Outrageous Reserve For Doubtful Debts In Balance Sheet

It is an anticipated loss therefore provision for doubtful debts is necessary.

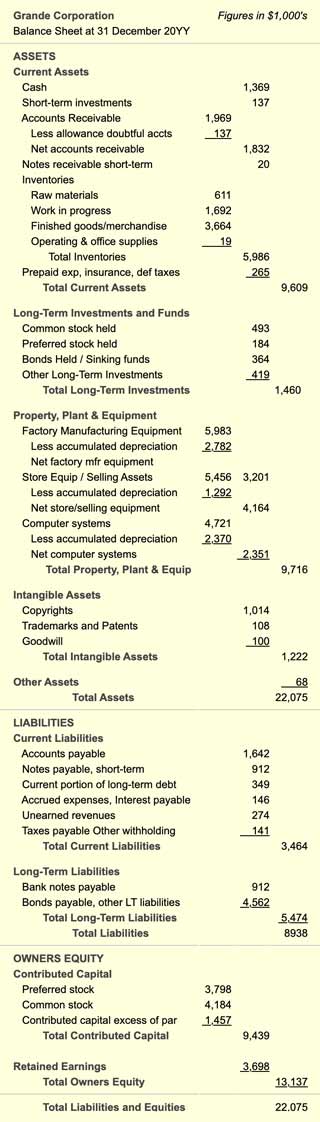

Reserve for doubtful debts in balance sheet. The 1000000 will be reported on the balance sheet as accounts receivable. It may be included in the companys selling. This includes business payments due and loan repayments.

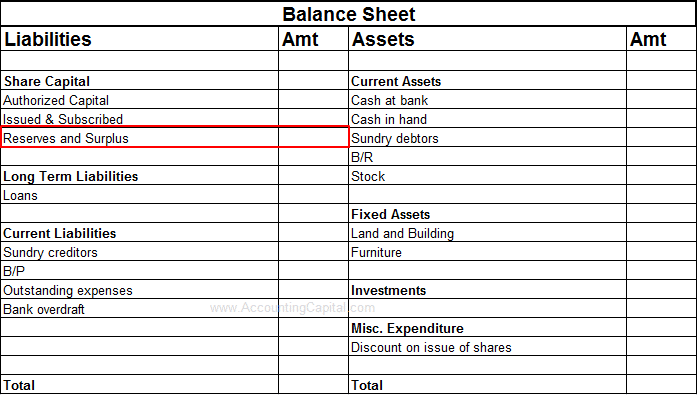

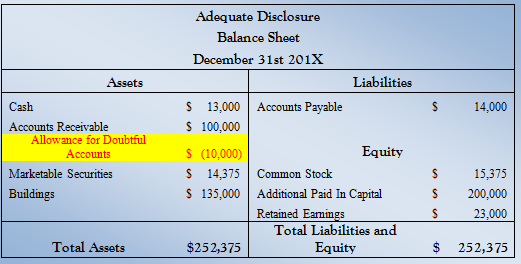

This is because it is a contra-asset account which is netted from the Accounts Receivable balance. Difference between Reserves and Provisions The terms reserves and provisions have been used as similar but there are differences between them. The two line items can be combined for reporting purposes to arrive at a net receivables figure.

The provision for doubtful debts is an accounts receivable contra account so it should always have a credit balance and is listed in the balance sheet directly below the accounts receivable line item. Statement of Financial PositionBalance Sheet Unlike the rest of the accounts the Allowance for Doubtful Accounts AFDA is not something that shows up on the financial statements. The increase in provision for doubtful debts will reduce the profit and also reduce the value of the trade receivables in the balance sheet.

We can also see that at any point of time the total amount of provision for doubtful debts is equal to the total net amount charged to the income statement right from the first year on account of change in provision for doubtful debts. The receivables account has a natural debit balance while the bad debt reserve has a natural credit balance. Bad Debt Expense Ac or Allowance for Bad debt Ac.

This approved list should be sent to the GM FA for obtaining. A journal entry is also passed in books of accounts by crediting debtors and debiting allowance for doubtful debts Understanding Doubtful Debts Reserve. Provisions should be made on a case-to-case basis and after a careful evaluation of the facts of each case.

A useful tool in estimating the allowance would be the accounts receivable aging report which states how far past due specific customers balances are that make up accounts receivable. Provision for Doubtful Debts-. The balance sheet approach estimates the allowance for doubtful accounts based on the accounts receivable balance at the end of each period.