Fine Beautiful Interpretation Of Balance Sheet

If you are a startup looking for funding or established company business you have to prepare a Balance Sheet.

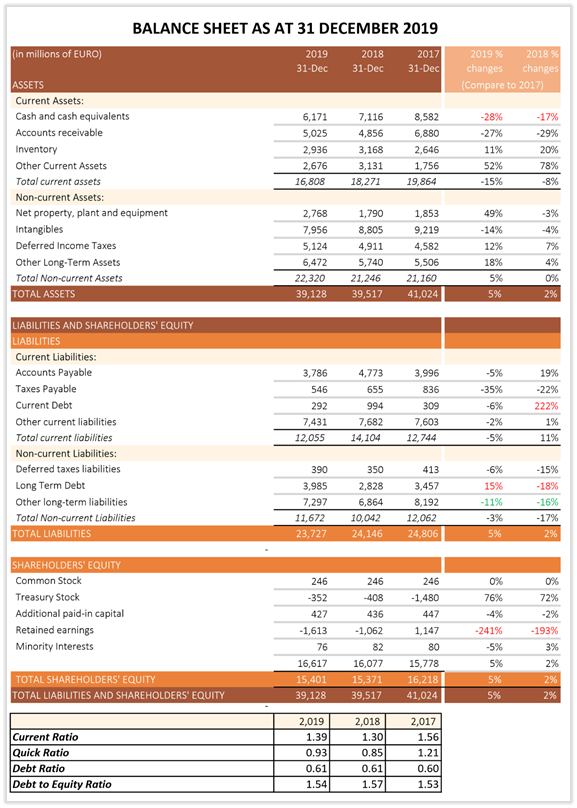

Interpretation of balance sheet. So we only need one period of data to derived the percentages and completed the analysis. A balance sheet is only a snapshot of a business financial position on. The balance sheet is separated with assets on one side and liabilities and owners equity on the other.

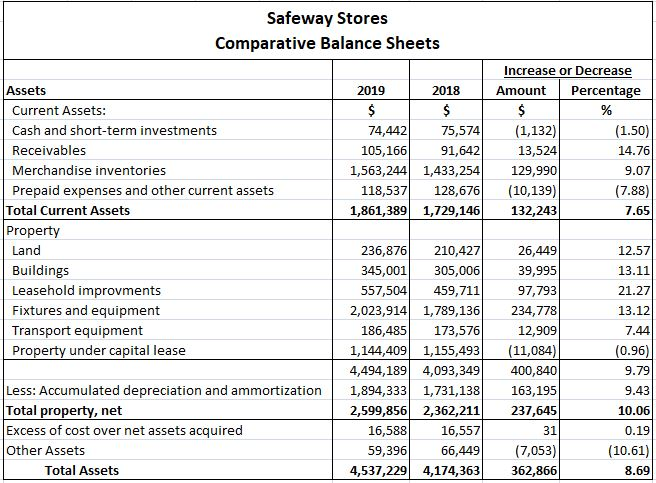

A balance sheet contains specific information about the net worth assets and liabilities of a business. The balance sheet is unlike the other key financial statements that represent the flow of money through various accounts across a period of time. It summarizes a companys financial position at a point in time.

How liquid its assets are - how much is in the form of cash or can be easily converted into cash ie stocks and shares. How to Interpret the Vertical Analysis of a Balance Sheet and Income Statement. How the business is financed.

Balance sheet income statement statement of retained earnings and statement of cash flow. This one unbreakable balance sheet formula. The balance sheet is an annual financial snapshot.

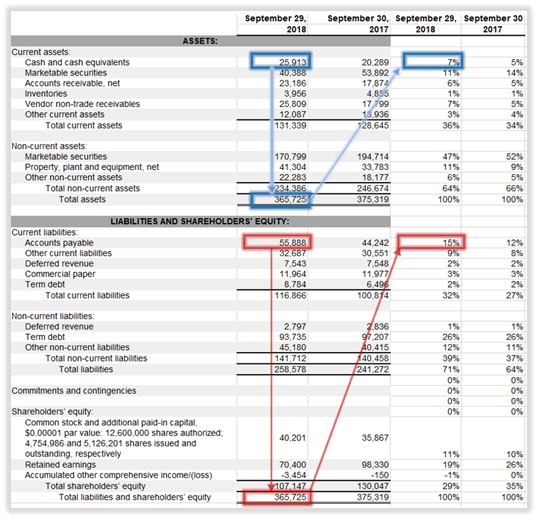

In essence the balance sheet tells investors what a business owns assets what it owes liabilities and how much investors have invested equity. Alongside with Income Statement and Cashflow Statement it helps to reveal a companys overall financial health. The balance sheet is so named because the two sides of the balance sheet ALWAYS add up to the same amount.

If youre seeing this message it means were having trouble loading external resources on our website. The balance sheet reports the companys assets liabilities and owners equity at a given point of time. Unlike Horizontal Analysis a Vertical Analysis is confined within one year or one vertical column of the Balance Sheet.

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)