Favorite Closing Inventory Statement Of Financial Position

What you have or what you are owed.

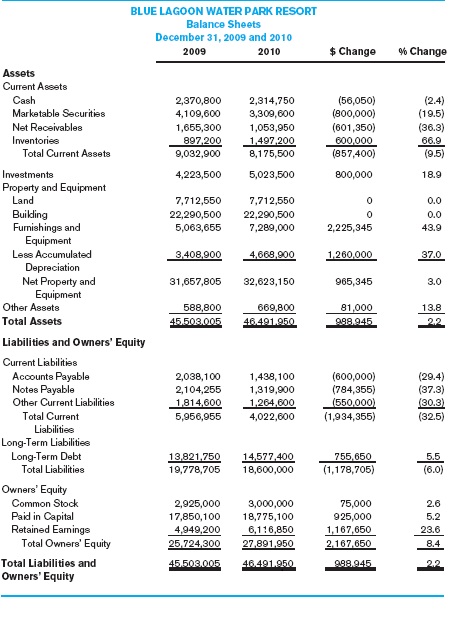

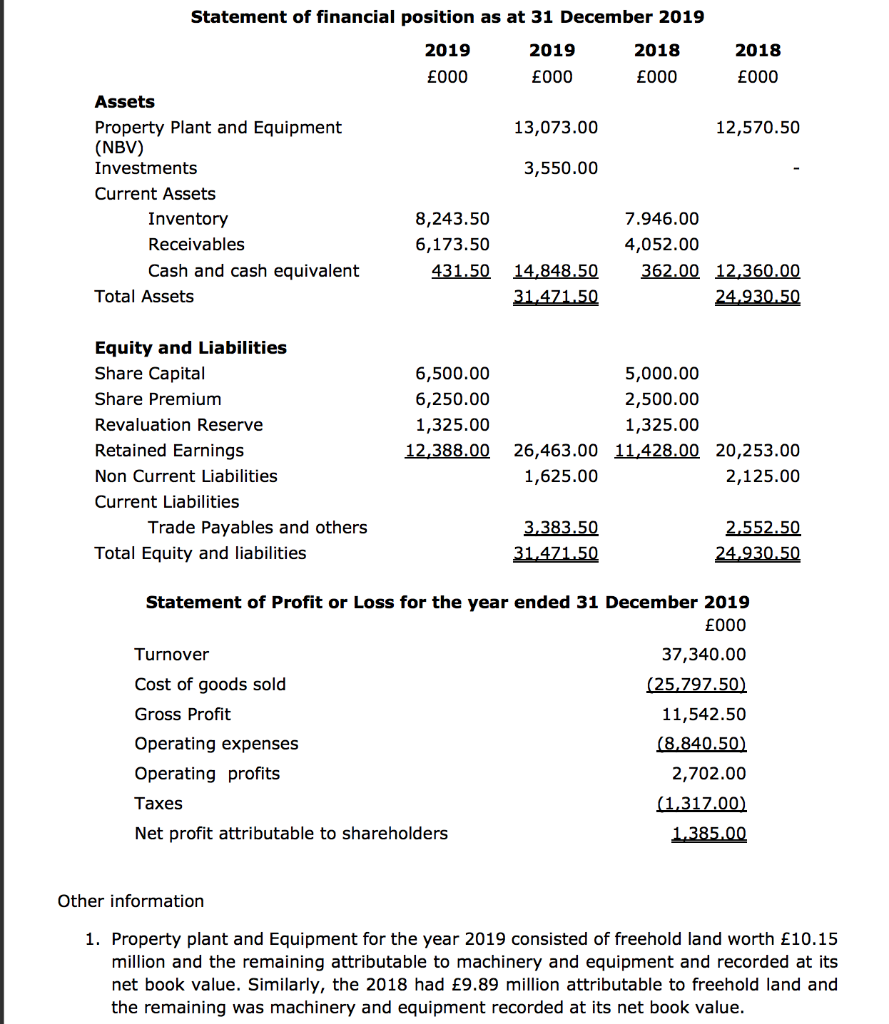

Closing inventory statement of financial position. Reporting of Inventory on Financial Statements Inventory is an asset and its ending balance is reported in the current asset section of a companys balance sheet. Therefor cost of purchases is not directly subtracted from sales revenue in the trading section of income statement as some of the goods purchased remain to be sold which are known as closing inventory. Topic 10 Statement of Cash Flows The statement of cash flows provides a reconciliation of opening and closing cash balances with cash being described as cash on hand and cash equivalents Cash flows are classified into.

