Top Notch Unearned Rent Revenue Balance Sheet

Classic examples include rent payments made in advance prepaid insurance legal reta.

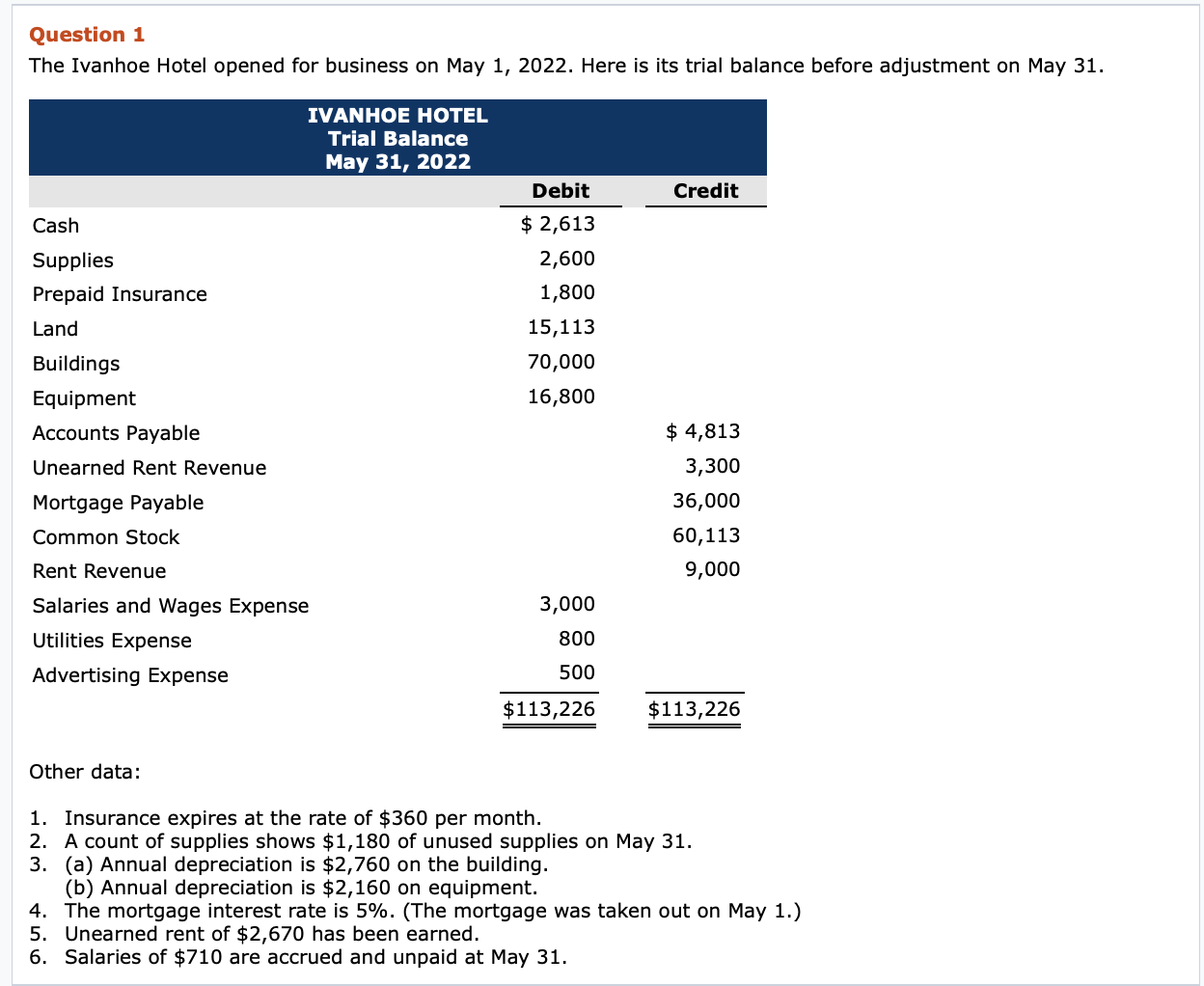

Unearned rent revenue balance sheet. Unearned revenue is usually disclosed as a current liability on a companys balance sheet. Unearned revenue is a liability for the recipient of the payment so the initial entry is a debit to the cash account and a credit to the unearned revenue account. Heres an example of a balance sheet.

The balance sheet approach for unearned revenue was presented earlier in this chapter and is represented at left below. For example if a business receives 600 for a six month rental the amount of revenue earned would be 100 each month 600 6 months 100 per month. This changes if advance payments are made for services or goods due to.

The company can make the unearned rent journal entry by debiting the cash account. Unearned rent journal entry. What Is Unearned Revenue on a Balance Sheet.

The nature of unearned rent is a liability which the company owes to its client or customer in providing the rent. The balance of unearned revenue is now at 24000. Unearned revenue is reported on a businesss balance sheet an important financial statement usually generated with accounting software.

All business companies record their unearned revenues on a balance sheet. At that point its balance sheet will report the remaining liability in the. Unearned Revenue in Balance Sheet The customers do advance payments for the services they expect to be performed within a few months or a year at stretch.

Usually this unearned revenue on the balance sheet is reported under current liabilities. At right is the income statement approach for the same facts. The balance will show up in the post closing trial of the balance sheet.