Matchless Deferred Rent On Balance Sheet

Deferred rent accounting occurs when a tenant is given free rent in one or more periods usually at the beginning of a lease agreement.

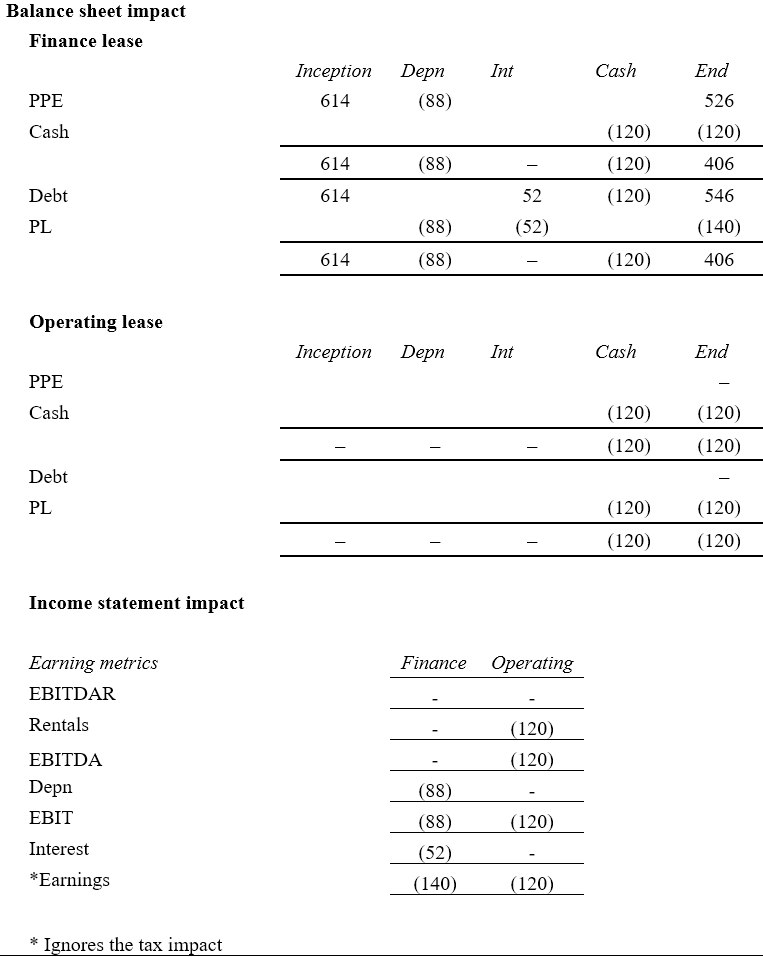

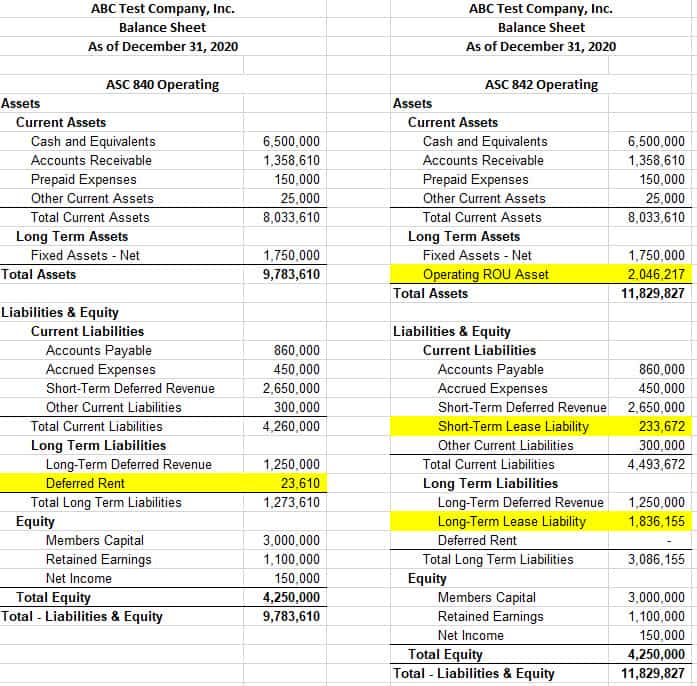

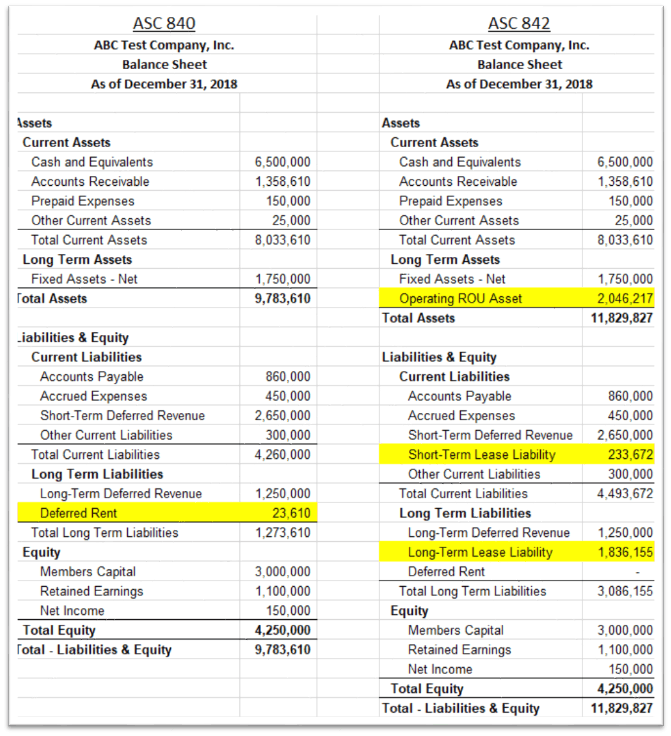

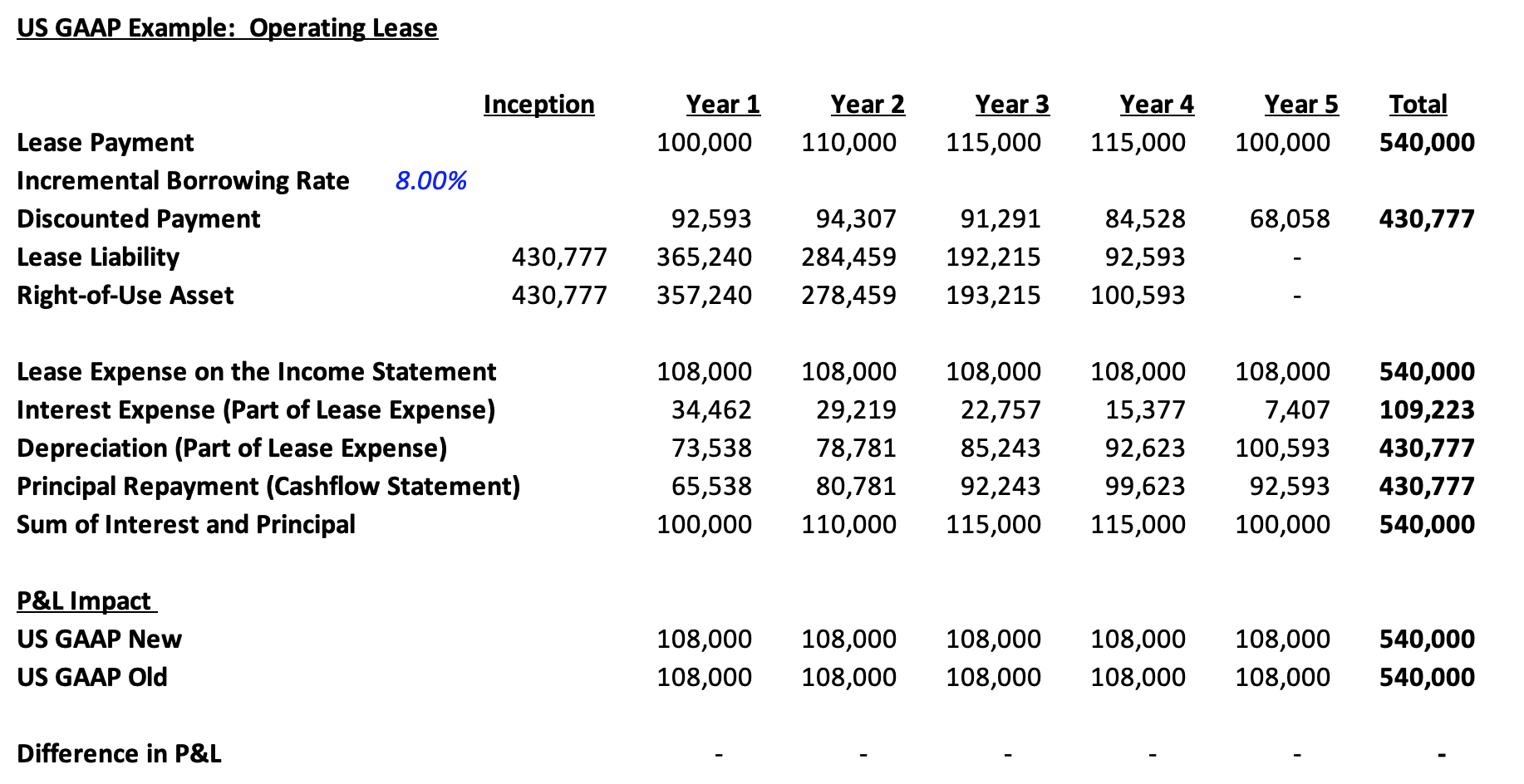

Deferred rent on balance sheet. 38 rows The deferred rents balance represents a deferred rent liability resulting from straight-lining. Deferred rent was the primary mechanism used for straight-lining. While operating leases under ASC 840 are not recorded on the balance sheet as they are under ASC 842 rent abatements and escalations will have an effect on the deferred rent recognized in a period.

Deferred rent is a balance sheet account that was used primarily in legacy lease accounting standards ASC 840 and IAS 17 however the concept still applies to the new ASC 842 standard but with very different presentation. A balance will build up and then burn off when the cash paid exceeds the amount expensed. This provides a lower but steady monthly cost.

