Perfect Prepaid Rent Balance Sheet Classification

A finance lease and an operating lease.

Prepaid rent balance sheet classification. Prepaid rent definition A current asset account that reports the amount of future rent expense that was paid in advance of the rental period. The following items at a minimum are normally found in a balance sheet. Prepaid rent is a balance sheet account and rent expense is an income statement account.

On the 1 April it pays the next quarters rent in advance of 3000 to cover the months of April May and June. The expense would show up on the income statement while the decrease in prepaid rent of 10000 would reduce the assets on the balance sheet. The only insight you had for future obligations was limited to the maturity analysis in the disclosure report.

Prepaid rent typically represents multiple rent payments while rent expense is a single rent payment. Deferred rent arises when the amount expensed exceeds the amount paid. Prepaid rent typically represents multiple rent payments while rent expense is a single rent payment.

The landlord that receives and holds the security deposit should report the amount as a liability. So a prepaid account will always be represented on the balance sheet as an asset or a liability. Prepaid rent is a balance sheet account and rent expense is an income statement account.

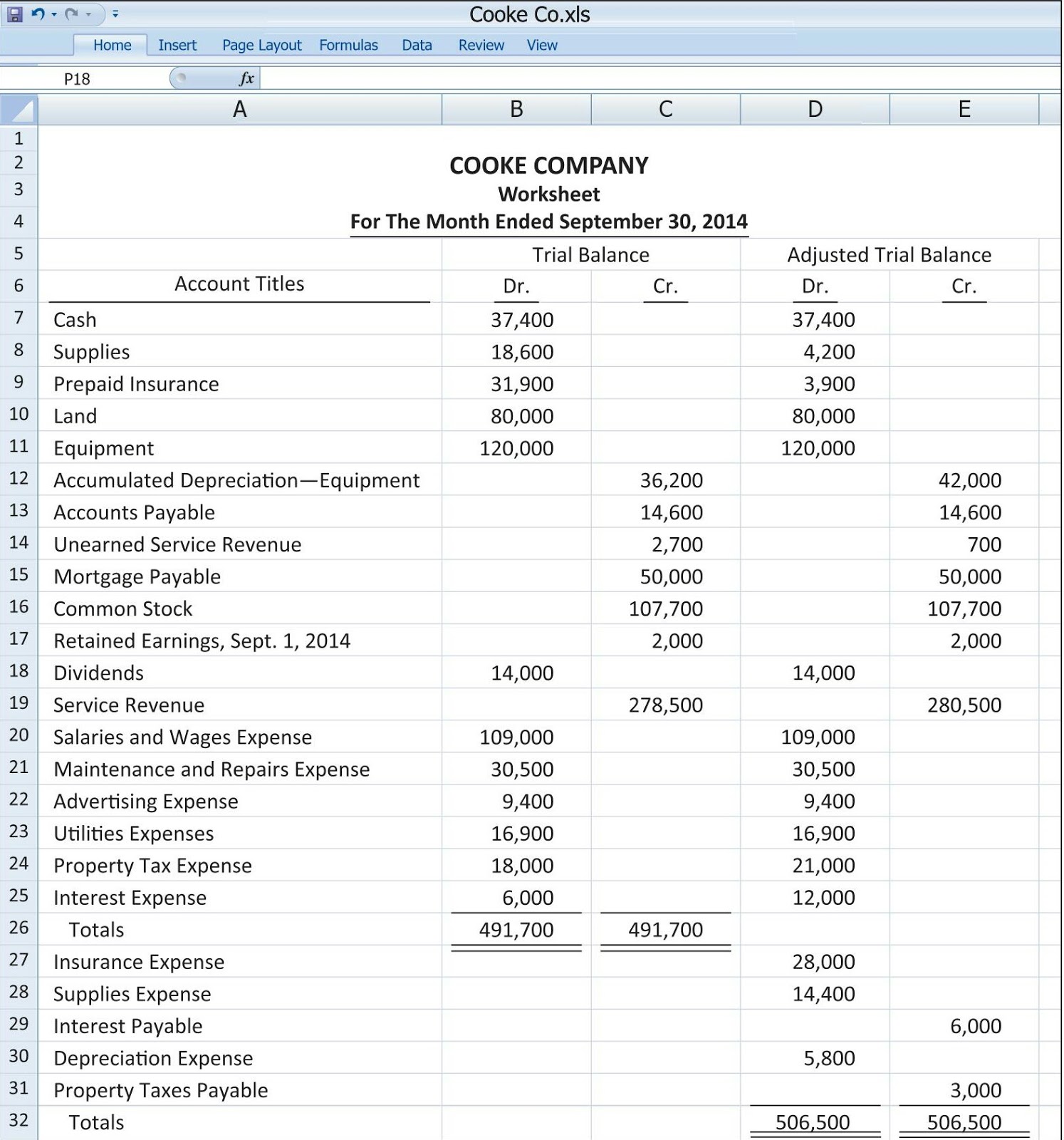

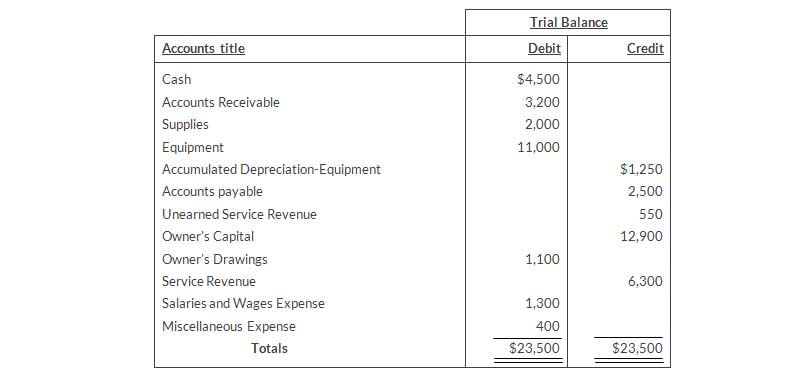

So a prepaid account will always be represented on the balance sheet as an asset or a liability. Refer to the first example of prepaid rent. Prepare a classified balance sheet in good form.

The adjusting entry on January 31 would result in an expense of 10000 rent expense and a decrease in assets of 10000 prepaid rent. Example Of Prepaid Rent. Under the ASC 840 standard only capital leases were recorded on the balance sheet.