Impressive Trial Balance Of Manufacturing Company

One million shares of.

Trial balance of manufacturing company. Effective communication basis We seek project solidity and effective team-work with your company and our set of collaborators. The trial balance for Lindor Corporation a manufacturing company for the year ended December 31 2016 included the following income accounts. What do you do when the trial balance doesnt balance.

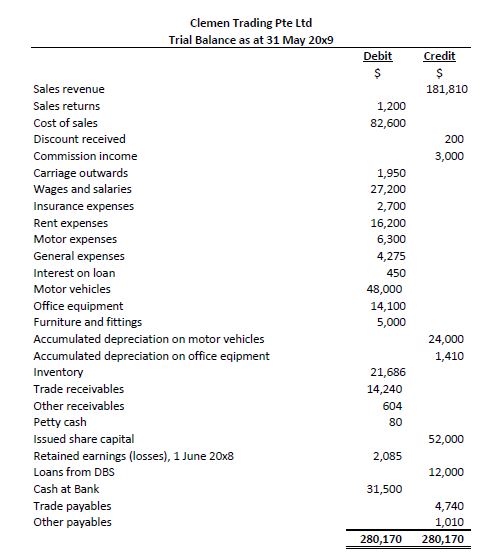

Fundamentals of Accounting Manufacturing ARAS SANTOS MANUFACTURING CO. The following trial balance has been extracted from the books of Saeed co. Trial Balance Ledger accountDimension Trial balance DimensionLedger account Trial Balance Print SequenceLedger Account Obstacle 2.

Dr Cr Cash deposits 117000 Trade debtors 1163000 Allowance fo. The trial balance does not include the accrual for income taxes. The trial balance for Lindor Corporation a manufacturing company for the year ended December 31 2018 included the following income accounts.

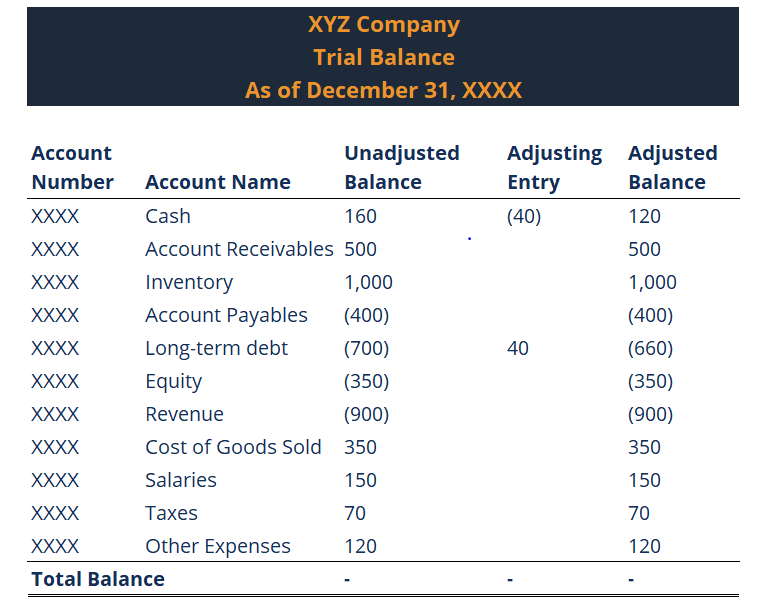

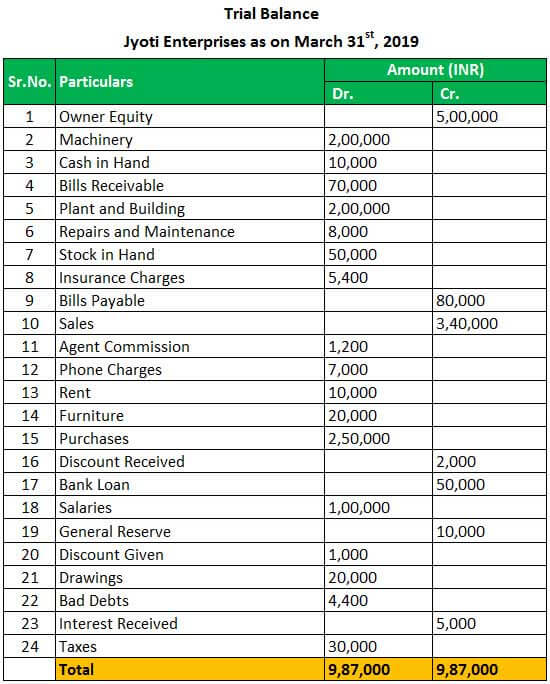

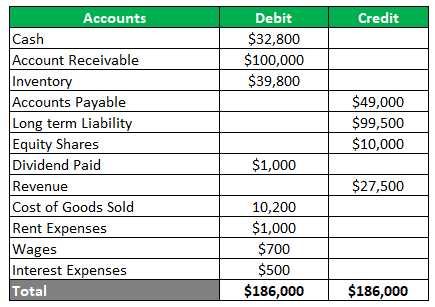

Not Excel Ready After extracting and collecting data you find that the trial balance report is not Excel ready. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. Trial Balance is the report of accounting in which ending balances of different general ledger of the company are available.

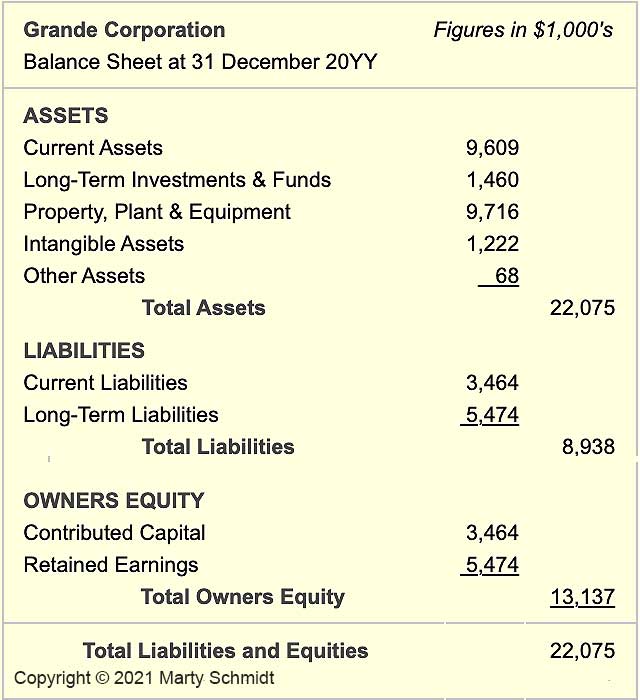

Balance Sheet Assets liabilities stockholders equity. Are expenses in the trial balance what you have paid for during the accounting period. TRIAL BALANCE December 31 2012 DEBIT CREDIT Cash 10100 Marketable Securities 22480 Accounts Receivable 38 000 Allowance for Bad debts 3000 Finished Goods inventory 46500 Good in process inventory 38 600 Raw materials inventory 53800 Factory Supplies inventory 8000 Land.

Typically you would choose the Export Save As or Print To File functions within the accounting program. The trial balance for Lindor Corporation a manufacturing company for the year ended December 31 2021 included the following accounts. Manufacturing Business - Trial Balance.