Casual Statement Of Corrected Net Profit Format

The March financial statements of Bold City Consulting Inc are prepared from the adjusted trial balance in Figure 1.

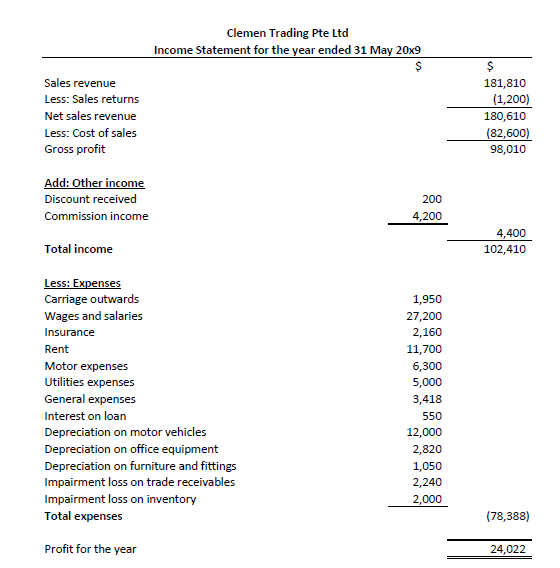

Statement of corrected net profit format. B Draw up a statement showing the revised profit after correcting the above errors. View full document. Sales or Revenue Section.

