Brilliant Accounting For Marketing Expenses Us Gaap

The US GAAP model for accounting for income taxes requires companies to record deferred taxes as compensation cost is recognized as long as that particular type of instrument ordinarily would result in a future tax deduction.

Accounting for marketing expenses us gaap. For other business entities US GAAP does not contain specific guidance on the accounting for government grants. Consistent with historical practice business entities might look to IAS 20 as a source of. The award may be classified as a liability under the following conditions.

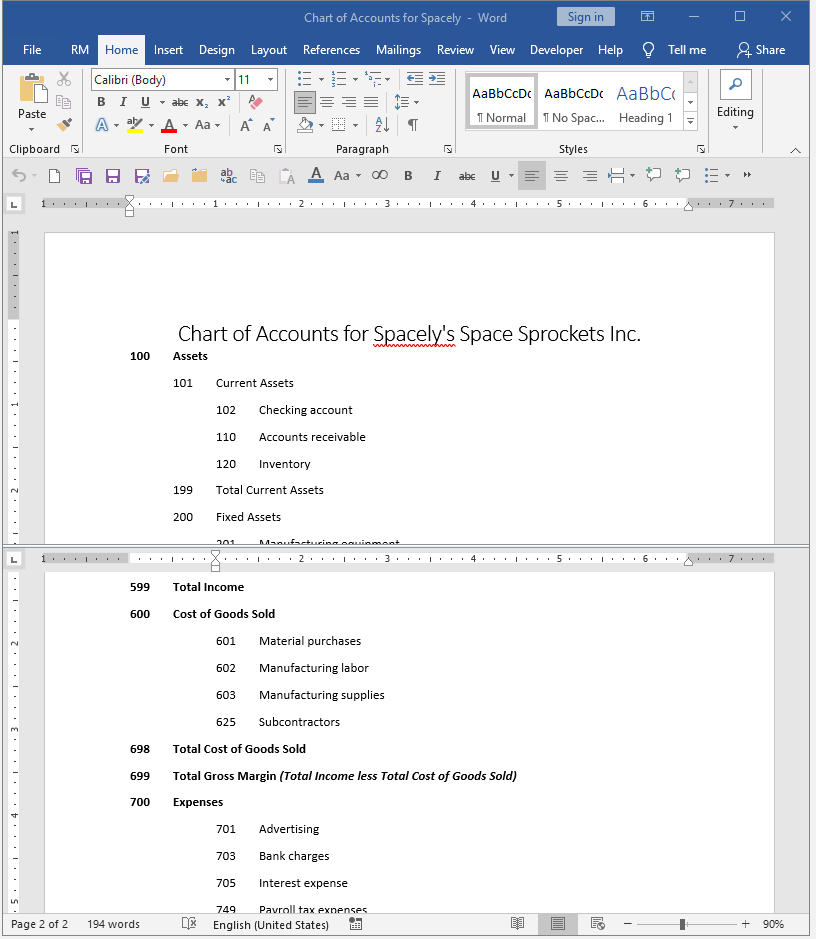

To learn more about the. GAAP provides different requirements for cost capitalization of film costs depending on the type of content being produced. The costs of other than direct response advertising should be either expensed as incurred or deferred and then expensed the first time the advertising takes place.

The measurement of the deferred tax asset is based on the amount of compensation cost recognized for book purposes. Development of advertising and other promotions. However the biggest concerns of a consumer while buying a product are its durability security and longevity.

