Breathtaking Ias 1 Summary

The IFRS Summaries provide an introduction to each standard in issue and a quick reference source of key requirements.

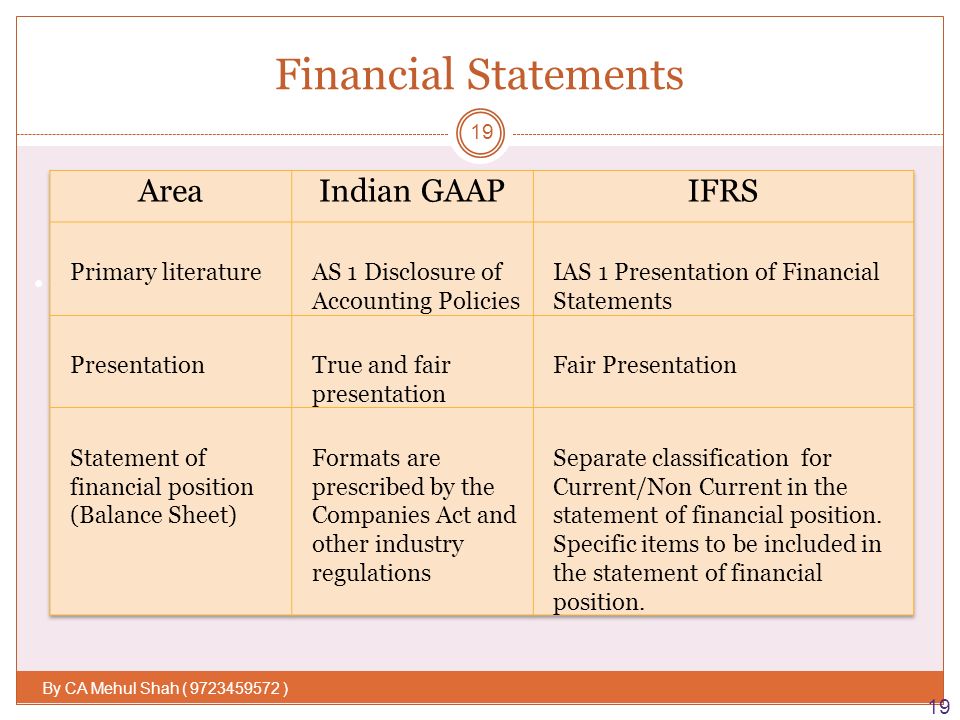

Ias 1 summary. International Accounting Standards which contained proposals to revise IAS 1. IAS 1 sets out the overall requirements for the presentation of financial statements guidelines for their structure and minimum requirements for their content. The Snapshots present a useful glance of key provisions with cross references to the summaries or standards as necessary.

Entities must choose between function of expense method and nature of expense method to present expense items. IN12 IAS 1 requires an entity to disclose comparative information in respect of the. SUMMARY OF IAS 1 Objective of IAS 1 The objective of IAS 1 2007 is to prescribe the basis for presentation of general purpose financial statements to ensure comparability both with the entitys financial statements of previous periods and with the financial statements of other entities.

IAS 8 Accounting Policies Changes in Accounting Estimates and Errors. After considering the responses the Board issued in 2003 a revised version of IAS 1. IAS 11 Standards for recognising measuring and disclosing specific transactions are addressed in other Standards and Interpretations.

It requires an entity to present a complete set of financial statements at least annually with comparative amounts for the preceding year including comparative amounts in the notes. In December 2014 IAS 1 was amended by Disclosure Initiative Amendments to IAS 1 which addressed concerns expressed about some of the existing presentation and disclosure requirements in IAS 1 and ensured that entities are able to use judgement when applying those requirements. And the other accounting policies used that are relevant to an understanding of the financial statements.

Corporate Financial Reporting 2. IAS 1 Presentation of Financial Statements Objective of IAS 1 The objective of IAS 1 is to prescribe the basis for presentation of general purpose financial statements to ensure comparability both with the entitys financial statements of previous periods and with the financial statements of other entities. You should also check these links too.

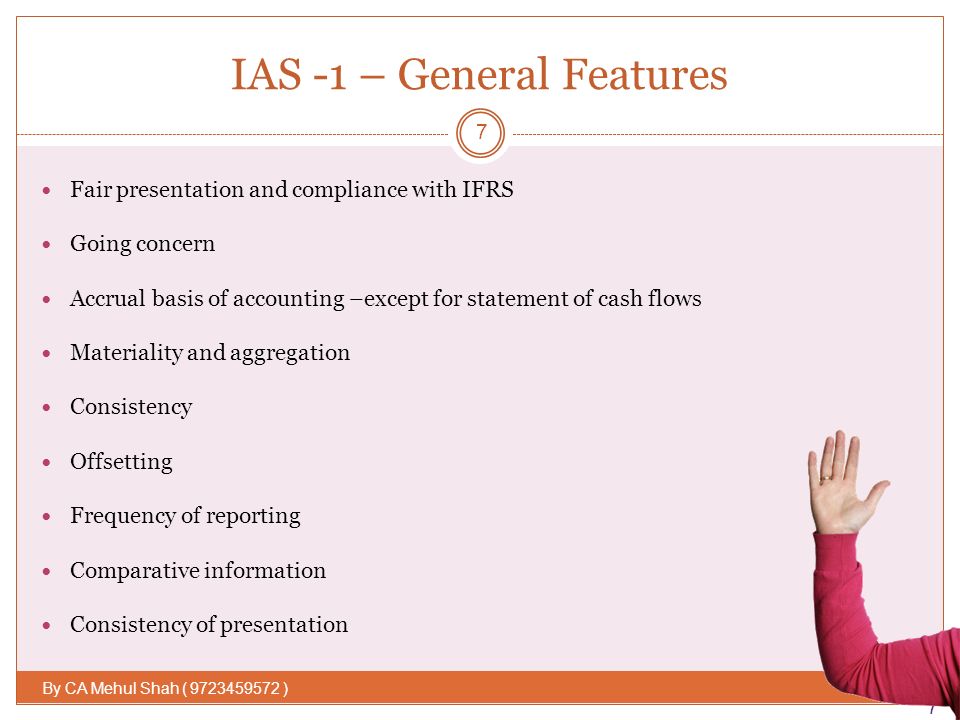

Substantive right to defer settlement must exist at the end of the reporting period Under the existing IAS 1 requirements a liability is classified as non-current if the entity has an unconditional right to defer settlement of that liability for at least 12 months after the reporting period. Short explanation of the key aspects of IAS 1 Presentation of Financial Statements For free content and ACCA CIMA courses visit. IAS 1108 the measurement basis or bases used in preparing the financial statements.