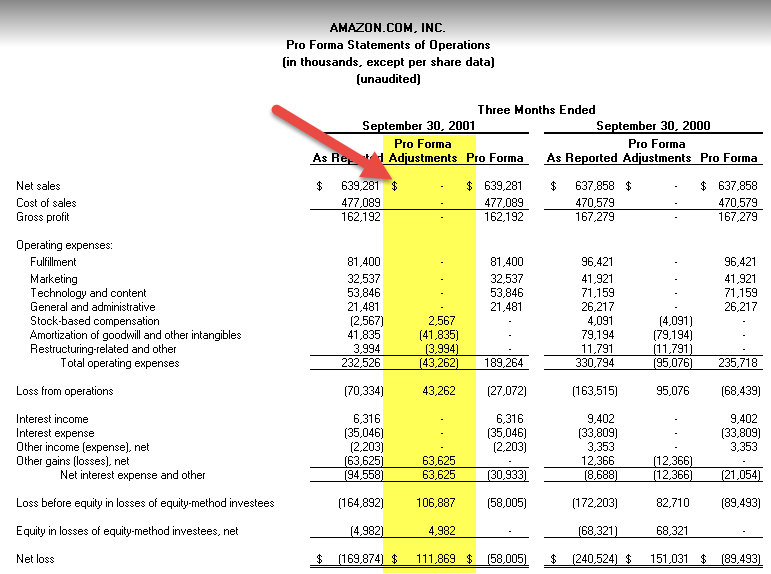

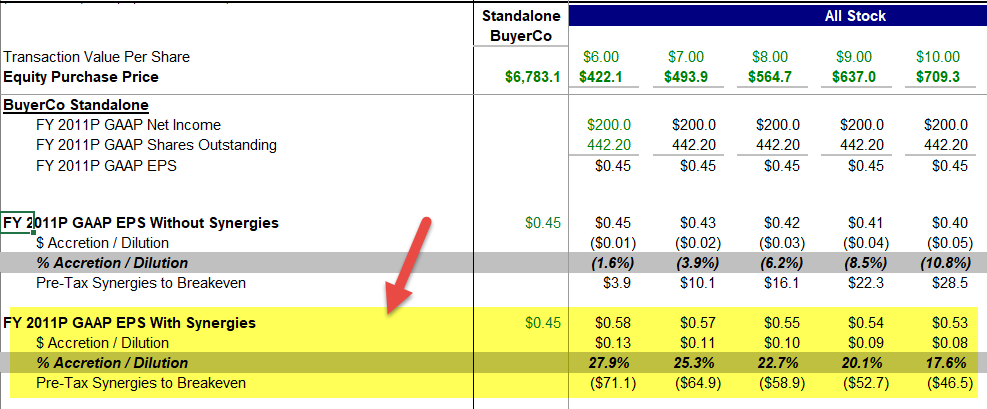

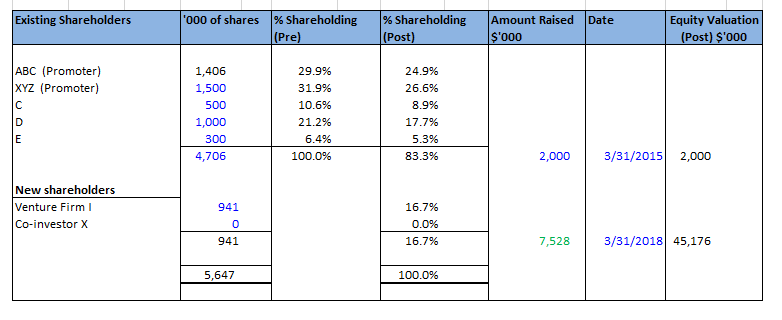

Pro forma financial statements are used for. Pro forma financial statements are sought after by investors and entrepreneurs for different reasons. Pro forma financial statements are a useful business planning tool whose purpose is to provide additional information to managers investors and lenders about the effect of a proposed transaction. What are Pro Forma Financial Statements.

