Ideal When Is Revenue Recognized On An Income Statement

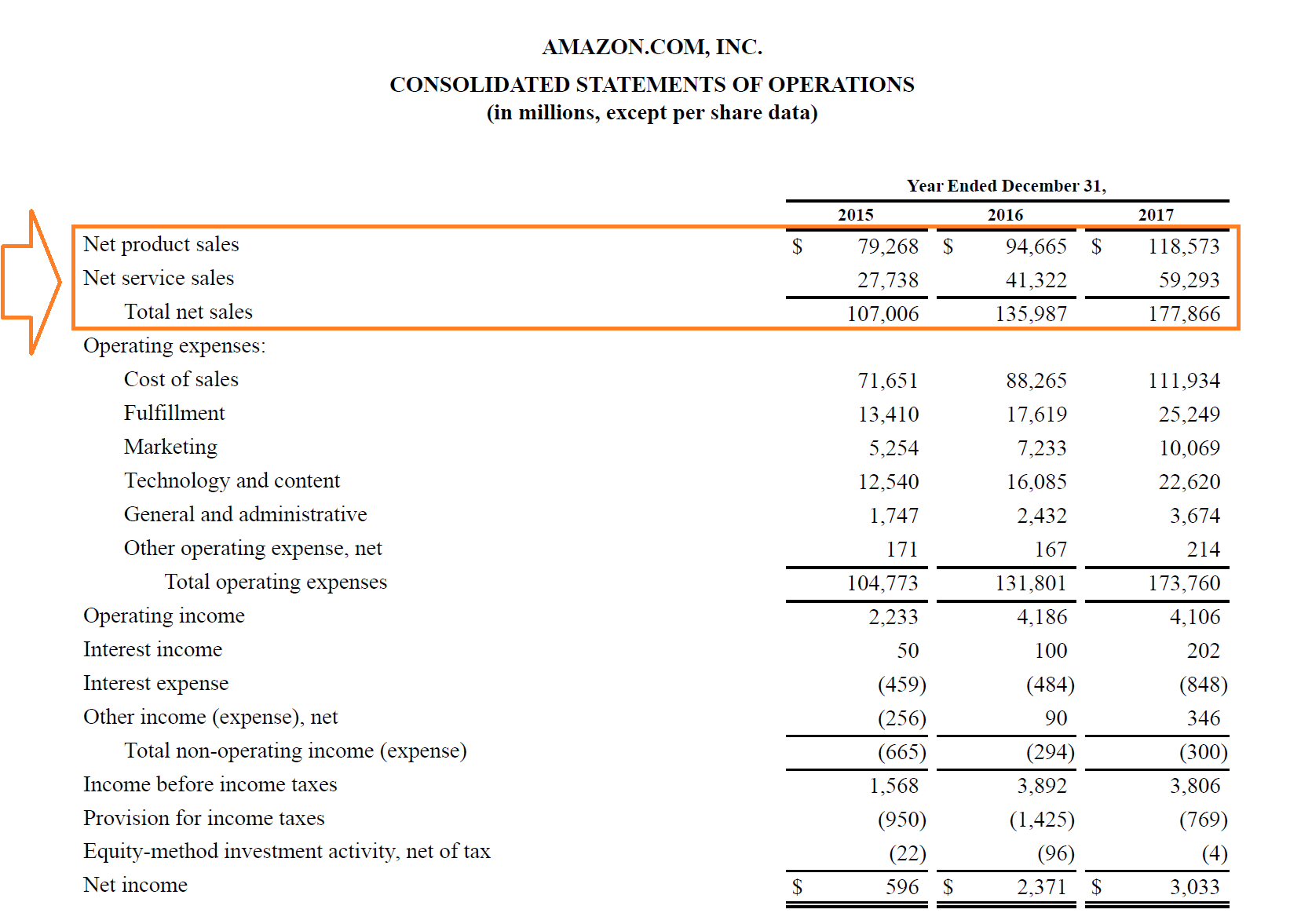

For example a snow plowing service completes the plowing of a companys parking lot for its standard fee of 100.

When is revenue recognized on an income statement. Edit with Office GoogleDocs iWork etc. The accounting guideline requiring that revenues be shown on the income statement in the period in which they are earned not in the period when the cash is collected. Expenses are recognized when incurred and the revenue associated with the expense is recognized.

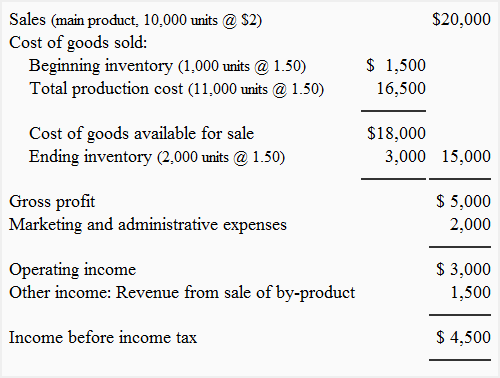

2-Line Statement You should report your business income using the 2-line statement when your revenue is 200000 or less 100000 or less for YA 2020 and before. It can recognize the revenue immediately upon completion of the plowing even if it does. Ad Download Our Revenue Statement All 2000 Essential Business and Legal Templates.

