Matchless Journal Entry For Lawsuit Settlement Loss

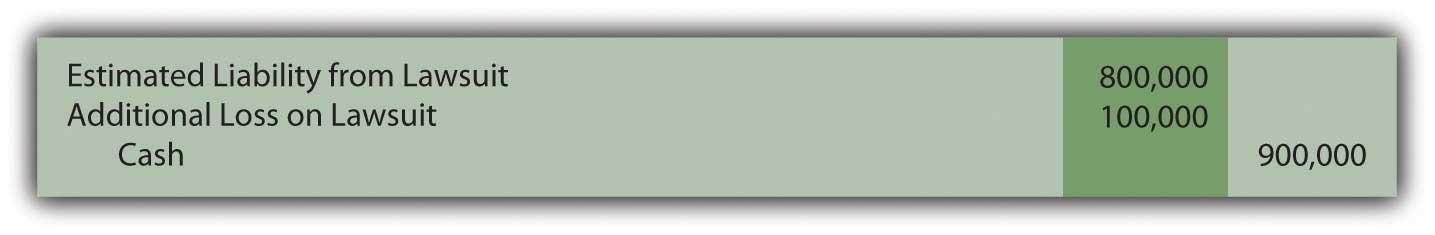

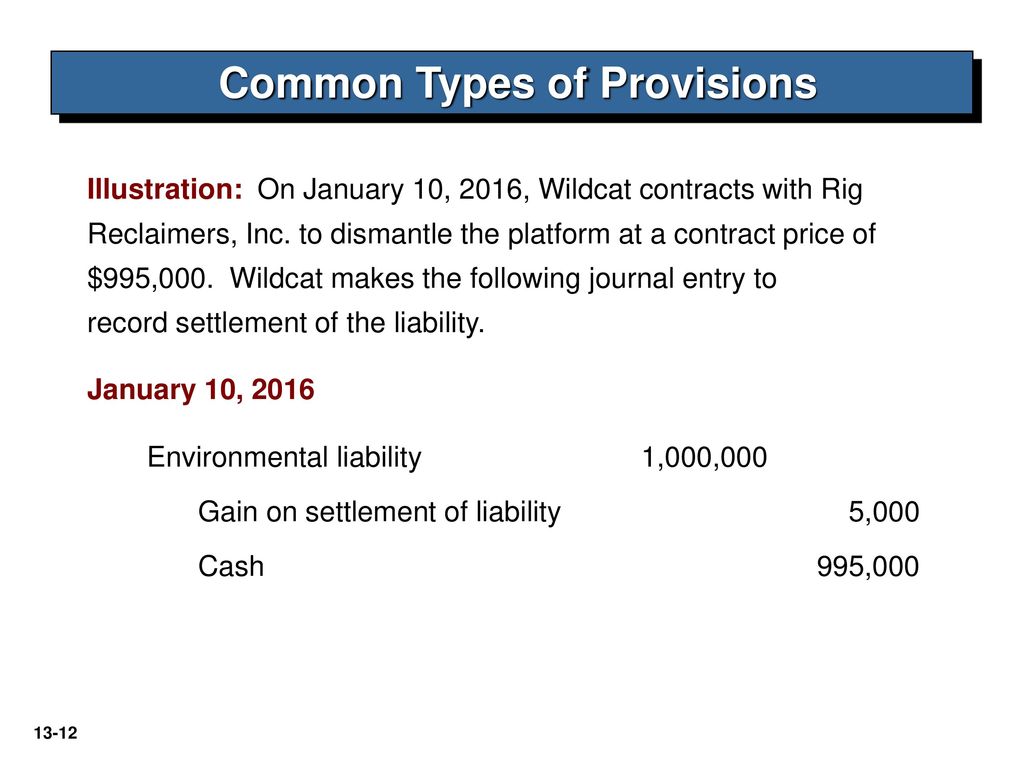

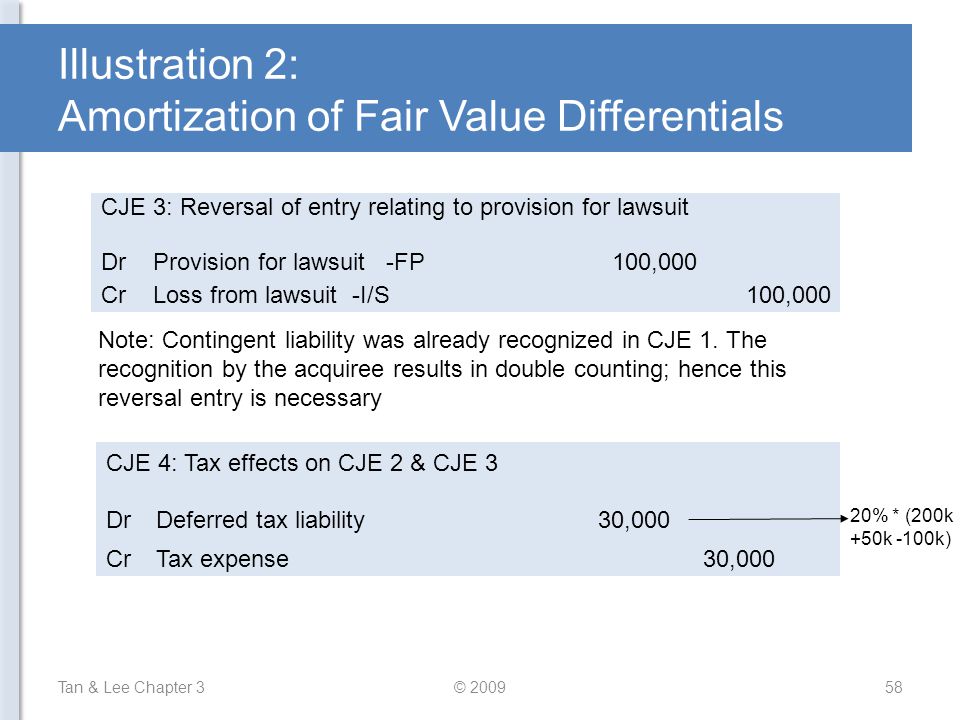

Wysocki corrects the balances through the following journal entry that removes the liability and records the remainder of the loss.

Journal entry for lawsuit settlement loss. Dr Insurer debtor 50000 Dr Loss 10000 Cr Storeroom asset 60000 And later when they make the payment. And the 3rd is Purchase Certificates. Journal Entry for American Style.

Capital Facts The facts arose out of Mr. That the settlement proceeds two S corporations received constituted ordinary income. Journal entries will not be passed.

