Impressive Tax Income Statement Interim Balance Sheet Example

There are 4 key difference between income statement vs balance sheet.

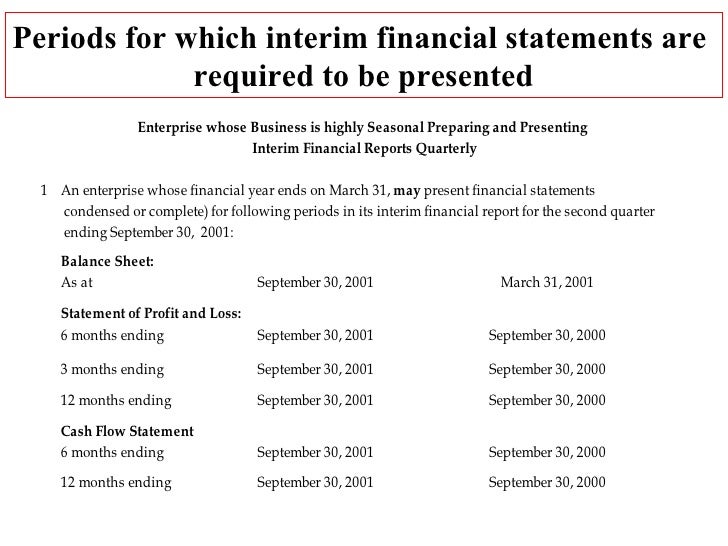

Tax income statement interim balance sheet example. Deferred income tax liabilities. Of independent assurance tax and advisory firms. To prepare interim statements for the second quarter of 2009 in accordance with SFAS 154 net income as originally reported in the first and second quarters of 2008 as well as in the first quarter of 2009 is restated to reflect the.

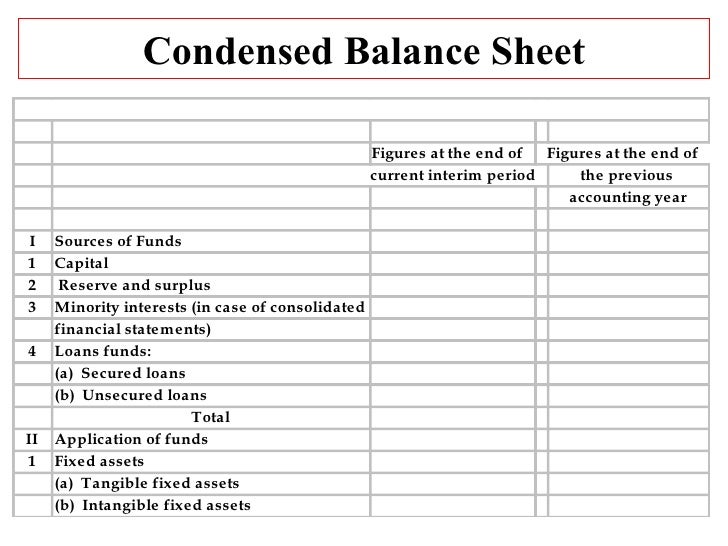

By examining a sample balance sheet and income statement small businesses can better understand the relationship between the two reports. The most common interim statement may be the quarterly report. Income statement is prepared for specific period For 12 months 6 months 3 months.

Thus the income or expense item will eventually be allowed for both GAAP and income tax purposes with the only difference being the timing of the item of income or expense. The balance sheet the income statement and the cash flow statement. The IPS Stockholders shall deliver to Buyer and BBLU pursuant to Section 11c below prior to the Closing Date the unaudited consolidated balance sheet of IPS as of a date ended the last complete month prior to the Closing Date the Balance Sheet Date and the consolidated income statement for the interim period ended at the Balance Sheet Date the Interim.

Updated Nov 7 2018. Gross operating pretax and after-tax. Assets are things your business owns such as equipment inventory accounts receivable or cash.

Income Tax Expense 35 Income Tax Expense on the income statement is 0. Year end date quarter end date etc. Income Tax Benefit on income statement is 35.

Interim Dividend Example On Feb. In the multi-step income statement four measures of profitability shown with an asterisk are revealed at four critical junctions in a companys operations. No benefit from the NOL Carryforward is reported on the 19x1 financial statemen ts.