Fantastic Adjusting Entry For Notes Payable

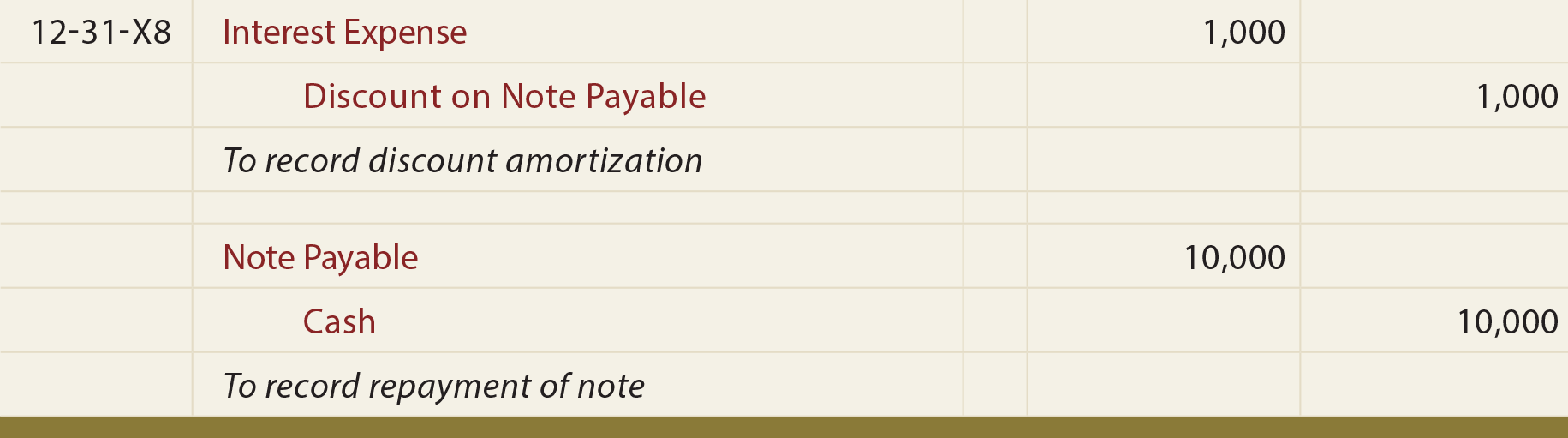

Notes Payable principal amount 10000.

