Outstanding Treatment Of Bank Loan In Cash Flow Statement

The interest on bank loans is usually an expense of the accounting period in which the interest is incurred.

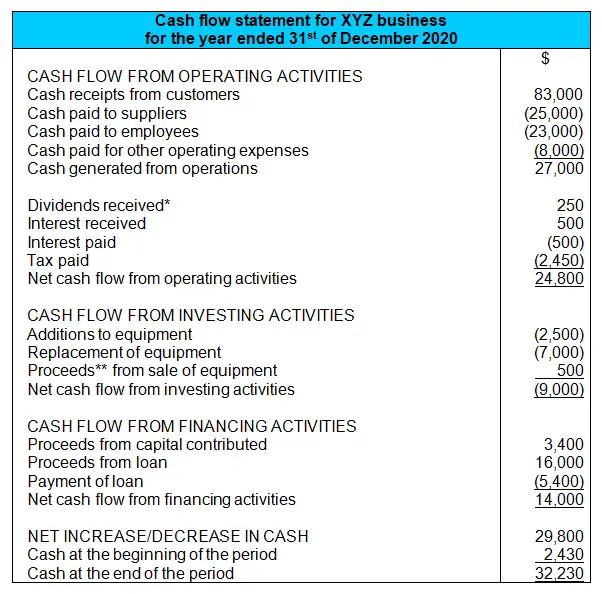

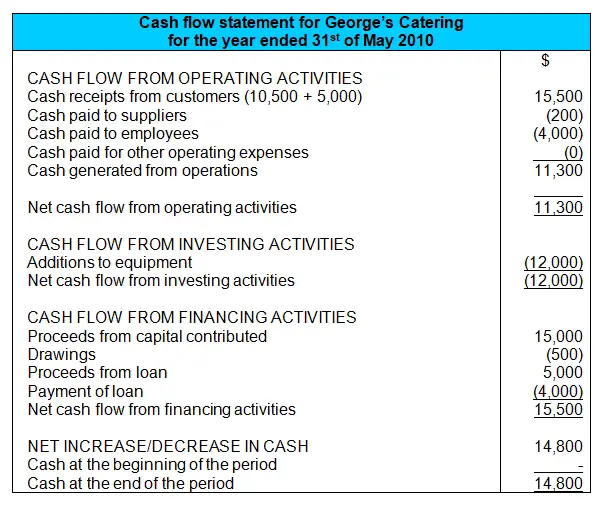

Treatment of bank loan in cash flow statement. Distinguish between operating activities investing activities and financing activities. Dividends paid are normally treated as financing activity because they are a cost of obtaining financial resources in the form of equity investment. This standard prescribe the guide lines which require an entity to present information about its historic cash flows and changes in those cash flows during the accounting period to intimate the users of financial statements about the cash generating ability and cash needs of the entity in the form of statement of cash flows by classifying such cash flows into operating investing and.

But if the repayment does not involve cash outflow then such transaction will not be disclosed in the statement of cash flows. However the interest paid also causes a change in the companys balance sheet and statement of cash flows. Income taxes and sales taxes 8.

Presentation of operating cash flows using the direct or indirect method 7. Cash flows as a list showing cash receipts receipts and cash payments payments and the net change in cash from three activities are operating activities ongoing and investing activities and financing activities for the facility economical during a specific time period a manner conducive to reconcile the cash balance in the first period The last period. Reporting Short-Term Bank Loans on the Statement of Cash Flows.

Therefore the interest appears on the income statement and reduces a companys net income. Cash Flows from Capital and Related Financing Activities. First things first a loan can be repaid in number of ways for example in cash by handing over certain asset or converting debt to shares etc.

Classification of certain cash payments and receipts in the statement of cash flows which has led to diversity in practice. Shareholders who buy shares in the entity may expect dividends in the same way a bank will expect interest on a loan. Financing cash flows typically include cash flows associated with borrowing and repaying bank loans and issuing and buying back shares.

Dividends and interest expense. The payment of a dividend is also treated as a financing cash flow. However for understanding of a common man you can consider like this that Loans advances are on the asset side of the balance sheet.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)