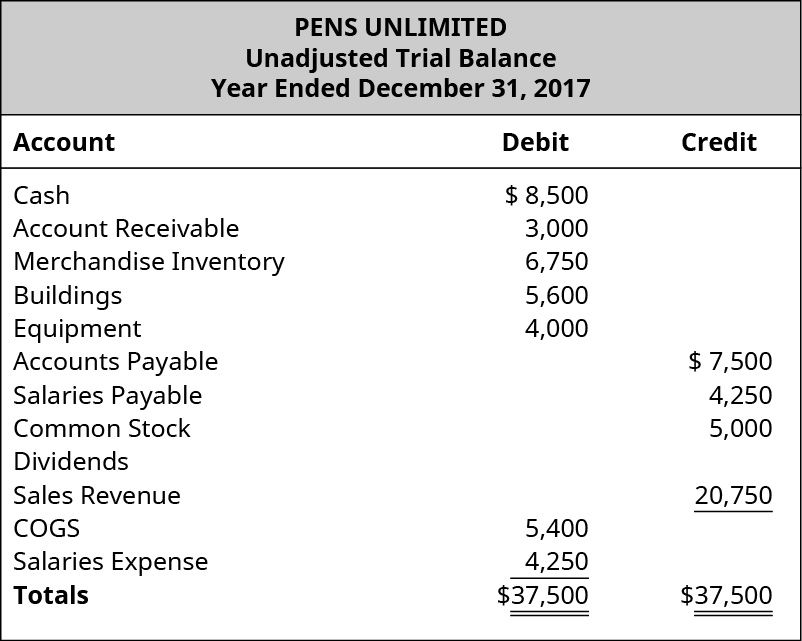

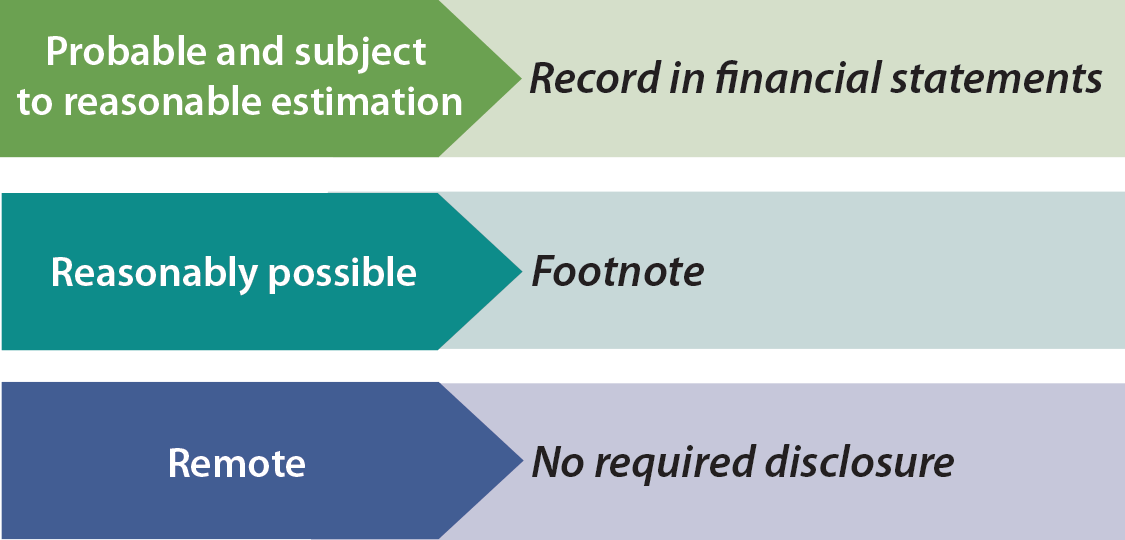

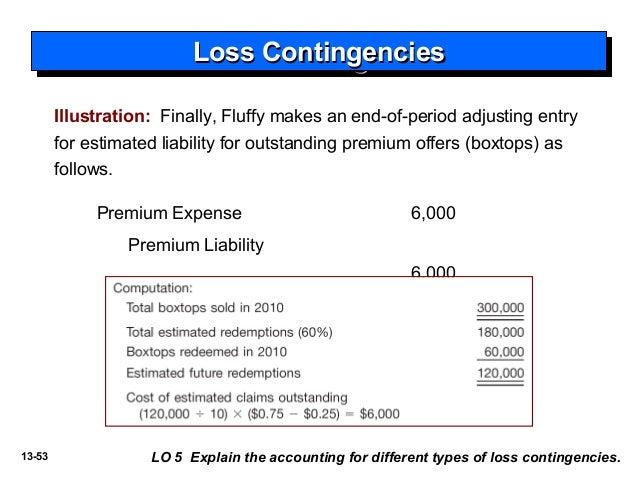

In this journal entry lawsuit payable account is a contingent liability in which it is probable that a 25000 loss will occur. Estimated liability from lawsuit 105B Retained earnings estimated loss 75B Accrued liability settlement 30B 4. For the debt you would compare the FMV of the asset transferred to the loan so 80000 vs 100000.

Baloyi in settlement of his account of R126. It is shown in the accounting period when the amount is determined to be probable and the amount