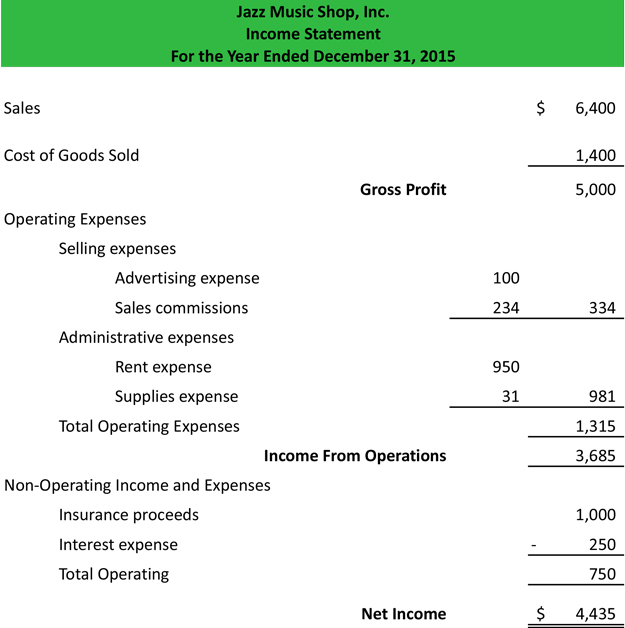

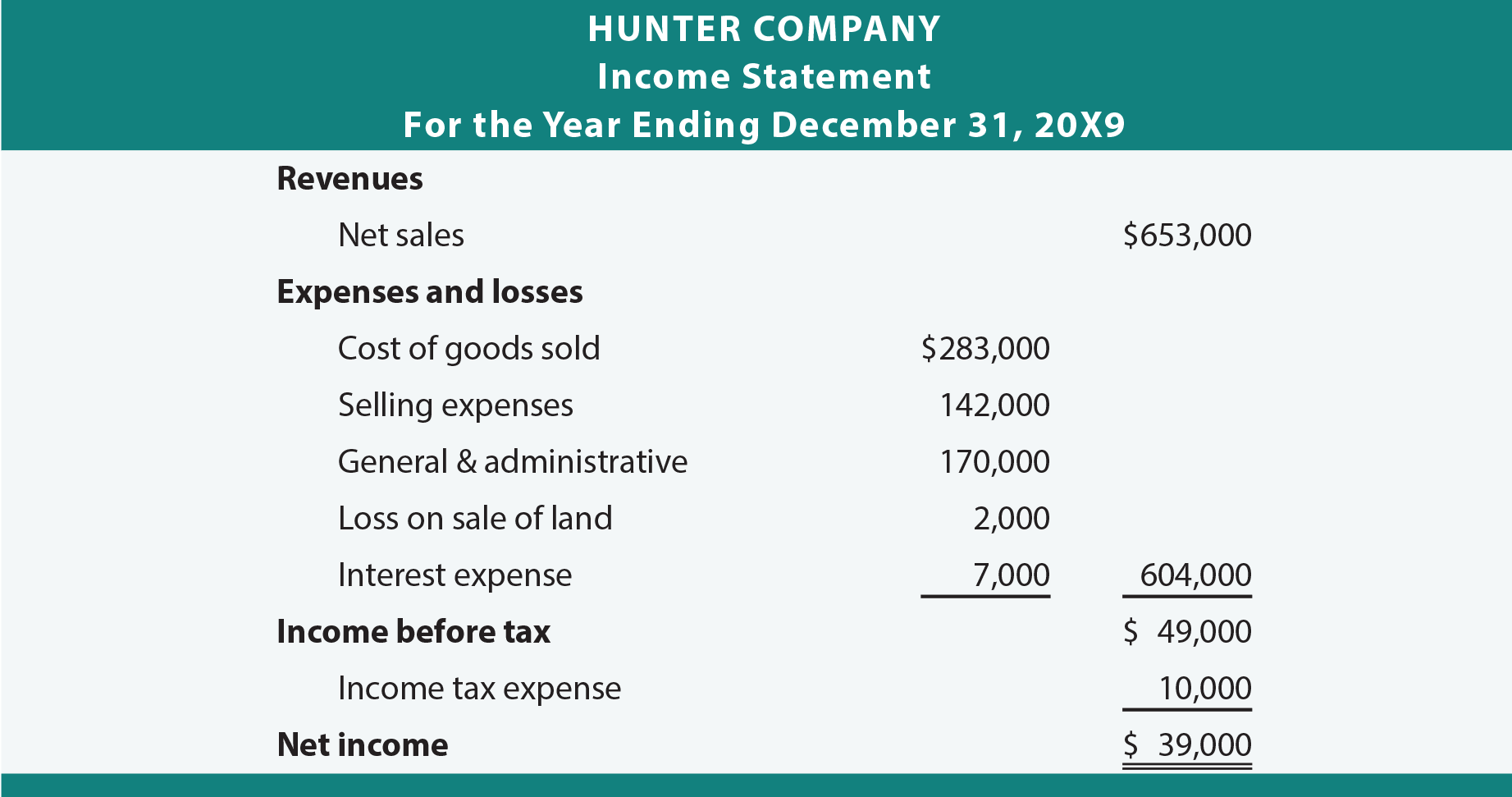

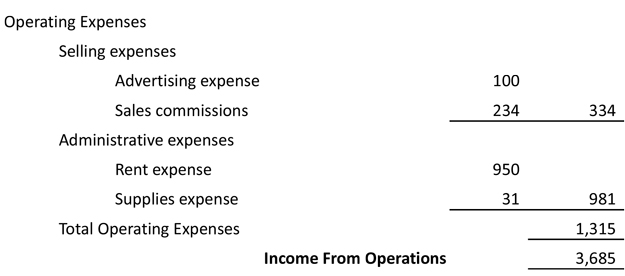

This account is the same as the second part of the account prepared in the direct. Gross profit income from operations income before income tax and net income. Prepare a statement of corrected net profit - think that whether the items are in trading andor profit and loss account then they will affect net profit.

A The objective of financial statements is to provide information about. Under this method we make up an account by name Adjusted Profit and Loss ac posting the Net Profit along with all the postings representing losses gains appropriations and adjustments. 2-Line Statement You should report your business income using the 2-line statement when your revenue is 200000 or less 100000 or less for YA 2020 and before.

