Stunning Treatment Of Accrued Interest In Cash Flow Statement

Classification of interest and dividends 45.

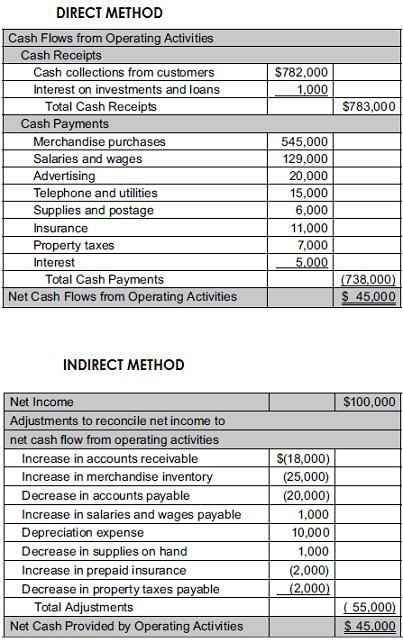

Treatment of accrued interest in cash flow statement. In recent years the FASB issued ASU 2016-152 and ASU 2016-183 which clarified guidance in ASC 230 on the classification of certain cash flows and removed some of. Under IFRS there are two allowable ways of presenting interest expense in the cash flow statement. Under the indirect method we take the profit or loss before tax and interest paid and then we subtract the amount of interest paid during the year.

Accrual interest is not added back because it is one part included in PAYABLES FINANCE LEASE 2Accrual enterst is written off in the Statement of cash flows because when the entity pays for the PAYABLES also account for the accrual interest. Statement of Cash Flow--Indirect Method Intermediate Accounting CPA Exam FAR Chp 23 p 2. Common classification errors in practice 5.

The indirect method adjusts accrual basis net profit or loss for the effects of non-cash transactions. Interest Paid on Statement of Cash Flow. Which results of operations are provided.

It will the net of interest expense for the period less the interest accrued but not paid yet. Interest paid is a part of operating activities on the statement of cash flow. When a company prepares its net income statement interest paid is subtracted as a debit.

Payment Interest Principal. The method used is the choice of the finance director. Presentation of operating cash flows using the.

Cash paid on interest will be present under the cash flow. Profit before interest and income taxes. Any increase in accruals shall be added to the profit before tax and any decrease in accruals should be subtracted from the profit before tax.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)