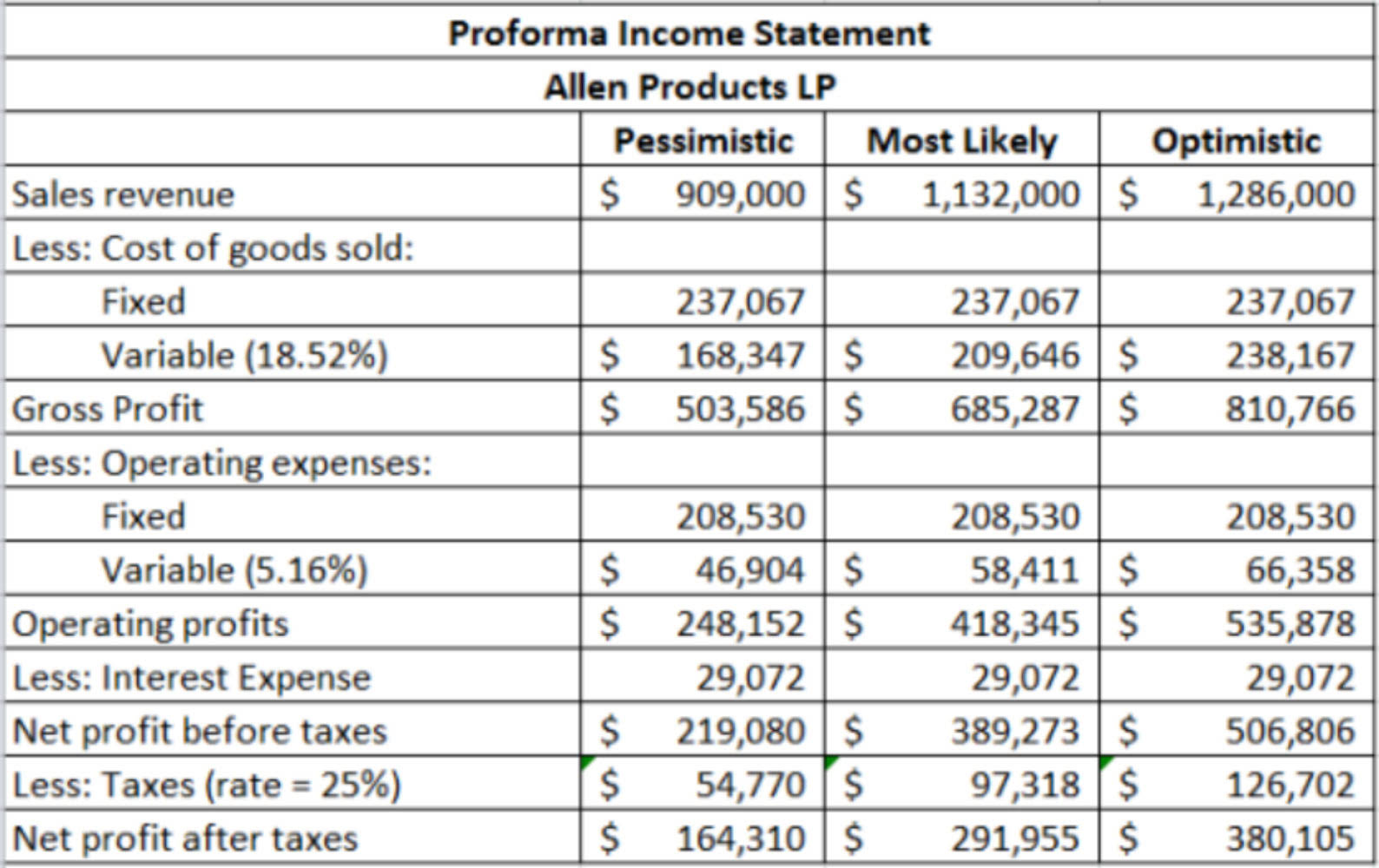

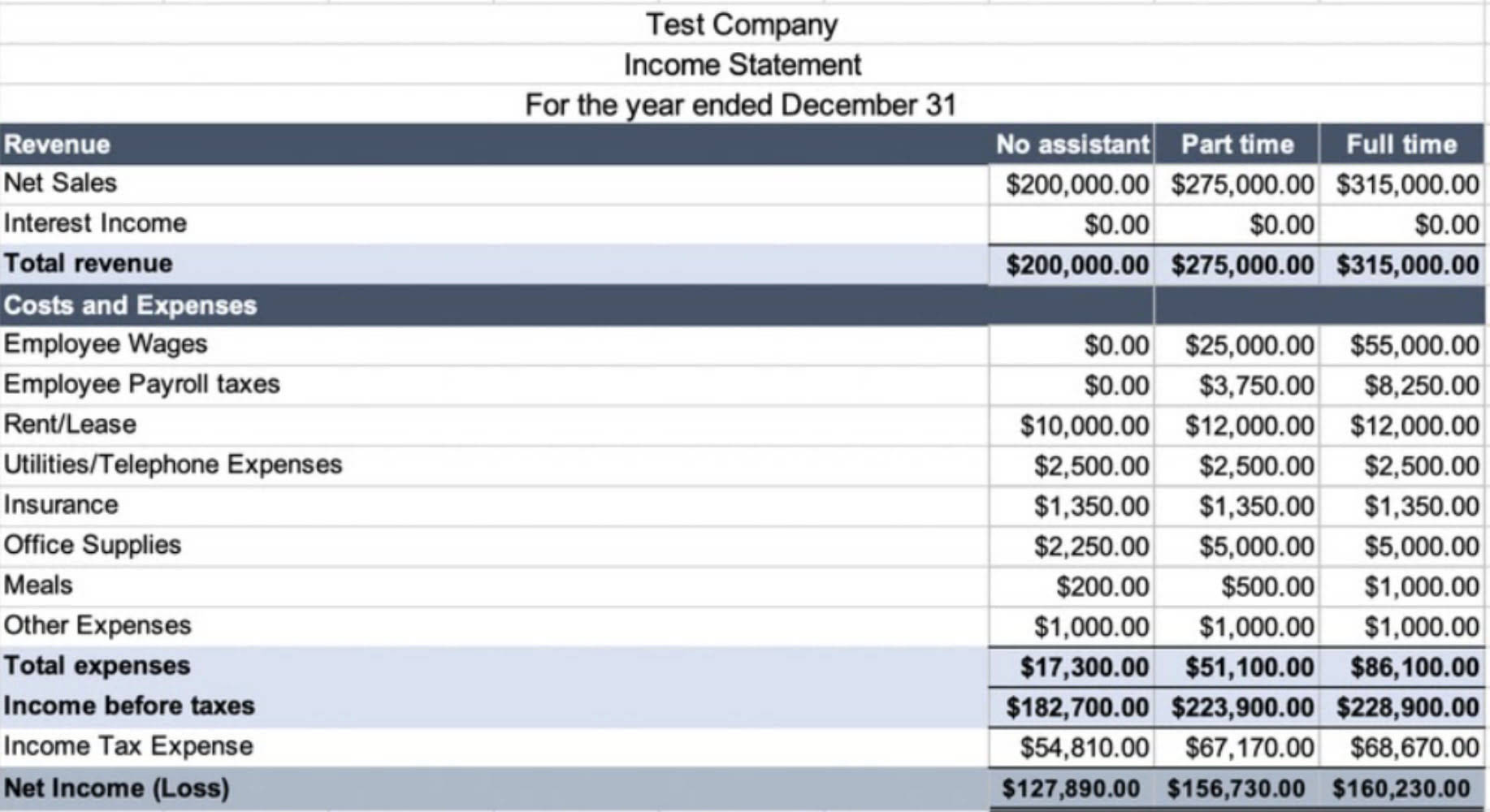

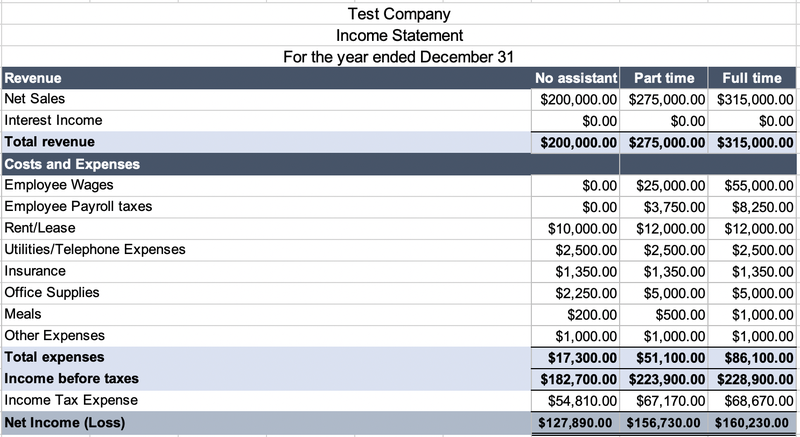

A strategic business owner can use a pro forma in the following ways. Pro-forma financial statements are also prepared and used by corporate managers and investment banks to assess the operating prospects for their own businesses in the future and to assist in the. Pro forma financial statements essentially forecast the future.

Just like the previous section a company can use a pro forma income statement balance sheet and cash flow statement to project how a significant event might affect its financial position. Most companies will use a percentage growth. Financial reporting comes standard with Bench.

