Simple Prepaid Expenses Treatment In Profit And Loss Account

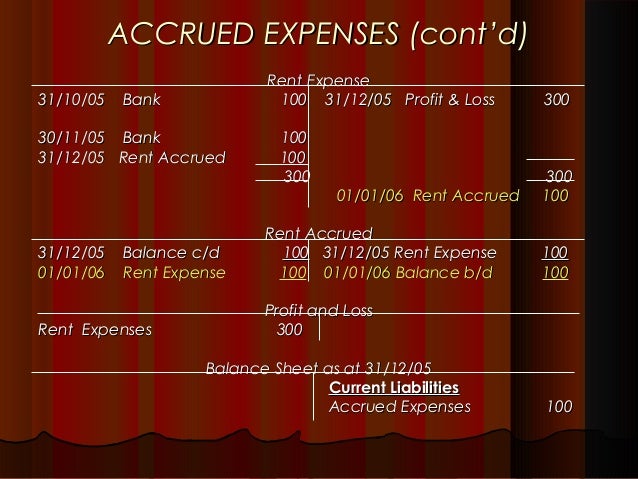

Outstanding Expenditure ac is a personal account and an equivalent of a creditor.

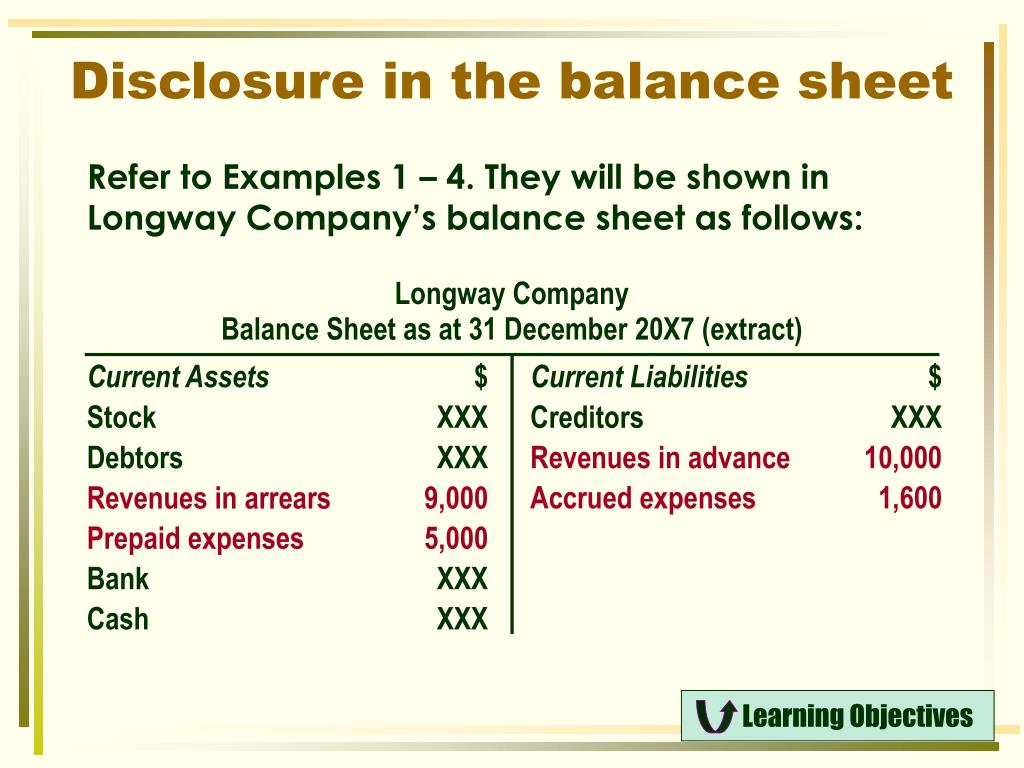

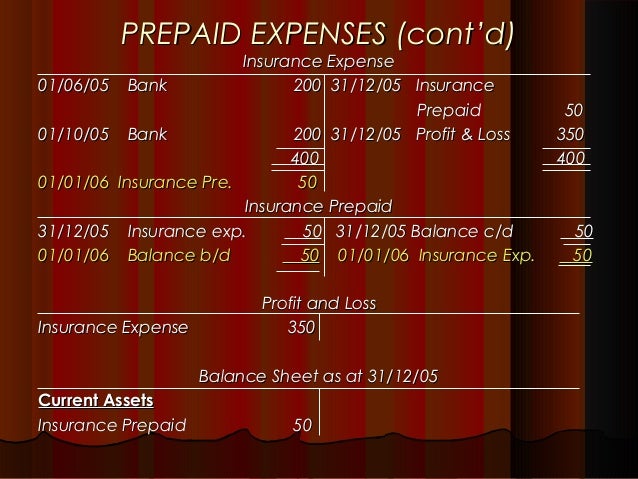

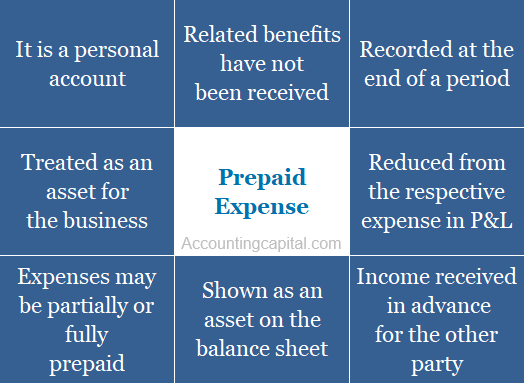

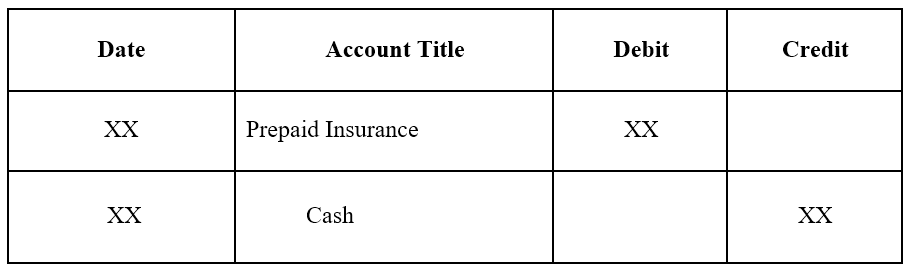

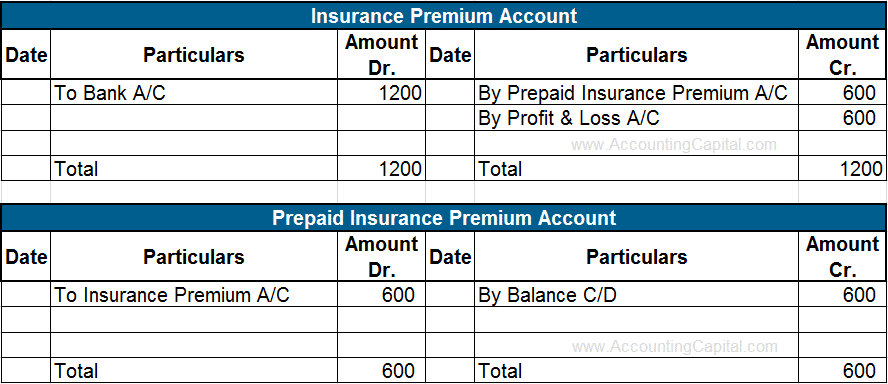

Prepaid expenses treatment in profit and loss account. The accruals also known as matching concept of accounts states that the figures shown on the final accounts of a business must accurately represent the financial period they are from. 12 month auditor recap. Prepaid Expenditure ac is a personal account and an equivalent of a debtor.

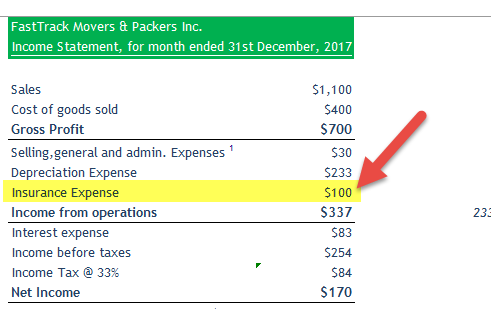

The PL statement shows a companys ability to generate sales manage expenses and create profits. It may so happen that we may earn some incomes during the current accounting year but not receive them in the same year. While preparing the Trading and Profit and Loss Ac we need to deduct the amount of prepaid expense from that particular expense.

When calculating a profit and loss account not every type of expense or revenue should be recorded. Perhaps when they come out of bond. Last years corporation tax provision would have been in last years profit and loss account but it wouldnt have been paid.

In which case the excise duty is a cost of. Show these transactions in the rental expense account. I assume that the excise duty was incurred on the import or manufacture of the goods and that the sale price has been set to recover this cost and make a profit.

When the asset is eventually consumed it is charged to expense. Certain expenses like insurance. Be sure to get professional financial advice before creating a profit and loss account yourself.

As the benefits of the expenses are recognized the related asset account is decreased and expensed. Prepayments in accounting Goods and services may be prepaid. A profit and loss statement PL or income statement or statement of operations is a financial report that provides a summary of a companys revenues expenses and profitslosses over a given period of time.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-01-5994210f98a84b468a9a113c94643d50.jpg)