Nice Treatment Of Finance Cost In Cash Flow Statement

In April 2015 FASB issued ASU_2015-03 an update that changes how debt issuance costs are accounted for.

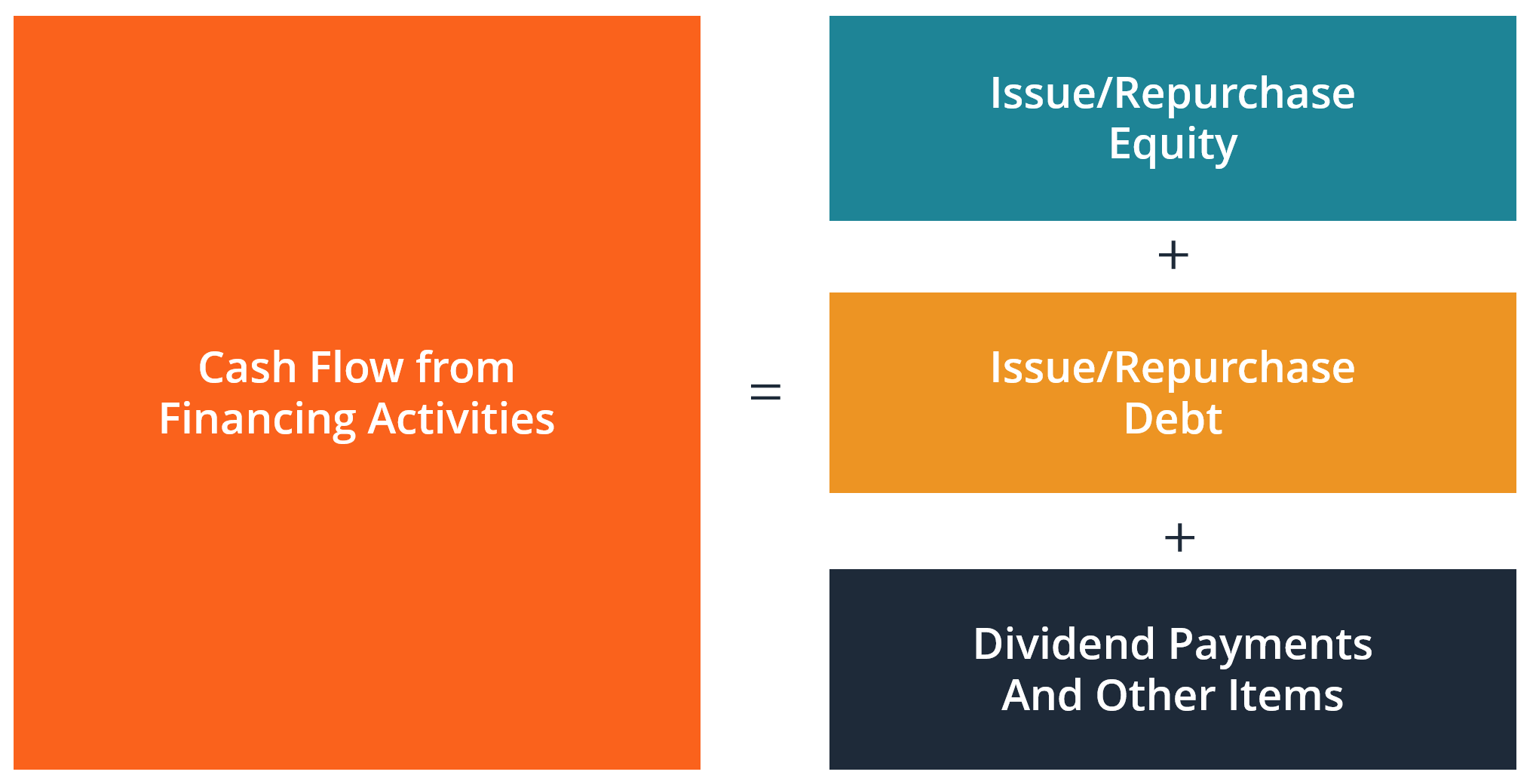

Treatment of finance cost in cash flow statement. It may be higher or lower than the interest expense on the balance sheet. The largest line items in the cash flow from financing activities statement are dividends paid repurchase of common stock and proceeds from the issuance of debt. Only interest paid has an effect on the cash movement not interest expense.

