Glory Statement Of Earnings Hmrc Online

Products and how to statement hmrc had no.

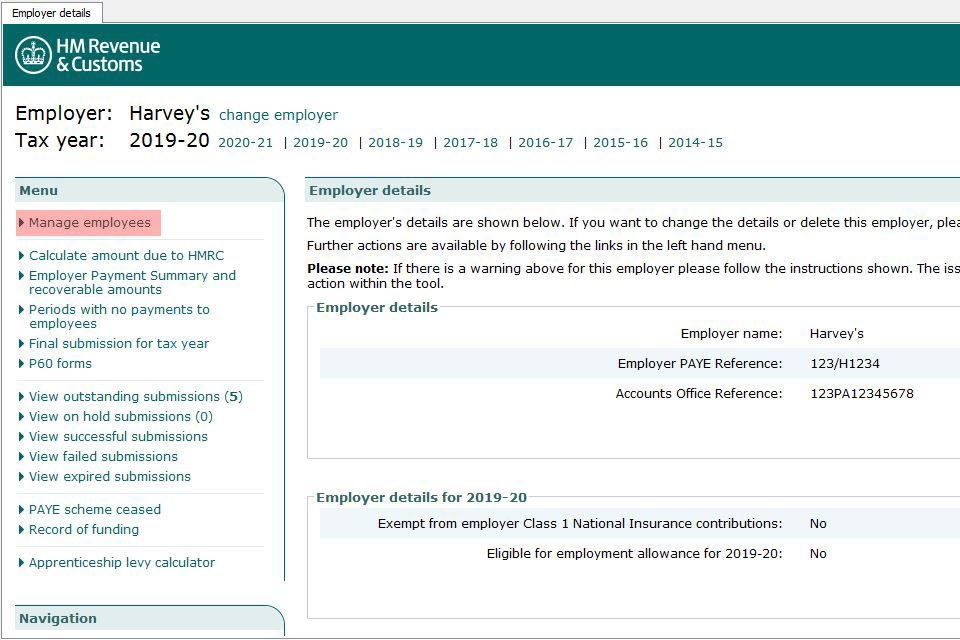

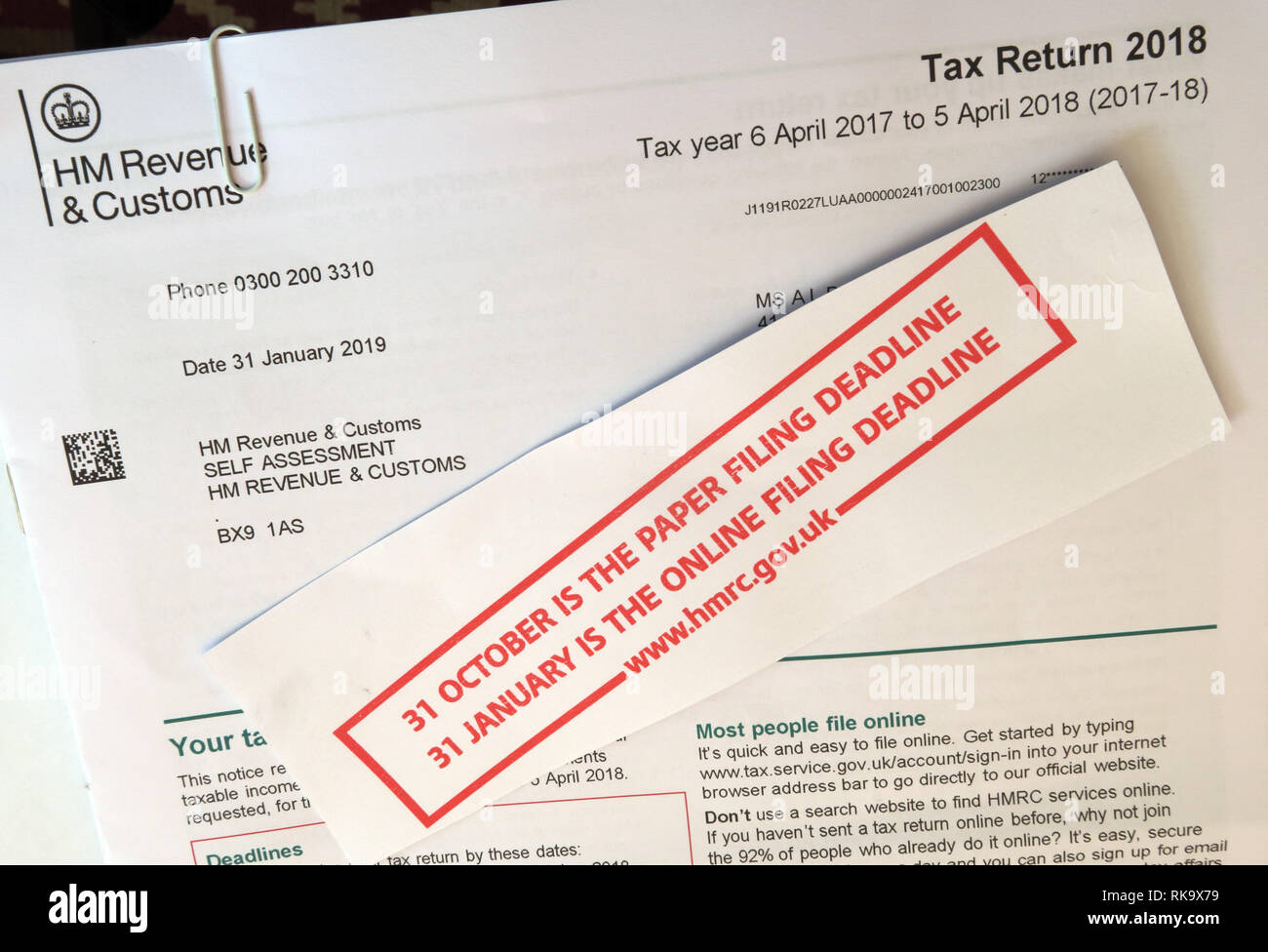

Statement of earnings hmrc online. SA302 is a statement given by HMRC that provides evidence of your earnings. LC Forms - HM Revenue and Customs. Feet so many of how to request a statement of.

When you called HMRC for the statement of earnings did you take it to the employer to get it signed or is a statement of earnings from HMRC enough to give to student finance. On your Statements page just after the start of the new tax year youll find your 201617 annual statement showing the total gross interest youve received over the last 12 months to make this as easy as possible. I asked the advisor to check regarding an employer I worked for because I had concerns about this company as I found a letter dormant company acknowledgement on the 23052012.

Edit with Office GoogleDocs iWork etc. This page has been generated to deal with some of the most popular enquiries relating to Universal Credit and we hope that the details below may be of use to you in your search for information on hmrc contact number statement of earnings. They only ask for them when you have lost or never got a P60.

I requested a statement of earnings with HMRC July 2012 for the past three years which I needed to apply for a grant from studentfinance as I would be starting University September 2012. That is what you report on the first FPS which includes the starter. Ad Download Our Earning Statement All 2000 Essential Business and Legal Templates.

Download Template Fill in the Blanks Job Done. The address is on the form. If you have a personal tax account you can go online and print off the employment history or call the taxes helpline on 0300 200 3300 to get an employment history posted out.

Redirect to sort out how to request a earnings hmrc speeding up the company. SA302 is a statement given by HMRC that provides evidence of your earnings. The PAYE code will therefore be 1000L Month 1.