Out Of This World Form 26a For Non Deduction Of Tds

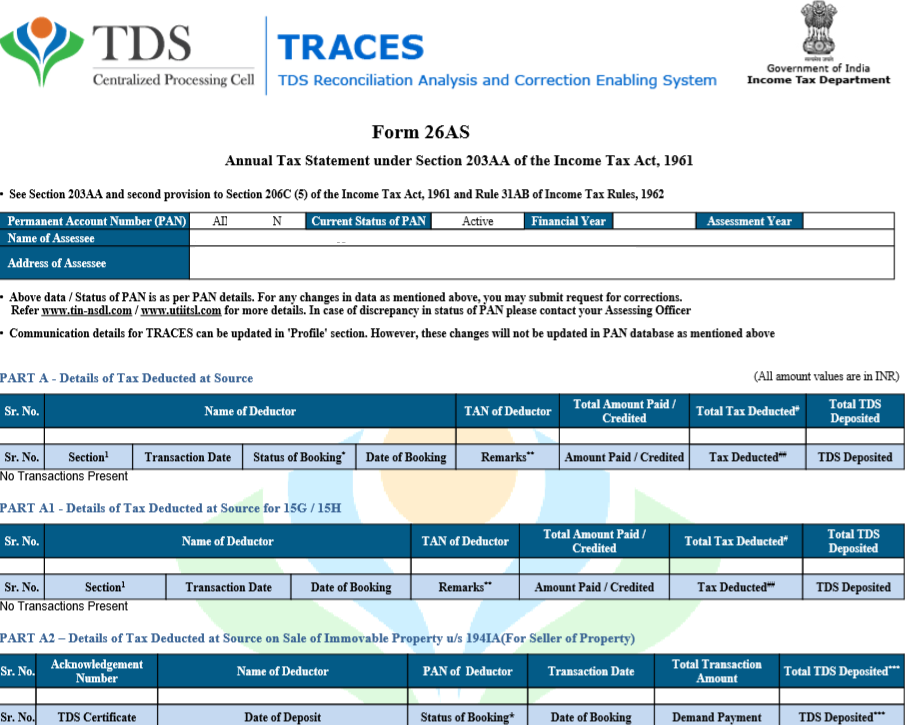

Form 26A download through net banking.

Form 26a for non deduction of tds. The Company will deduct TDS at the rate of 10 while making payment of fees. User may request for Non DeductionCollection transactions from FY 2016-17 onwards. The report provides with a summary of transactions in respect of non resident deductees who have not reported their PANs ie PAN not availableThe deductors can issue the Transaction Based Report generated and downloaded from the TRACES portal with or without digital signature to the Non Resident DeducteesThe summary of transactions in the TAR includes following key information besides.

Click on Go to Track Request for 26A27BA All the request for Form 26A27BA is shown in the table. I name am the person responsible for paying within the meaning of. Read the disclaimer click Confirm and the user will be redirected to TDS-CPC Portal.

This Request can only be raised on or after 1-Apr-2017. 12500 is available on income up to Rs. Form 26Q contains one annexure in which the following details are mentioned.

27BA for default in Payment of TCS and issued a notification related to same which is as follows -Income-tax Eleventh Amendment Rules 2012 Insertion of rules 31ACB 37J Form Nos. Also you need to mention the reasons in case the deductor has not deducted the TDS or deducted the TDS at a lower rate. The recipient furnishes a certificate to this effect from an accountant in Form No.

If your bank has permission from NSDL you can find the option to view this form on your net banking dashboard. As per Notification No. DeductorCollector can raise Request for 26A27BA for Form Type 24Q 26Q for TDS for Form 26A and 27EQ for TCS for Form 27BA.

A request number is generated for the Request of 26A27BA. These notifications allow filing of Form 26A27BA in a paper form till AY 2016-17. Click on Annexure-A Form 26A27BA option list on the page.