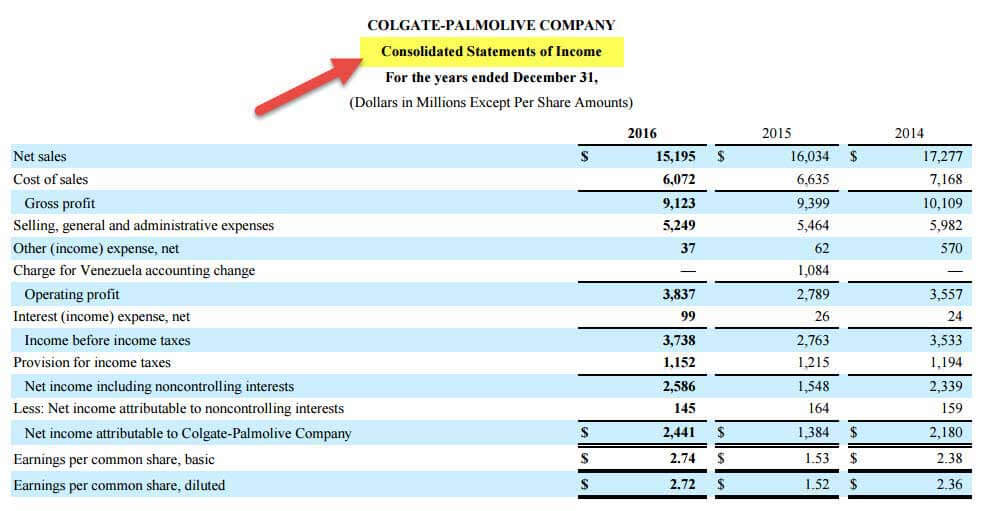

A tax computation is a statement showing the tax adjustments to the accounting profit to arrive at the income that is chargeable to tax. You should use the 4-line statement when your revenue is more than 200000. Companies should prepare their tax computations annually before completing the Form C-S C.

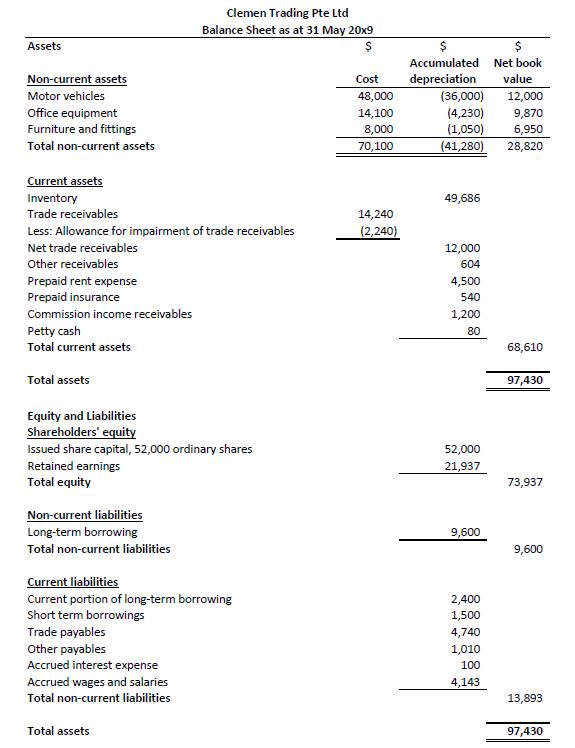

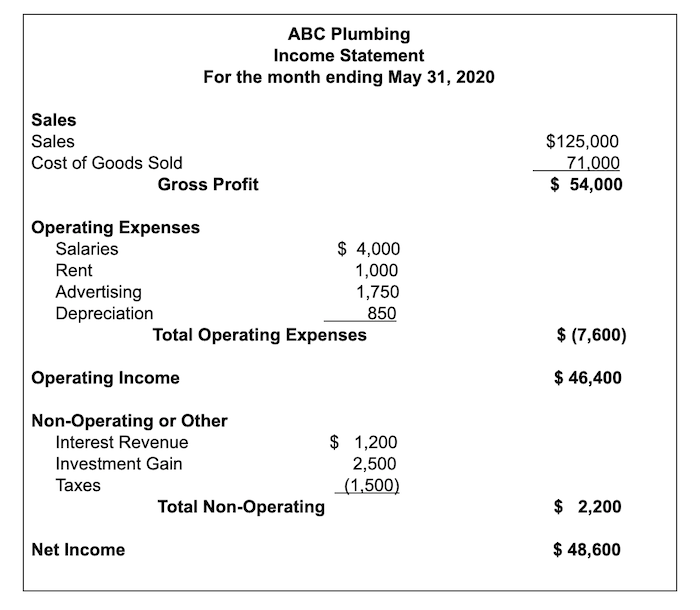

Typically it proves useful in gauging a companys net profit per unit of income earned. Tax adjustments include non-deductible expenses non-taxable receipts further deductions and capital allowances. In arriving at net income the statement presents the following subtotals and totals.

That leaves them with a gross profit of 300000. B Statement of Corrected Net Profit for yr ended 31 Dec 20X2 Net Profit as per accounts 1600 Add iv Purchases under stated 36 1636 Less i Sales overcast 70 ii Rent undercast 40 Corrected Net Profit 1526 25. As shown below this is accomplished by listing each net asset fund in a separate column.