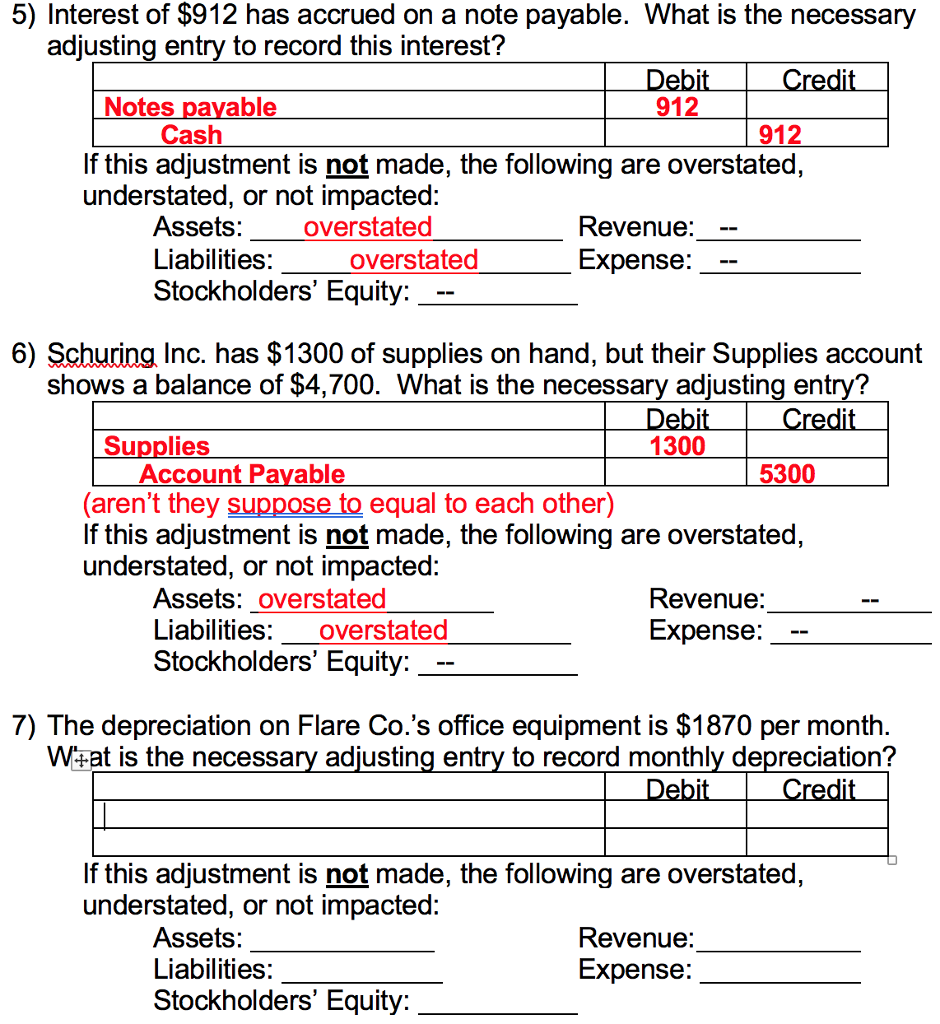

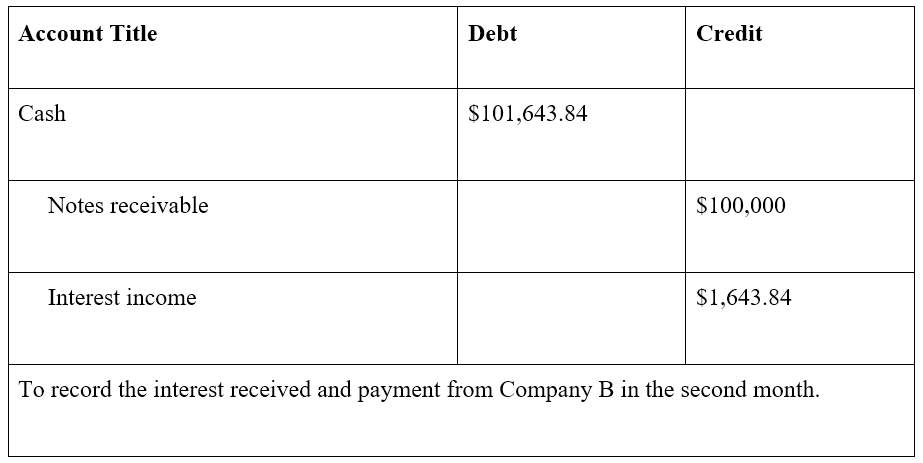

Adjusting entry for notes payable. In this lesson you will learn which. 10000 x 9 x 60 days remaining in note 360 days in year Cash 10000 75 150 10225. Adjusting journal entry for notes payable will discuss options for setting up a system for recording notes payable in an accounting system.