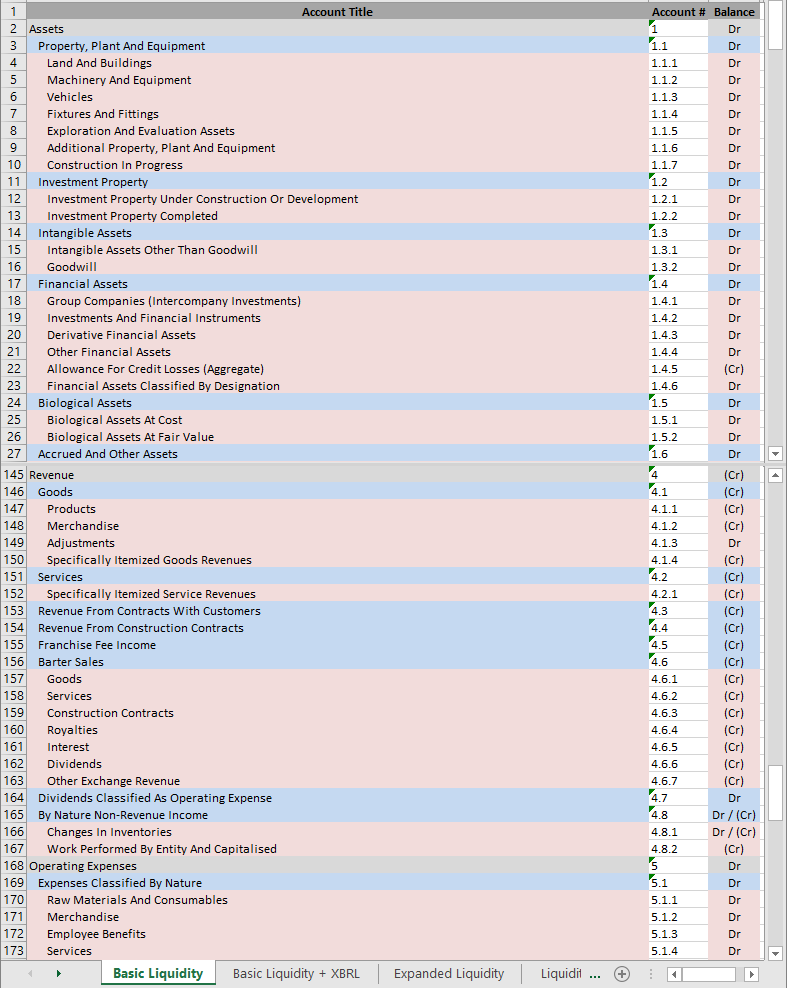

For instance product design durability specifications etc. US GAAP also has specific requirements for motion picture films website development cloud computing costs and software development costs. The accounting for these research and development costs under IFRS can be significantly more complex than under US GAAP Under US GAAP RD costs within the scope of ASC 730 1 are expensed as incurred.

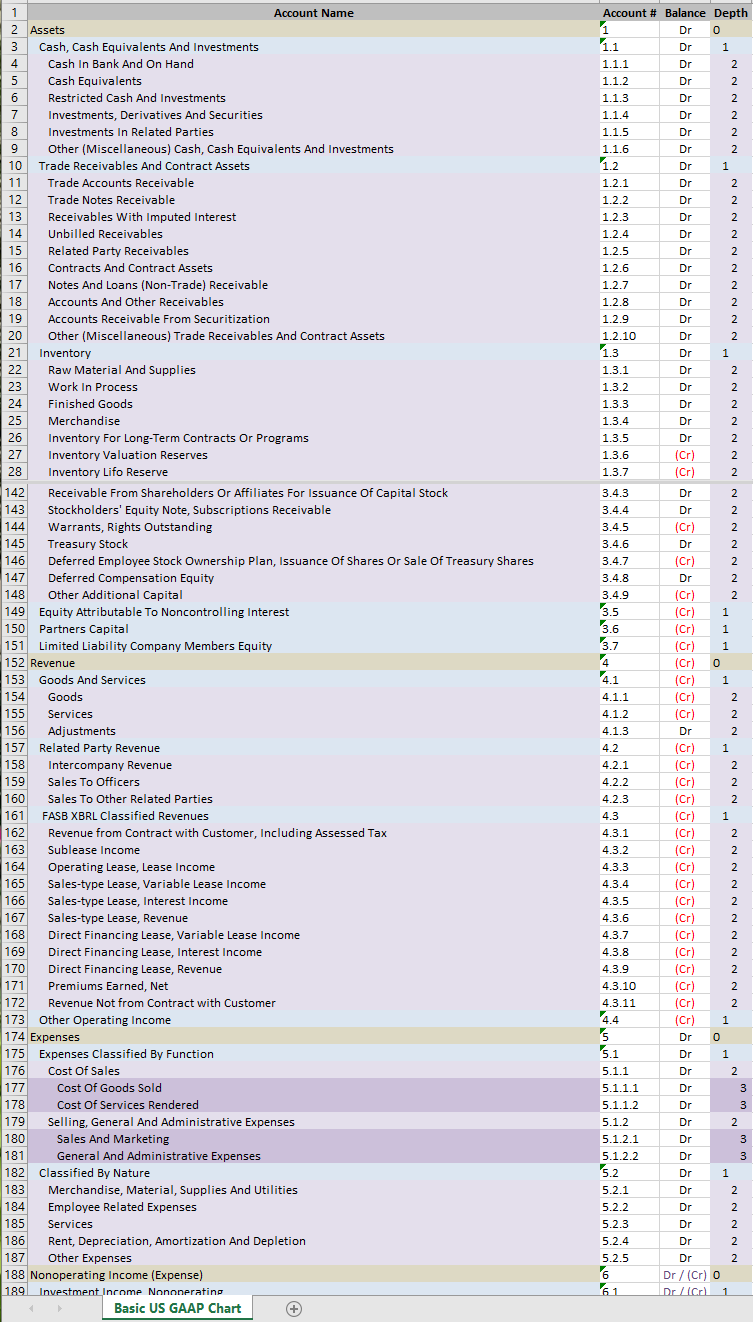

US GAAP Generally Accepted Accounting Principle is the new mantra for Accounting and Corporate Finance Professionals world over. Between US GAAP and IFRS generally as of 30 June 2020. Background A detergent manufacturer incurs significant costs developing a new technology that allows consumers to wash clothes significantly quicker.

Globalisation and access to Global Capital and securities market has enhanced the need to assimilate the principles of US. FASB ASC 350-50 provides GAAP standards for the recording of costs for web site development. This is an accounting policy election and should be applied consistently to similar types of advertising activities.