Unique Cash Flow Statement Using Direct Method

The direct method cash flow statement is one way to show the cash flow from operating activities of a business.

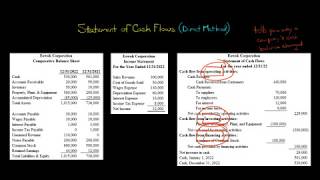

Cash flow statement using direct method. The direct method of presenting the statement of cash flows presents the specific cash flows associated with items that affect cash flow. The Direct Method or the Indirect Method only apply to the Cash Flow from Operations and do not effect the Cash Flow from Investing or Cash Flow from Financing sections of the Cash Flow Statement. If the direct method of preparing the statement of cash flows is used the Financial Accounting Standards Board requires companies to disclose the reconciliation of net income to the net cash provided by used by operating activities that would have been reported if.

In the indirect method cash flow from operations calculation is done using net income as the base. Items that typically do so include. In this video 2503 Statement of Cash Flows.

A cash flow statement can be presented using two methods. In FASBs view the direct method better achieves the cash flow statements primary objective to provide relevant information about the reporting entitys cash receipts and cash payments and the overall objective of financial reporting to provide information that is useful to users in making. Direct Method Lesson 1 Roger Philipp CPA CGMA first compares and contrasts the two methods for calculat.

The statement of cash flows under indirect method for Tax Consultation Inc. The direct method of developing the cash flow statement lists operating cash receipts eg receipt from customers and cash payments eg payments to employees suppliers operations etc in the operating activities section. The Direct Method is the preferred method by FASB but due to its laborious nature most Accountants prefer the Indirect Method.

The direct method is also known as the income statement method. The direct method uses actual cash inflows and outflows from the companys operations. A cash flow direct method formula is used to calculate cash inflows and cash outflows when preparing a cash flow statement using the direct method.

Also known as the income statement method the direct method cash flow statement tracks the flow of cash that comes in and goes out of a company in a specific period. The two methods differ in terms of how the cash flow from operating activities is calculated. In the direct method the cash flow statement from operations is calculated using only cash transactions such as cash spent and cash received.