Spectacular Which Item Shows A Debit Balance In The Trial Balance

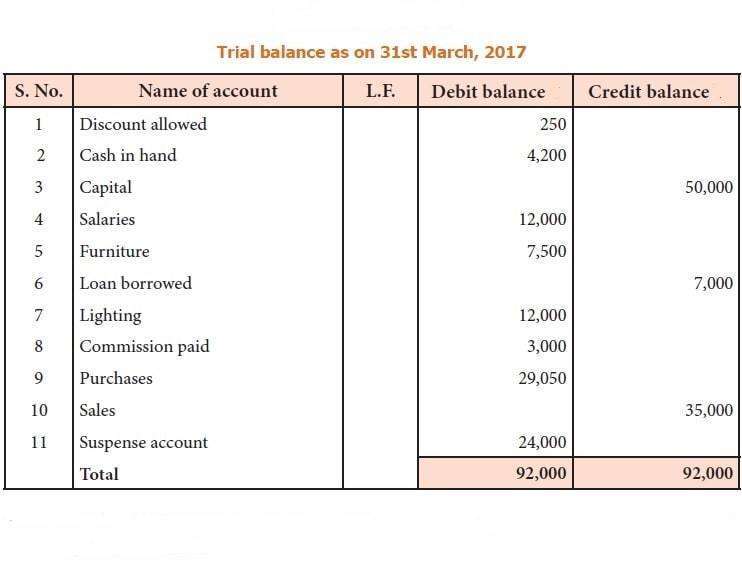

It is usually prepared at the end of an accounting period to assist in the drafting of financial statements.

Which item shows a debit balance in the trial balance. Whereas the Balance Sheet is the statement that shows the companys financial status by reviewing the capital liabilities and assets on a particular date. All three have exactly the same format. A debit balance is a net amount often calculated as debit.

It has our assets expenses and drawings on the left the debit side and our liabilities revenue and owners equity on the right the credit side Hence Prepaid expense is an expense which is shown in Dr. Just so what goes on the credit side of a trial balance. Trial Balance is a part of the accounting process that shows the debit and credit balances received from the ledger accounts.

Ledger balances are segregated into debit balances and credit balances. The trial balance is a list of all the accounts a company uses with the balances in debit and credit columns. Trial Balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements.

The trial balance in excel is as follows. Omissions of economic events. Debit Balance In a General Ledger when the total credit entries are less than the total number of debit entries it refers to a debit balance.

A trial balance includes a list of all general ledger account totals. The trial balance is recorded under debit and credit columns while a balance sheet ideally displays total assets liabilities and stockholders equity. The format of the trial balance is a two-column schedule with all the debit balances listed in one column and all the credit balances listed in the other.

Generally assets and expenses have a positive balance so they are placed on the debit side of trial balance. Assets liabilities equity dividends revenues and expenses. An asset and expense increases when it is debited and visa versa.