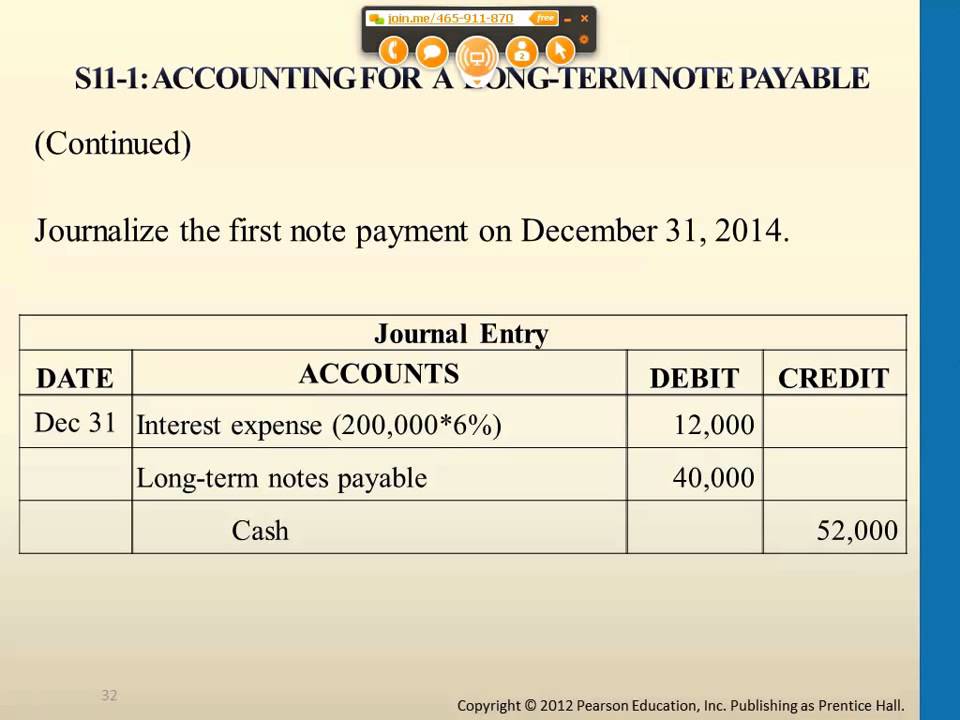

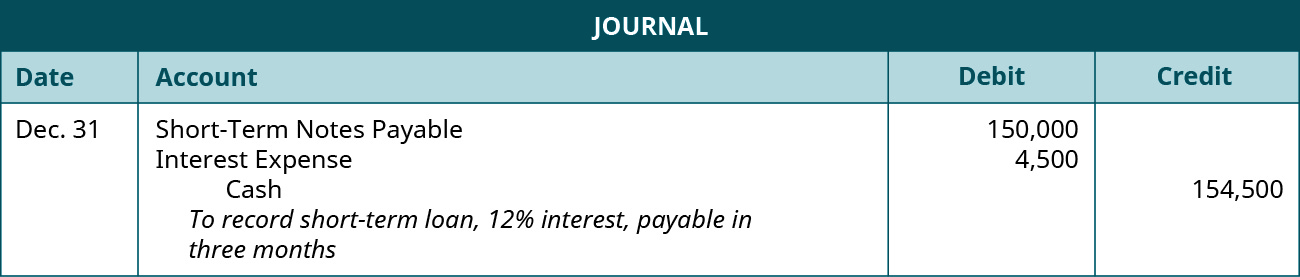

When Sierra pays cash for the full amount due including interest on October 31 the following entry occurs. Record journal entries related to notes payable. Understand the details of the note.

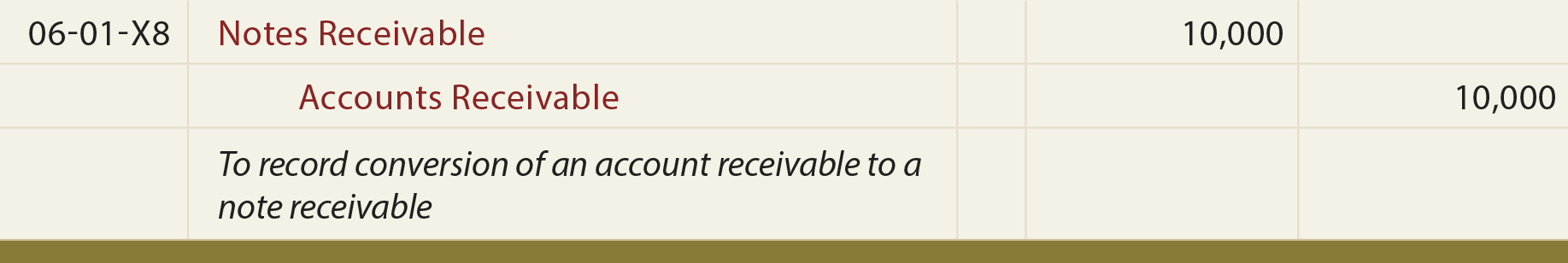

Accounts Payable decreases debit and Short-Term Notes Payable increases credit for the original amount owed of 12000. An adjusting entry is a journal entry in your accounting records that records revenues and expenses for which you have yet to receive or pay money. Both the items of Notes Payable and Notes Receivable can be found on the Balance Sheet of a business.