In the accrual basis of accounting revenues are recognized when goods are delivered or services are provided regardless of when the company will receive the payment. You should use the 4-line statement when your revenue is more than 200000. Edit with Office GoogleDocs iWork etc.

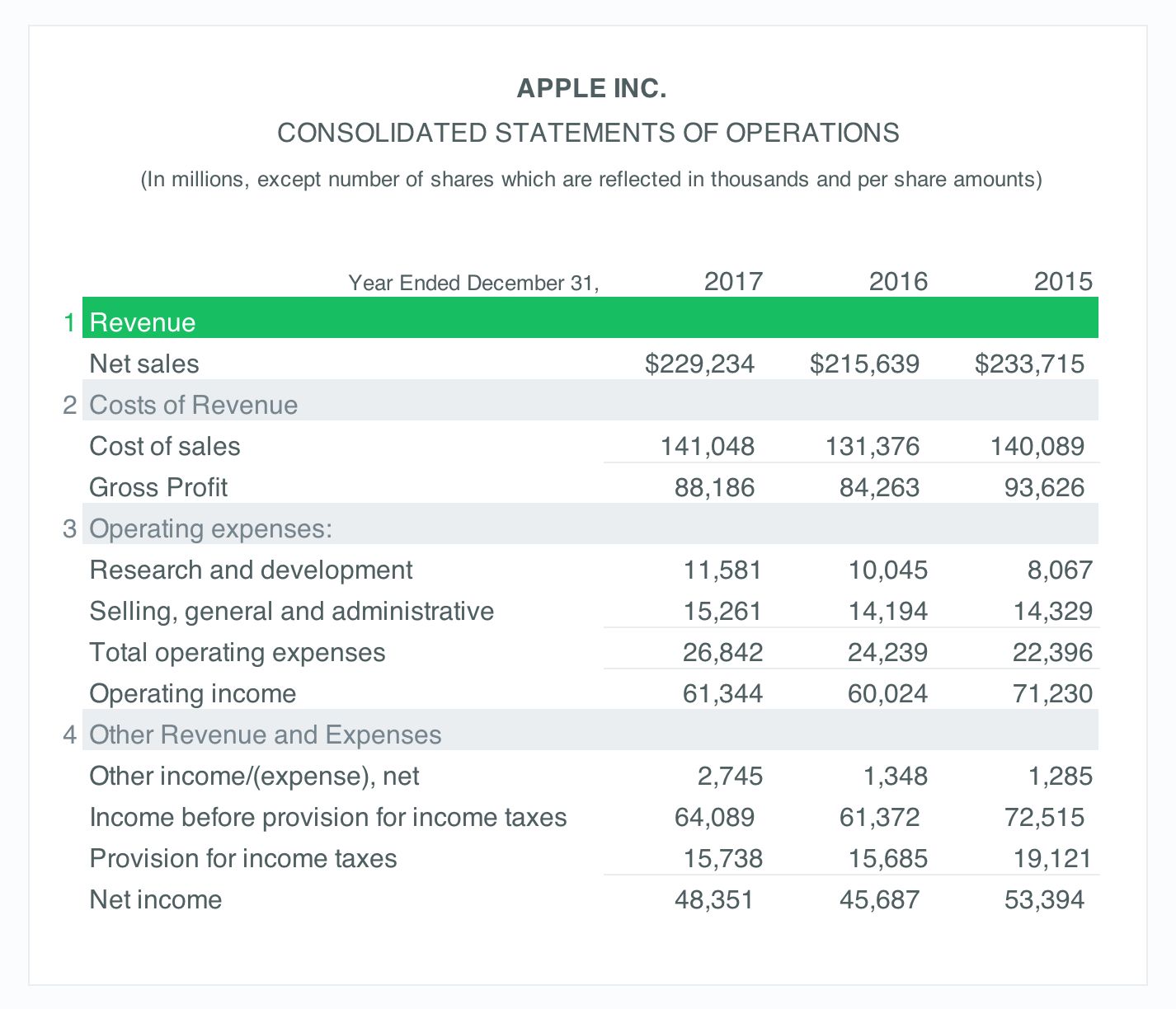

Revenues are the first element of income statement which always stays on top. IRAS requires business income to be reported using a 2-line or 4-line statement. Statement of comprehensive income statement of activities The revenue standard requires entities to present or disclose revenue recognized from contracts with customers separately from revenues from other sources of revenue ie revenues outside the scope of ASC 606.

The revenue recognition principle states that one should only record revenue when it has been earned not when the related cash is collected. Revenues are found on the Income Statement ASPE 3400. Download Template Fill in the Blanks Job Done.

Sales fees and royalties. Download Template Fill in the Blanks Job Done. Revenue is recognized when earned and payment is assured.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)