Smart Accounting For Income Taxes Proper Balance Sheet Format

The balance sheet lets you track your current assets and liabilitieshow much money you have to work with.

Accounting for income taxes proper balance sheet format. The income statement tells you how much money you made during the reporting period and how much you spent. As a general picture a balance sheet comprises of the companys assets. In order to properly account for income taxes it is important to understand that the Internal Revenue Service code that governs accounting for tax liability isnt the same as the generally accepted accounting principles GAAP for reporting tax liability on the financial statements.

The amount of liability will be based on its profitability during a given period and the applicable tax rates. Finally you get a Sales Tax Report so you can see the total Sales Tax figures for each tax rate on your Income and Expenses. The Income Statement totals the debits and credits to determine Net Income Before Taxes.

On the second tab called Transactions is where youll enter your transaction detailsdate description amount and category matching with the categories in your Chart of Accounts tab. New businesses may not have well established accounting team but they must prepare the income statement at the end of the day. Target audiences for these Templates.

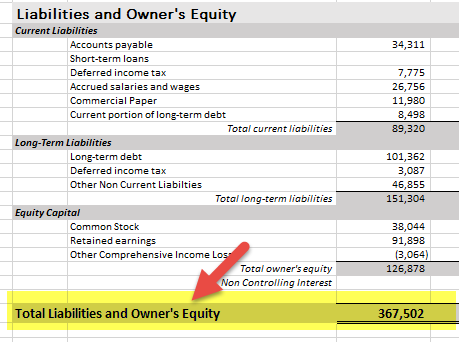

After that is the Balance Sheet which gives you a snapshot of the financial position of your business. The account form consists of two columns displaying assets on the left column of the report and liabilities and equity on the right column. In order to effectively use the balance sheet you need to know its basic structure and features.

The financial statements are key to both financial modeling and accounting. It lists only the income and expense accounts and their balances. The assets are listed on the left hand side whereas both liabilities and owners equity are listed on the right hand side of the balance sheet.

Income Statement Income Statement The Income Statement is one of a companys core financial statements that shows their profit and loss over a period of time. The Microsoft Excel spreadsheet available for download at the bottom of this page provides a general ledger income statement and balance sheet for small businesses who wish to use double entry accounting to ensure their books properly balance but using an Excel spreadsheet rather than commercially available accounting software. A balance sheet is considered as a key source of data in line with analyzing the investment level and perfomance of a certain company.