Smart Ratio Analysis Of Samsung Company

Samsung Electronics Co Ltd.

Ratio analysis of samsung company. The story told by the DuPont analysis is similar to the story told by analyzing ratios. Shows a Profitability Score of 700. The Profitability Score for Samsung Electronics Co Ltd.

The EVEBITDA NTM ratio of Samsung Electronics Co Ltd. Hence Samsung ltd ability to pay off its short-term liabilities with its current assets is quite higher in comparison to its peer. Additionally there are enough liquid assets to satisfy current obligations.

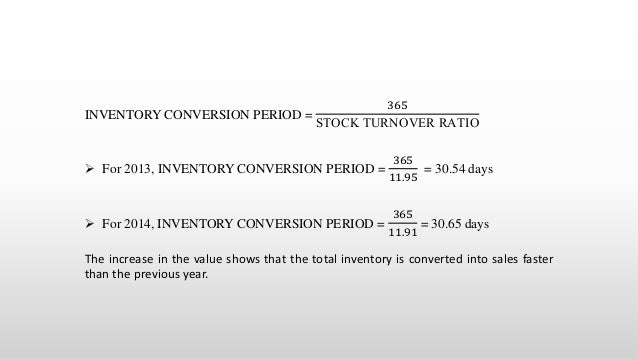

The different ratios find in the table are ROE in which there are ratios of Profitability assets turnover ratio and leverages are included and there is average ration of ROE is given. A DuPont analysis of Samsung and Apple industry is shown in the table below. The financial leverage ratio for the company declined from 148 to 142 between 2013 and 2014.

Is significantly higher than its peer groups. According to these financial ratios Samsung Electronics Co Ltds valuation is way below the market valuation of its sector. Ad See all the ways PitchBook can help you explore company data.

It generally indicates good short-term financial strength. Accounts Receivable are among the industrys. Total Debt to Equity MRQ.

Price to Book Ratio 206. Research and analyze 3 Million companies. Research and analyze 3 Million companies.