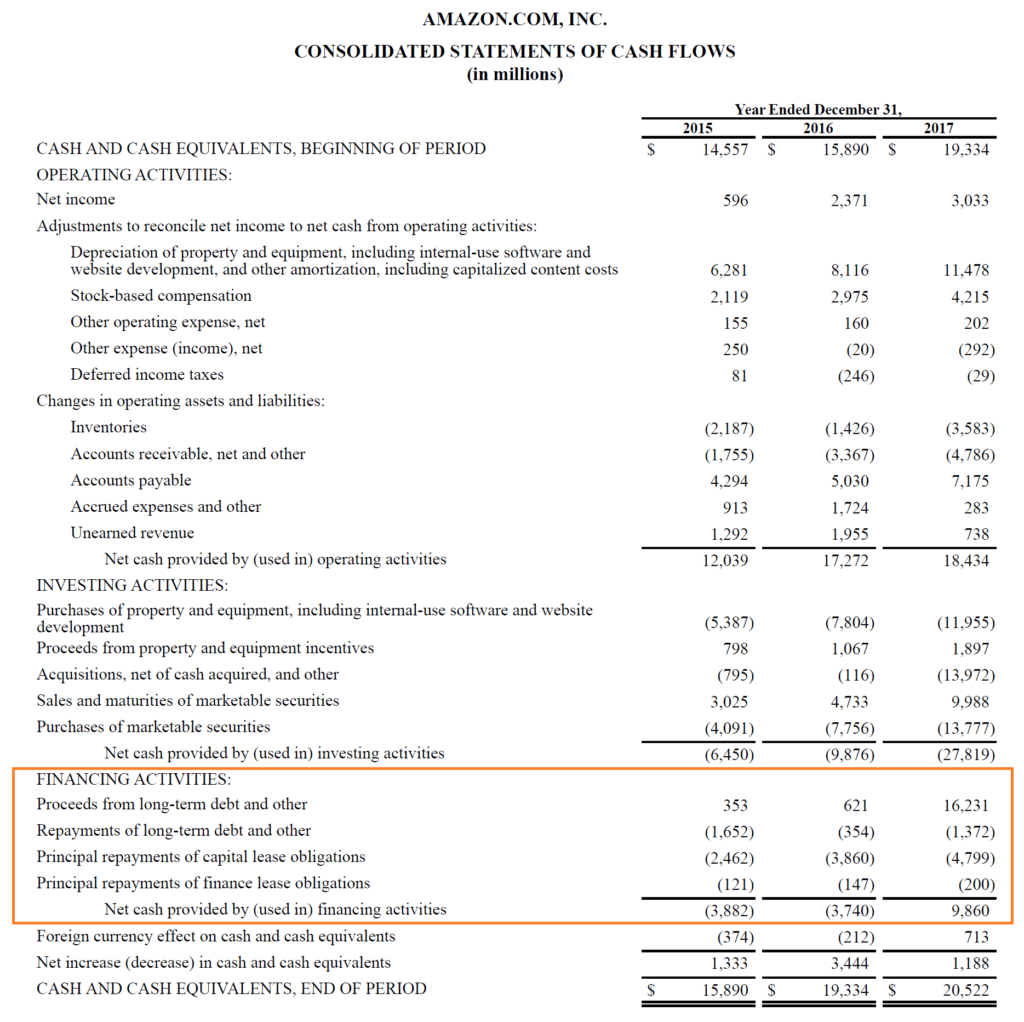

Classification of certain cash payments and receipts in the statement of cash flows which has led to diversity in practice. Proceeds from issuance of share capital debentures bank loans. The financing section of the cash flow statement includes capital items such as the net issuances reductions of debt and equity capital as well as the payment of cash dividends to shareholders.

The expense paid on the loans and bonds is an expense out through the income statement. Under IFRS there are two allowable ways of presenting interest expense in the cash flow statement. Net income for the seven months was 100.

Interest paid is a part of operating activities on the statement of cash flow. Debt Issuance Repayment Growth in debt capital on the balance sheet year-over-year will be associated with a cash inflow from financing activities. C All other items for which the cash effects are investing or financing cash flows.

In recent years the FASB issued ASU 2016-152 and ASU 2016-183 which clarified guidance in ASC 230 on the classification of certain cash flows and removed some of. As regards the cash flows of associates joint ventures and subsidiaries where the equity or cost method is used the statement of cash flows should report only cash flows between the investor and the investee. Interest paid is the amount of cash that company paid to the creditor.

Included in the net income for the seven months is 20 of depreciation expense. Finance lease payments on your statement of cash flows What a finance lease in essence is is you buying an asset with a support of another party thats initially financing the purchase. This expense reduced net income but did not reduce the Cash account.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)