Beautiful Negative Retained Earnings On Balance Sheet How To Make Projected Balance Sheet In Excel

In a 3-statement model the net income will be referenced from the income statement.

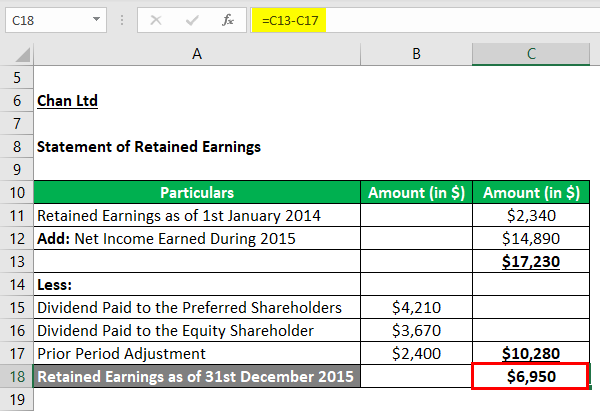

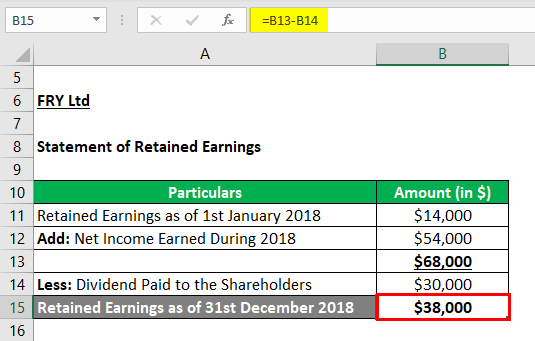

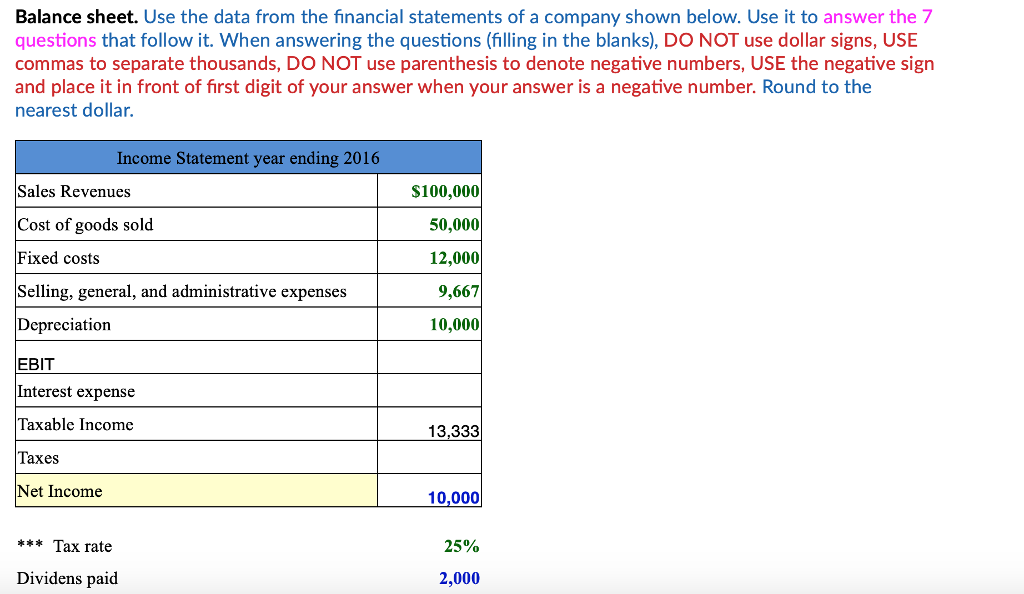

Negative retained earnings on balance sheet how to make projected balance sheet in excel. Warren Buffet recommended creating at least 1 in market value for every 1 in retained earnings on a five-year rolling basis. Beneath it list the name of the organization and the effective date of the balance sheet the last day of the quarter or fiscal year. To calculate retained earnings find the ending balance of retained earnings from the previous period on your annual report.

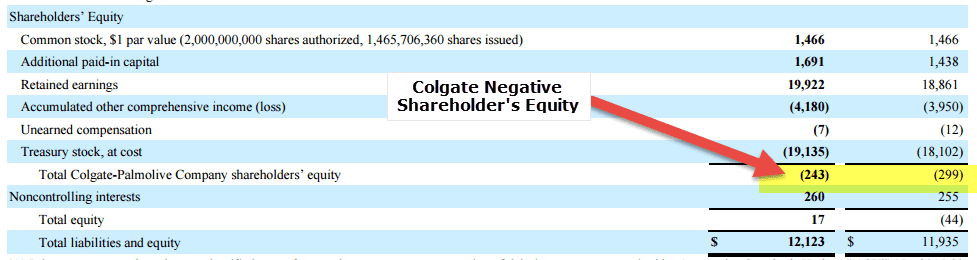

Negative retained earnings appear as a debit balance in the retained earnings account rather than the credit balance that normally appears for a profitable company. Retained earnings can be negative if the company experienced a loss. My suggestion dont waste another minute trying to figure out how to balance your balance sheet.