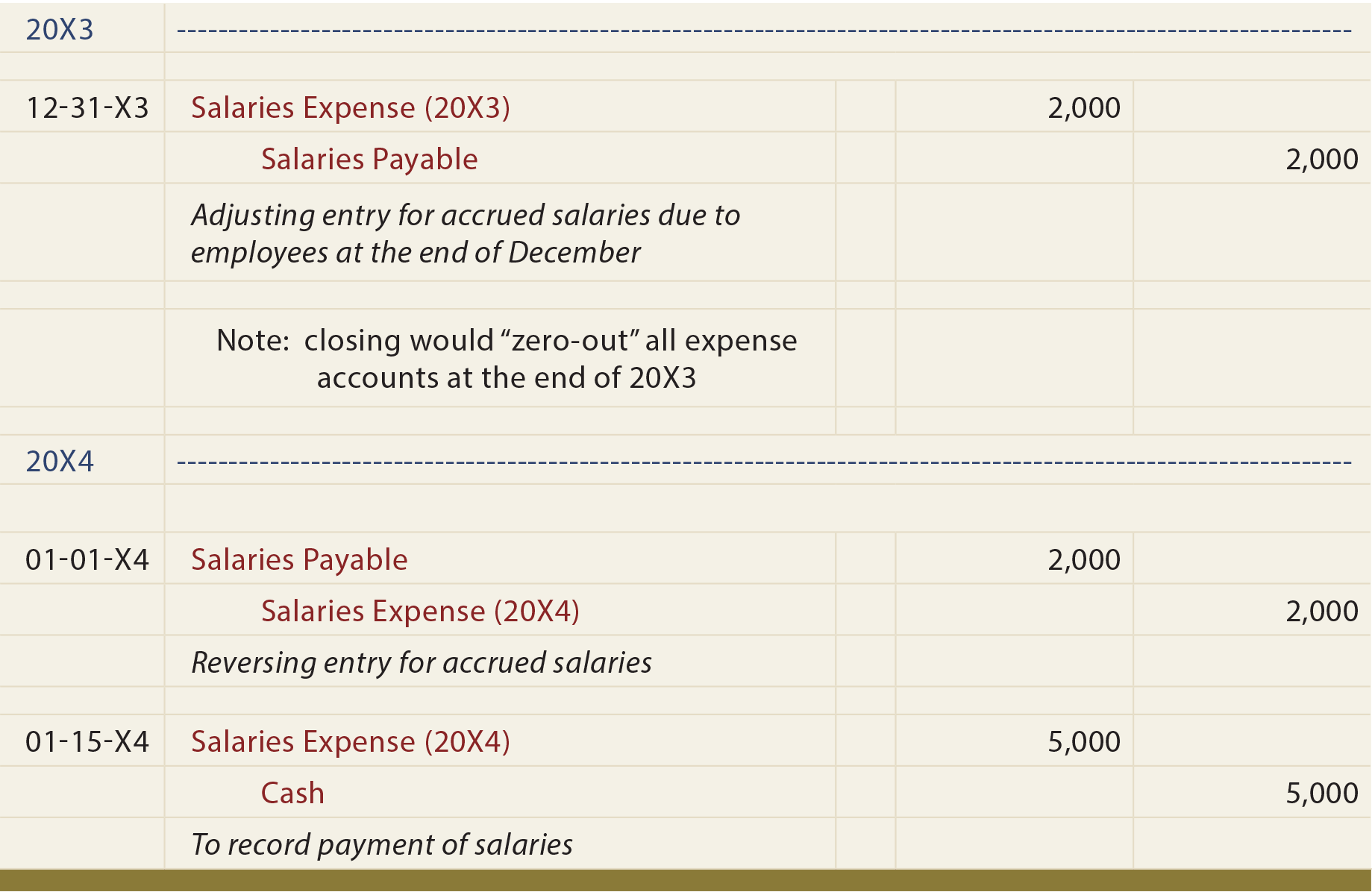

If playback doesnt begin shortly try restarting your device. Adjusting entries are entries made at the end of an accounting period at the end of a month or year. For example if the supplies account had a 300 balance at the beginning of the month and 100 is still available in the supplies account at the end of the month the company would record an adjusting entry for the 200 used during the month 300 100.

Assume a company borrowed 10000 on June 1 and that it must be paid back in one year plus interest that is at the rate of eight percent. Adjusting entries are a very important part of the accounting cycle because they ensure that you are reporting the companys financial situation accurately. Each month that a company has a notes payable an adjusting entry is required to record accrued interest expenses.

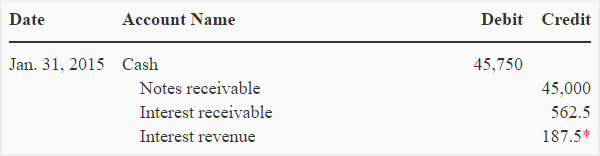

While Notes Payable is a liability Notes Receivable is an asset. 10000 x 9 x 30 days in Dec 360 days in year To record accrued interest on note at year end. Notes Receivable record the value of promissory notes that a business owns and for that reason they are recorded as an asset.