Fine Beautiful Gross Profit Journal Entry

Entity A purchased merchandise at 40 per unit before.

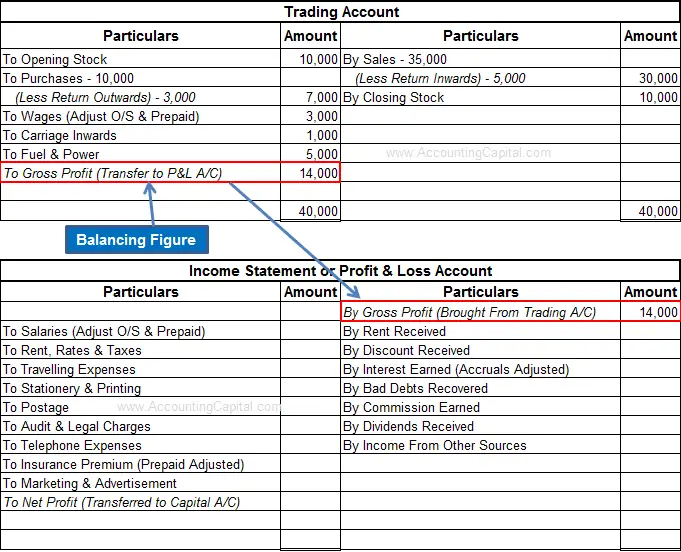

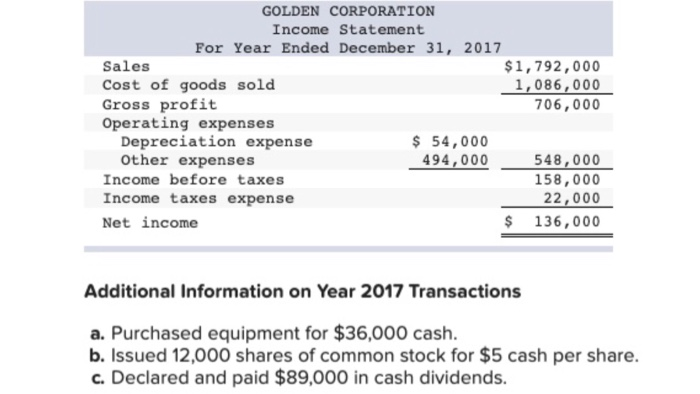

Gross profit journal entry. A Prepare journal entry to record gross profit for 2014. ABC can now recognize 3000 of gross profit which reduces the balance in the deferred. The gross profit method of estimating ending inventory assumes that the gross profit percentage or the gross margin ratio is known.

After the Sales Journal is printed when prompted to print the Gross Profit Journal click Yes. If a product sells at 75 and the cost of the product is 45 then the gross profit for the product is 75 45 30. That is an increase or decrease in stock value.

