Divine Provision For Doubtful Debts In Income Statement

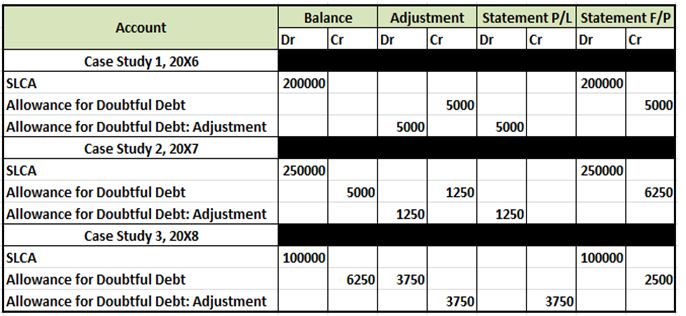

When increase then expense deducted from profit and when decrease then income added in profits.

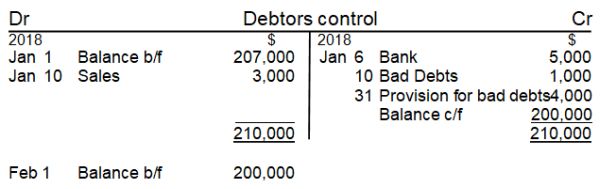

Provision for doubtful debts in income statement. While provision for doubtful debts needs to be recorded as an expense in the Income statement. So if estimated allowance for doubtful debt is same as last accounting period no accounting entry will be required in the current period as the total receivables will be reduced by the amount of allowance which has already been created. The provision for doubtful debts is an estimated amount of bad debts that are likely to arise from the accounts receivable that have been given but not yet collected from the debtors.

The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected. It is nothing but a loss to the company which needs to be charged to the profit and loss account in the form of provision. It is done on the reason that the amount of loss is impossible to ascertain until it is proved bad.

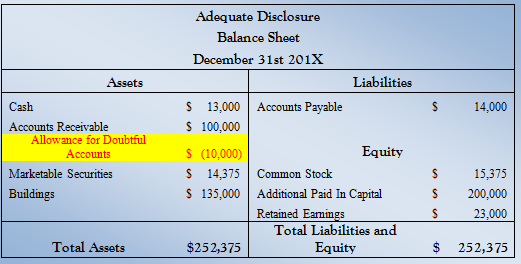

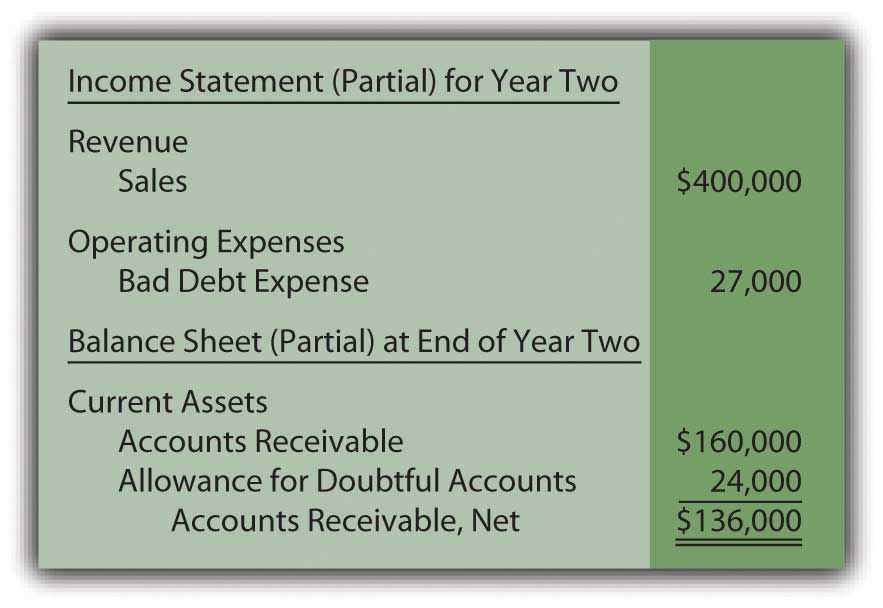

It is identical to the allowance for doubtful accounts. The allowance for doubtful debts is created by forming a credit balance which is netted off against the total receivables appearing in the balance sheet. If Provision for Doubtful Debts is the name of the account used for recording the current periods expense associated with the losses from normal credit sales it will appear as an operating expense on the companys income statement.

For Quarter 2 due to the receipt of cash from the doubtful debts profit is now higher by 80000 as this effectively reduce  the provision for doubt debts. It is similar to the allowance for doubtful accounts. Provision for bad debts can only appear in the income statement if there is an increase in provision.

Provision for bad debts is the estimated percentage of total doubtful debt that needs to be written off during the next year. This Bad Debts Expense account will be shown separately under Operating Expenses on the Income Statement. From the Income Statement- Assuming that earlier in Quarter 1 provision for doubtful debts of 100000 is created hence reducing corresponding the profit by the same amount.

A change to the balance in the allowance for doubtful accounts also affects bad debt expense on the income statement. Only change increase or decrease in provision for doubtful is shown in the income statement. Provision for doubtful debts seems to be suffering from the same predicament beacuse strictly speaking the estimate for doubtful debts is not an obligation to an external party as per IAS 37 definition of a provision.