Ace Wages Payable Income Statement

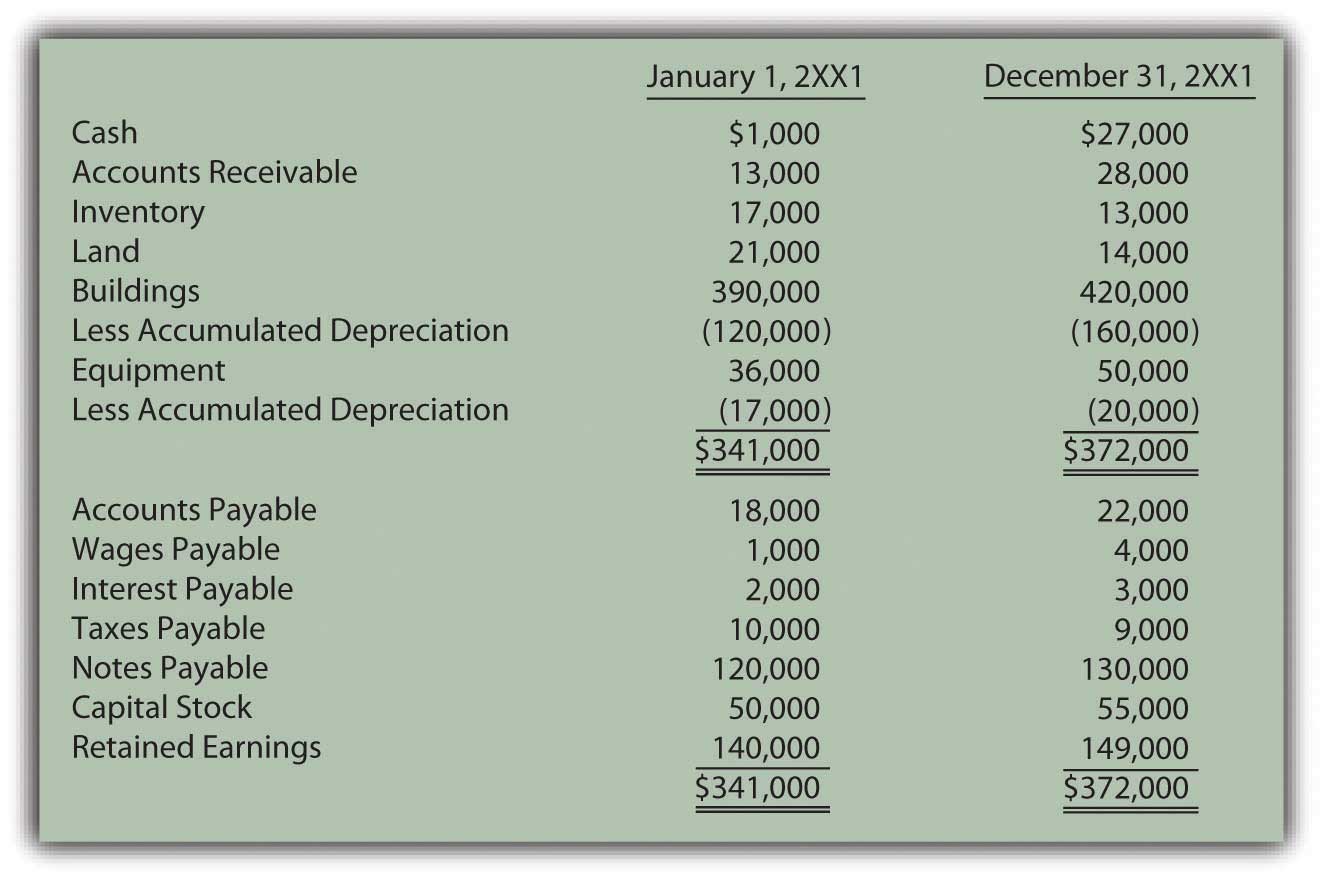

Wages payable and other payable accounts are recorded in the current liabilities.