The difference between the straight-line expense and lease payments is accounted as deferred or prepaid rent under ASC 840. To account for those differences the accountant should use a deferred rent expense account. Determine the cost of the lease for its entire period including free months discounted months or months that go up because of inflation.

The transition to ASC 842 will result in the elimination of the deferred rent account from the balance sheet but will generally not impact net income or. Companies accrue and report expenses in the period in which an expense is incurred to match with the revenue that the incurrence of the expense helps generate based on the expense matching principle of the accrual. The difference makes up the deferred portion of the rent.

Its amount in this journal entry can be calculated by using the total rent payment in the lease agreement dividing by the payment period. In this example each month for the first six months of the lease the deferred rent. Deferred rents are recorded in either an asset account eg other current or noncurrent assets when the cumulative difference between rent expenses and rent payments as of a balance sheet date is negative or a liability account eg other current or noncurrent liabilities when the cumulative difference is.

Deferred rent is the balance sheet account that was used under ASC 840 to enable straight-line rent expense. Deferred revenue is a liability on a companys balance sheet that represents a prepayment by its customers for goods or services that have yet to be delivered. Deferred rents are recorded in either an asset account eg other current or noncurrent assets when the cumulative difference between rent expenses and rent payments as of a balance sheet date is negative or a liability account eg other current.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)