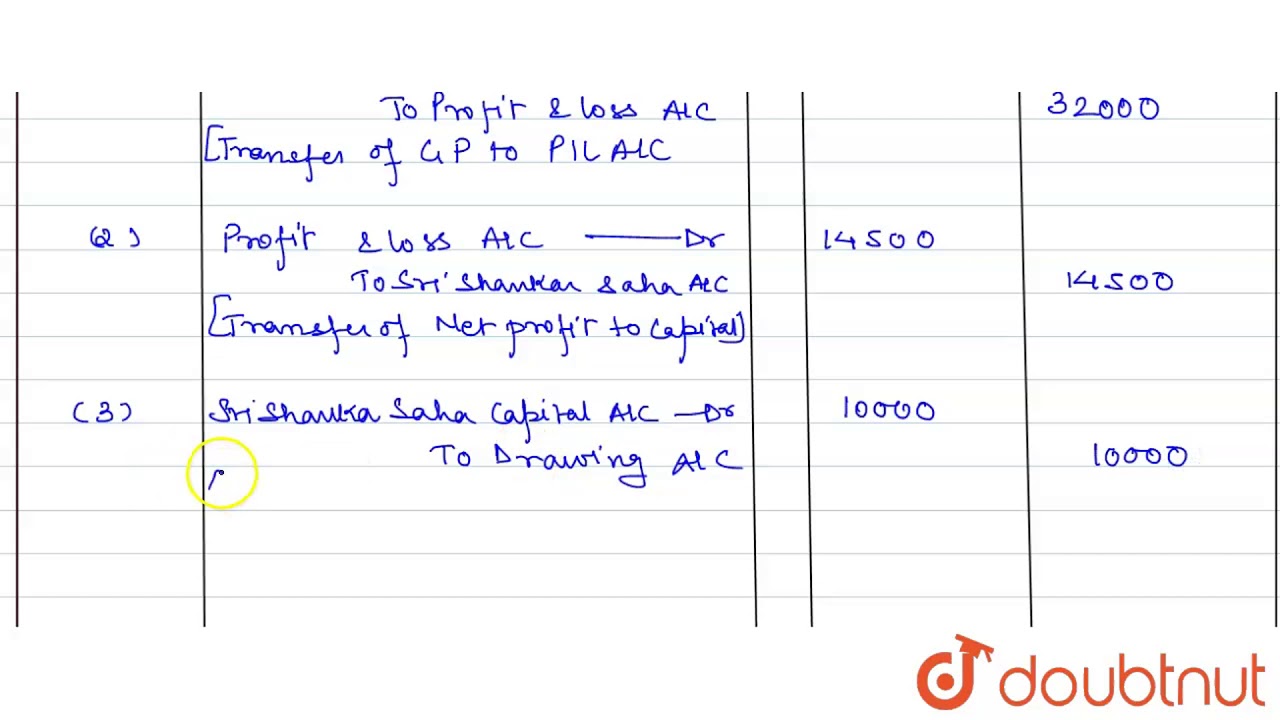

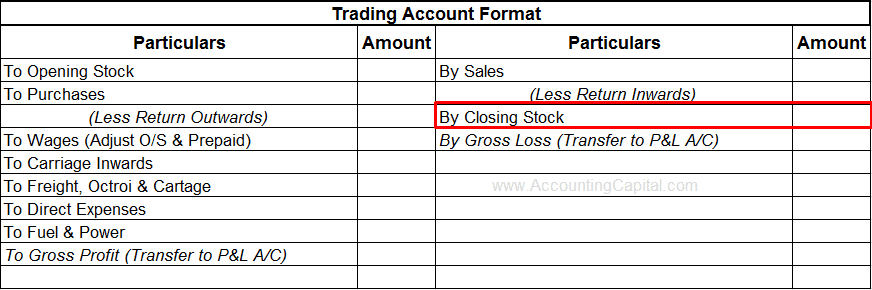

The methods differ in the inter-period distribution of revenue and gross profit. Pass the closing entries indicate how the different ledger accounts will be dealt with and prepare Trading Account and Profit Loss Account for the year ended 31st March 2012. So if you received 10000 in cash and can associate 2000 in costs to the project your gross profit is 8000.