can be estimated. Dr Bank 50000 Cr Insurer debtor 50000 In this second scenario we record the loss the difference between the value of the asset lost and the amount of the claim of 10000.

The 2nd is Replacement Cost. Issued a receipt for R105 to B. Accrued liability - settlement 30B Cash 30B 5.

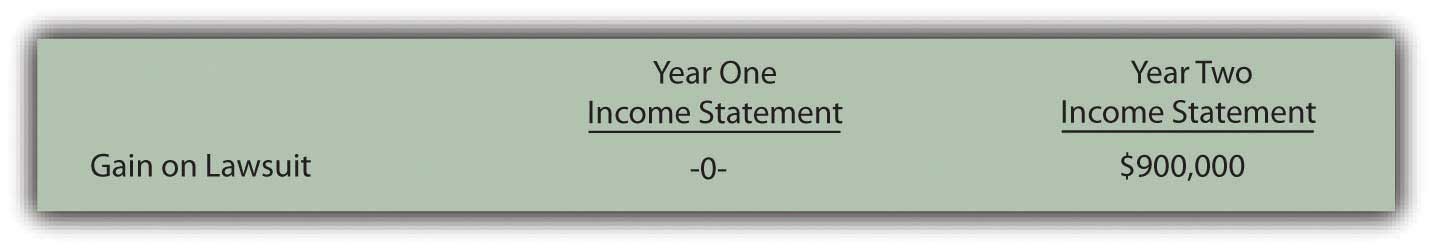

At the time of cash received cash discount is allowed. Slappy Ventures Slappy Ventures needs to calculate the gainloss on debt and gainloss on the assets transferred. You account for legal damages or settlements as gains or losses on your income statement.