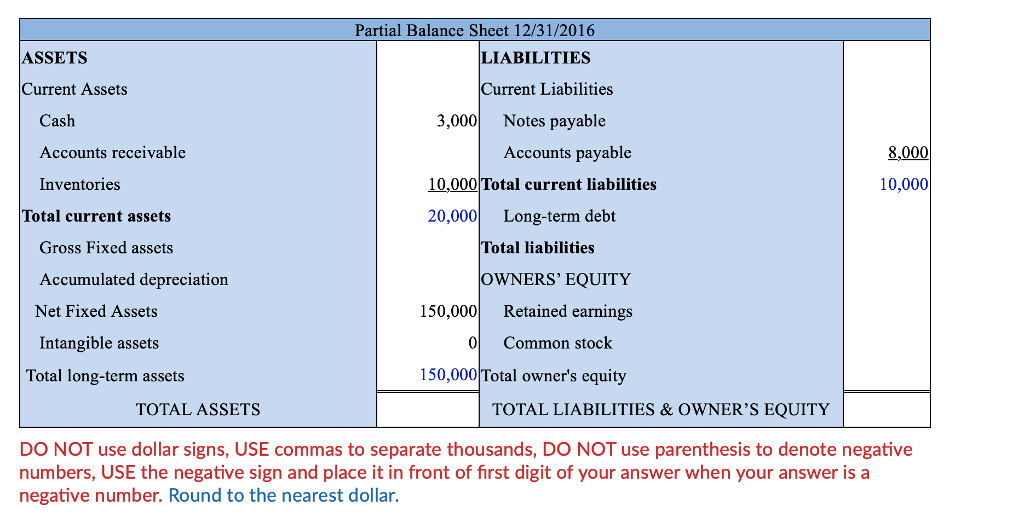

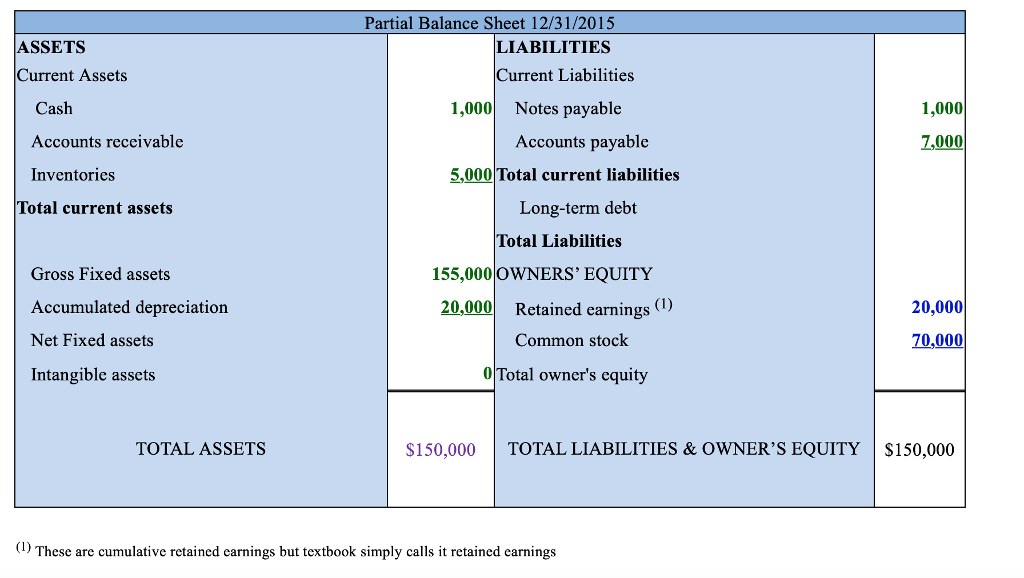

Meanwhile barring a specific thesis on dividends dividends will be forecast as a percentage of net income based on historical trends keep the historical. Also known as a statement of financial position or report on financial condition a balance sheet is the synopsis in which a business reports the resources it relies on to make money. Since retained earnings go under the shareholders equity youre increasing the retained earnings and at the same time the liabilities side of your.

Negative retained earnings can be an indicator. That means youll report them on your balance sheet in the equity section and carry the RE 0 from the previous reporting periods retained earnings. The income statement records the companys profitability for the same period as the balance sheet.

The companys total assets must equal the sum of the total liabilities and total owners equity. Every period a company may pay out dividends from its net income. Retained Earnings are part actually involves projecting net income and dividends rather than retained earnings itself.

This is the total amount of net income the company decides to keep. The second section lists the firms liabilities and owners equity for a small business or retained earnings for a corporation. Cash an asset rises by 10M and Share Capital an equity account rises by 10M balancing out the balance sheet.