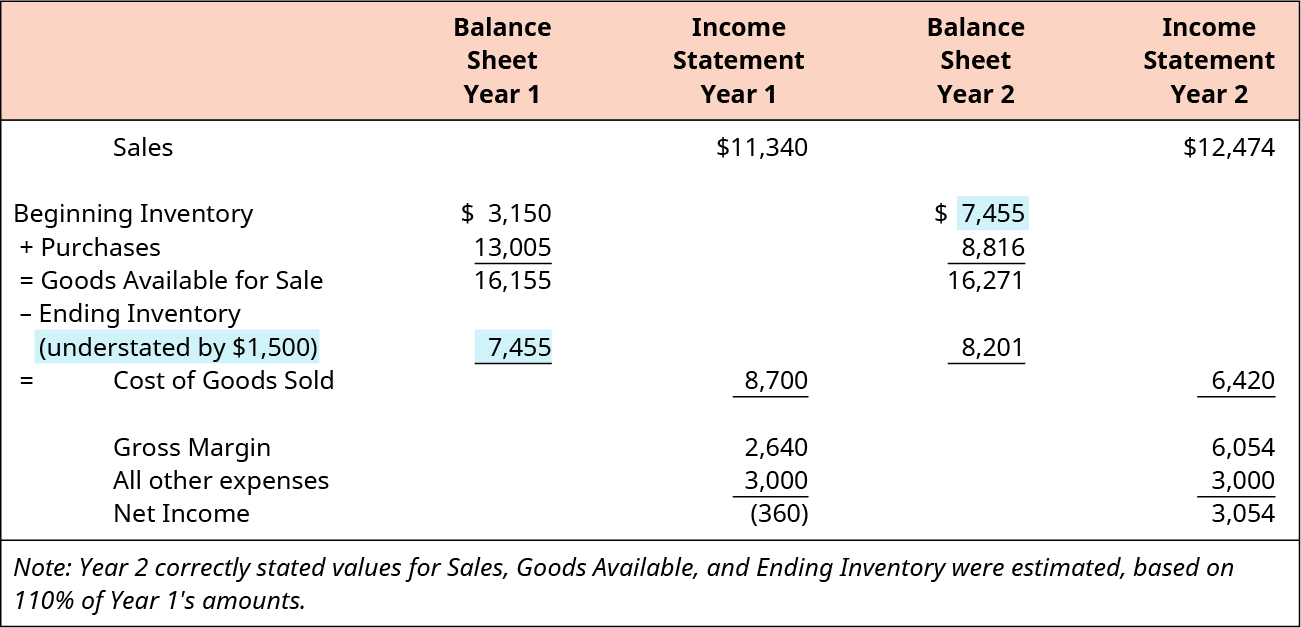

After investigation you have discovered the following errors in the draft financial statements. 1 500 items which had cost 15 each and which were included at 7500. The value of the closing stock on the Balance Sheet determines the financial position of the business.

Closing inventory of 3000 will appear on the statement of financial position as an asset. These items were found to have been defective at the date of the statement of financial position. It is a combination of raw materials work in progress WIP and finished goods.

The ledger account behind the adjustment causes problems for some candidates. Cost of Sales Opening inventory Purchases - Closing inventory. Although the name of this report has changed in the nonprofit world to the statement of financial position SOP the concept and the equation are essentially the same as any business balance sheet or statement of personal net worth.

Statement of Financial PositionBalance Sheet. As crispy correctly pointed out. Operating activities cash received from customers and cash paid to suppliers investing activities acquisition and disposal of non-current assets.

1 minute of reading. Overvaluation or undervaluation can give a misleading picture of the working capital position and the overall financial position. Gross profit is thus.