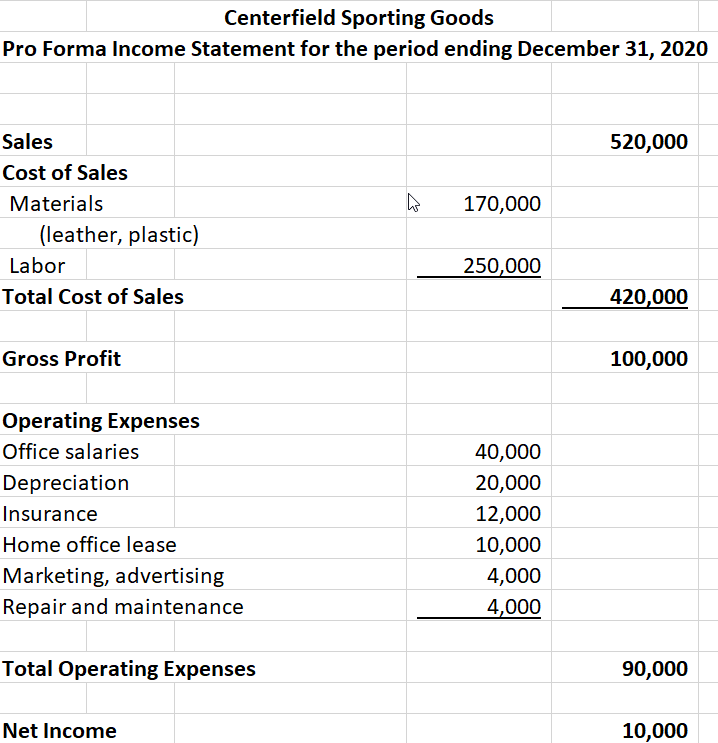

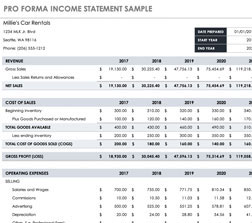

This includes any transaction or event that results in the registrant obtaining control over another entity. Pro forma financial statements are valuable tools managers can use to plan for the future anticipate and control risks and acquire funding for their business. The income statement is perhaps the most important of all pro forma statements.

Pro-forma financial statements are created by looking at and predicting budget changes based on various factors. Standard accounting statements like the balance sheet look at historical financial information but pro forma documents look forward to help you predict future income through different types of accounting statements. Having these estimates will help the company budget for future cash expenditures and prepare for strong or weak future profits.

31101 Pro forma financial information is required if a significant business combination has occurred in the latest fiscal year or subsequent interim period or is probable see Section 20054. They consider both the best case scenario and the worst case scenario allowing you to have a more knowledgeable approach to your business transactions. These projected financial statements are referred to as pro forma financial statements.