Wages payable income statement. Salaries And Wages Payable Salaries And Wages Expense Post Closing Trial Balance Salaries And Wages Multiple Step Income Statement TERMS IN THIS SET 77 Indicate which accounts should be debited and credited. Someone who is paid wages gets paid a certain amount for each hour worked. Expenses include costs for all primary and secondary business operations while accounts payable focuses on obligations the company has made to debtors suppliers vendors and.

Wages payable does not go on a companys income statement. Wages payable is an accrual account which means that the company has incurred wage expenses but has not paid them as of the reporting date. The number of days the salary has accrued are 26 27 28 29 30 and 31 6 days Each Day 2000 of Salary accrues therefore 2000 x 6.

It presents the companys revenue often broken down into various revenue streams such as product sales and royalties earnings. While accounts payable may seem similar to an expense at first heres how they differ. A new wages payable liability is created later in the following period if there is a gap between the date.

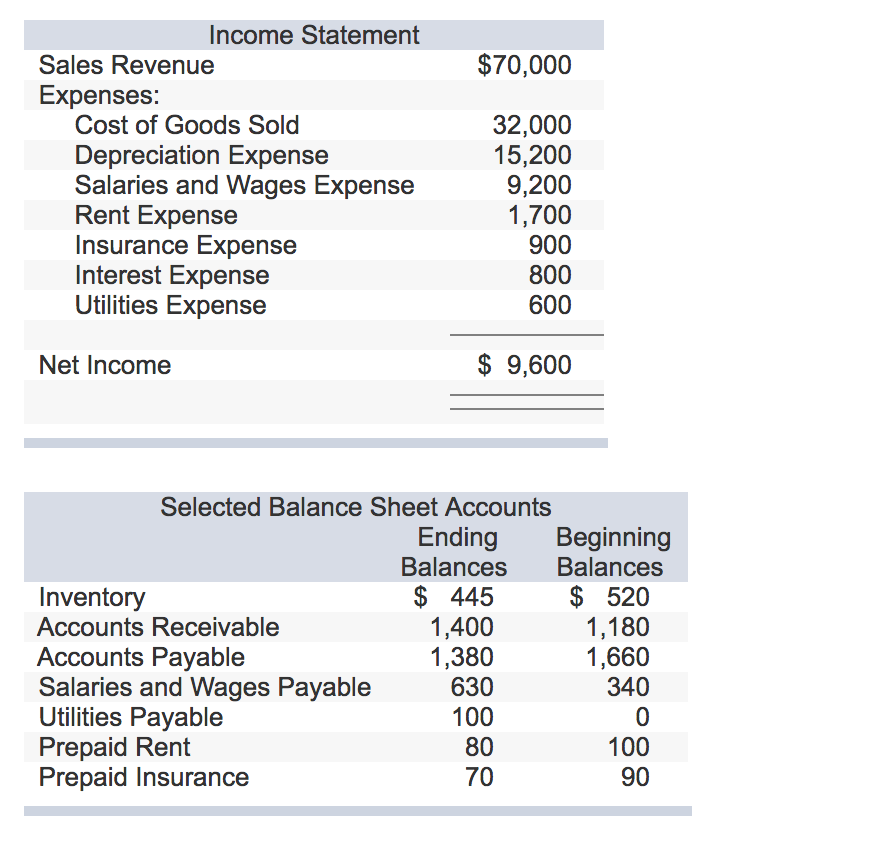

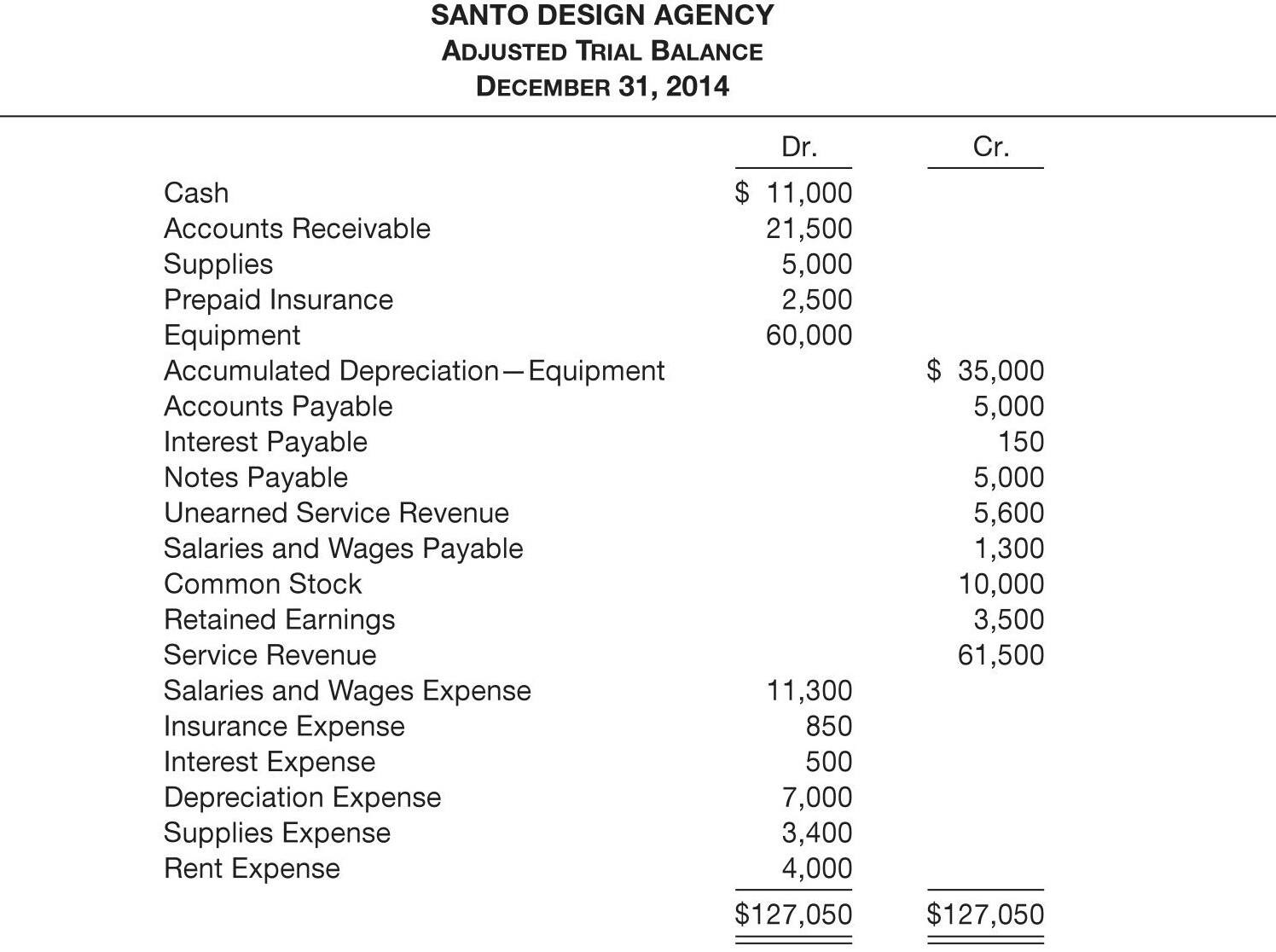

Salaries and wages of a companys employees working in nonmanufacturing functions eg. Accounts payable is located on the balance sheet and expenses are recorded on the income statement. It goes on its balance sheet.

Accrued Expenses and Revenues. The Income Statement The income statement documents how much money a company has made over the course of a given time frame such as a quarter or a year. The balance in this account is typically eliminated early in the following reporting period when wages are paid to employees.

Free Financial Statements Cheat Sheet. Salaries and Wages as Expenses on Income Statement. When you flip over to the income statement you will see that two week accrual plus a payroll expense that reflects wages incurred and paid during the current accounting period.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)