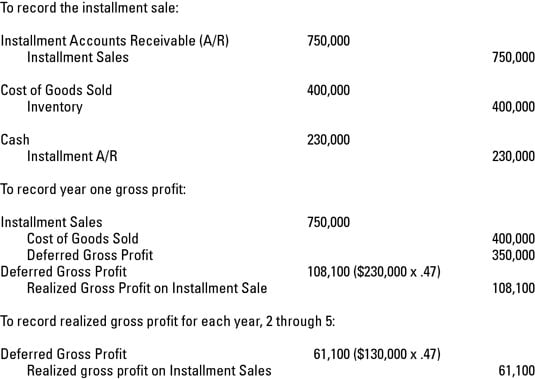

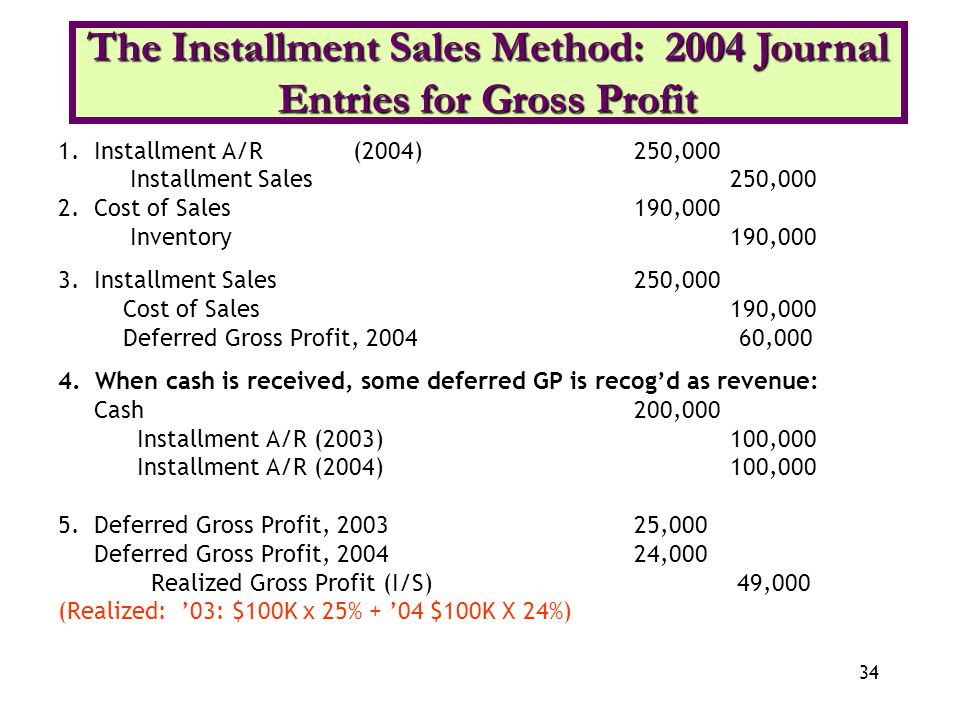

The following is the Trial Balance of C. Defer the gross profit on the sale. THIS IS AN EXAMPLE OF WHAT THE JOURNAL ENTRIES SHOULD LOOK LIKE WITH DIFFERENT NUMBERS.

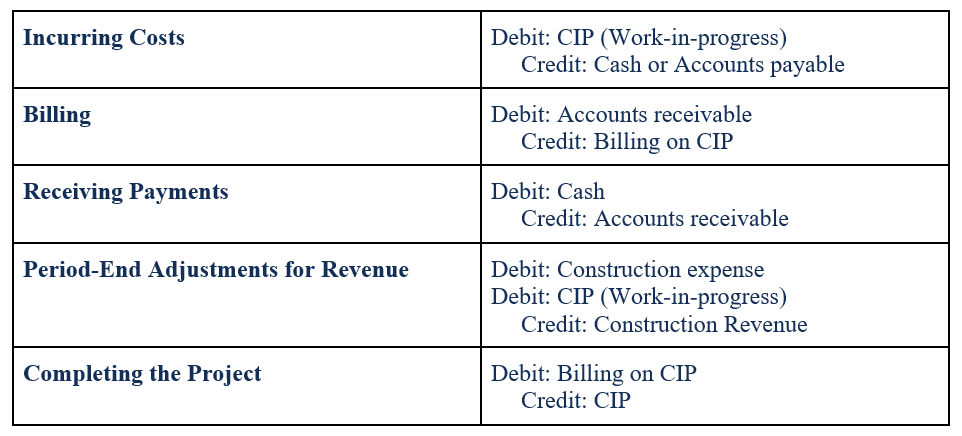

At the end of each period make a journal entry to recognize profit equal to the product of the gross profit rate on the installment sale and the actual cash collection. First calculate the gross profit percentage received on actual cash received. If 20 of the work is completed in the current accounting period the business recognizes only 20 of the profit in the current year.

The Cost of Goods Sold Journal Entry is made for reflecting closing stock. The Cost of Goods Sold is deducted from revenues to calculate Gross Profit and Gross Margin. I Sales COGS Gross-Profita Gross Profit- Calculationsa Re- Ending Total D Soldo 0 Inventoryo 750000 540000 o 210000 600000 432000 0 168000 150000 o 1080003 -42000 20 od a Give all journal-entries-Planet recorded for the purchase of.