Unique Bank Financial Statement Analysis Ppt Deferred Income Tax Liability Example

At the end of each financial year deferred tax assets and liabilities are recalculated.

Bank financial statement analysis ppt deferred income tax liability example. Further you add it back on the cash-flow statement under operating activities and account for it on the balance sheet under EDIT. Consider a company with a 30 tax rate that sells a product worth 10000 but receives payments from its customer on an. FASB 109 Summary FASB 109 notes a critical assumption of financial accounting--that the reported amounts or book bases of assets and liabilities will be recovered and.

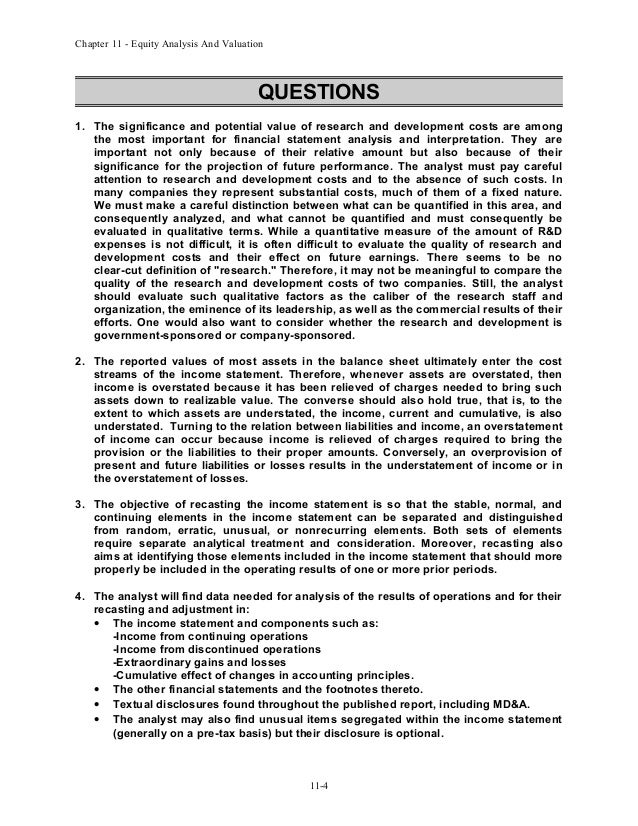

Deferred Tax arises from the analysis of the differences between the taxable profit and the accounting profit. And IFRS 12. Income statement reports straight-line depreciation in years 1-4 of 2500 each year.

Disclosure of Interests in Other Entities. Temporary difference leading to a deferred tax liability DTL Below is an example of the creation of a deferred tax liability. Assuming a deferred tax liability of 10.

To understand the meaning and objectives of financial statement. GAAP as well as rules and regulations of the US. For book purposes depreciate using straight-line method.

Deferred income tax assets and liabilities are computed annually for differences between the financial statement and tax. The reported financial statements for banks are somewhat different from most companies that investors analyze. For tax purposes depreciate using MACRS Yr 150 Yr 233 Yr 317.

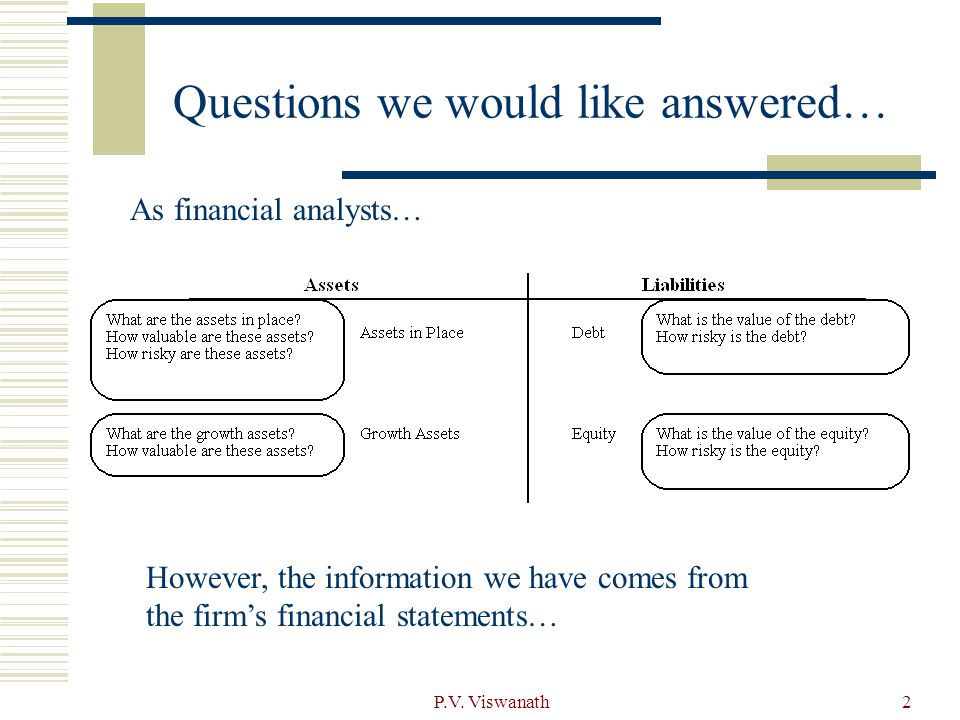

The creation of the deferred tax asset or the deferred tax liability has been criticized greatly because of the major reason that the said creation does not connects in any manner with the conceptual framework of presentation of the financial statements and also with the statement of financial concepts. This is done by comparing the tax bases and carrying amounts of. To know the business environment in which the Bank is working.