First Class Financial Statement Assertion

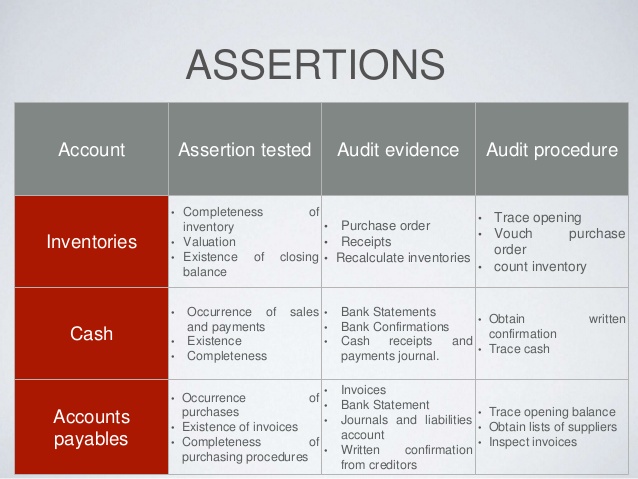

An auditor must obtain sufficient competent evidence to support the financial statement assertions.

Financial statement assertion. Financial Statement Assertions Assertions are representations by management explicit or otherwise that are embodied in the financial statements. However the auditor does not simply design tests with the broad objective to identify material misstatement. Financial statement assertions are the set of information that the preparer of financial statements is providing to another party.

For example when a financial statement has a cash balance of 605432 the business asserts that the cash exists. Since financial statements cannot be held to a lie detector test to determine whether they are factual or not other methods must be used to establish the truth of the financial statements. The moment the financial statements are produced the assertions or the claims of management also exist eg all items in the income statement are assured to be complete and.

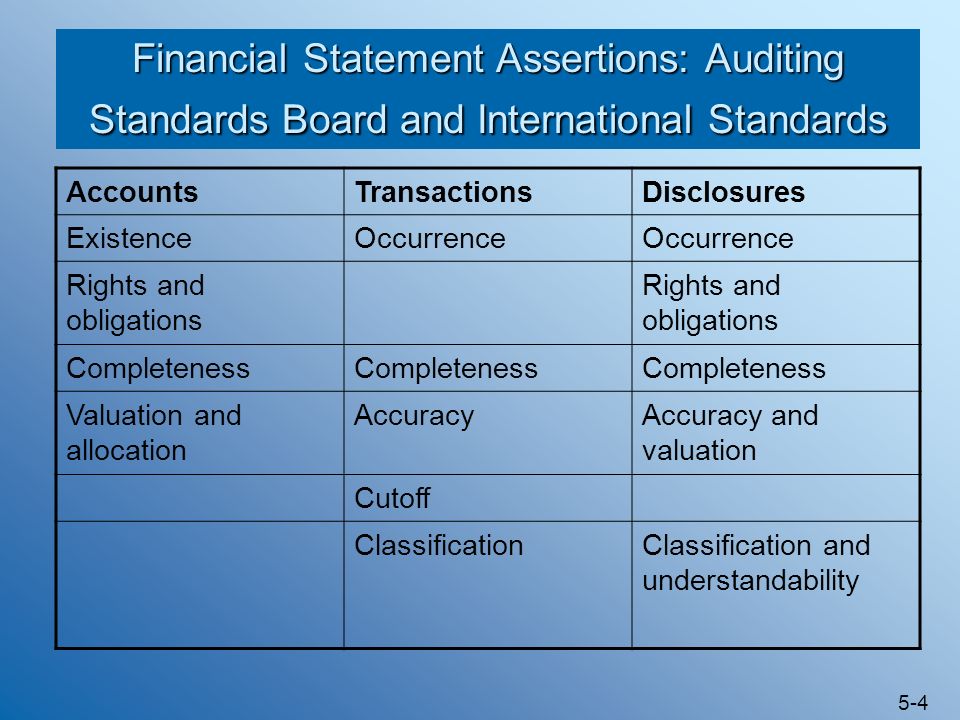

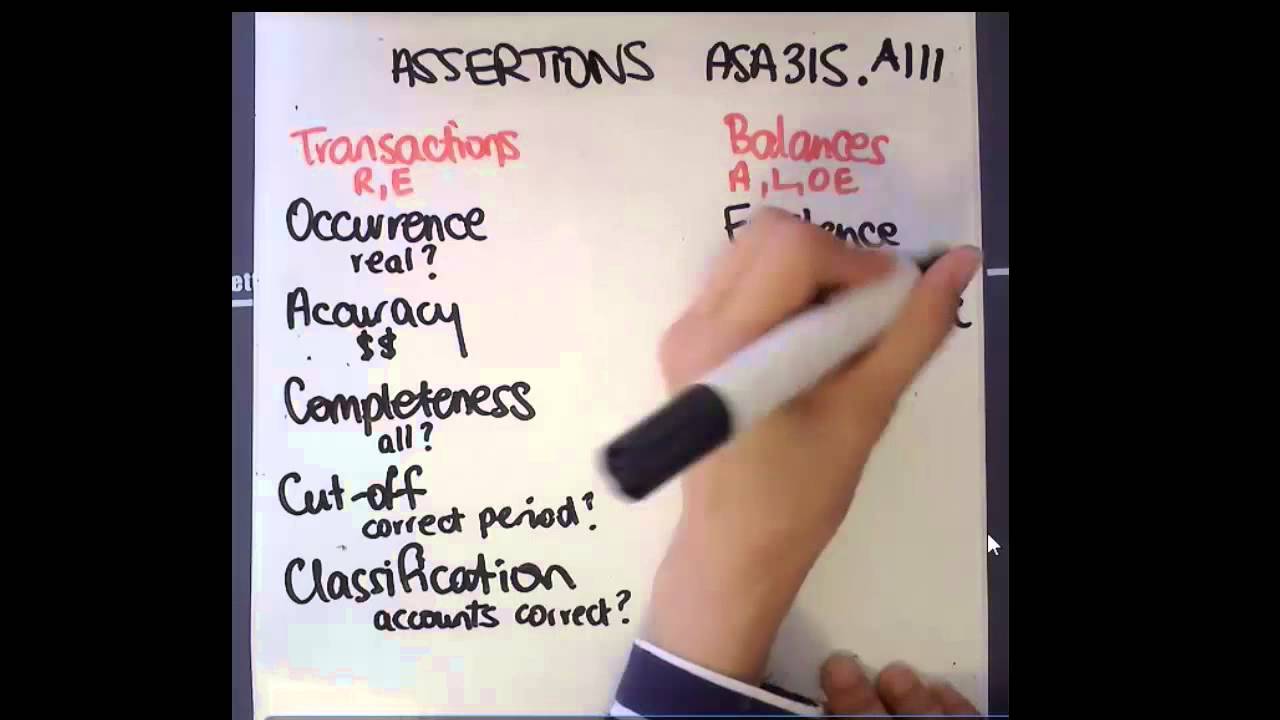

There are five different financial statement assertions that the auditors collect to justify every item in the financial statement. Balance sheet or statement of financial position has 4 assertions. Let me explain all the balance sheet assertions through an example.

When the allowance for uncollectibles is 234100 the entity asserts that the amount is properly valued. Financial statement assertions include a set of claims that are crucial for the preparation of financial statements. Financial statement assertions or management assertions are a companys official statement that the figures the company is reporting are accurate.

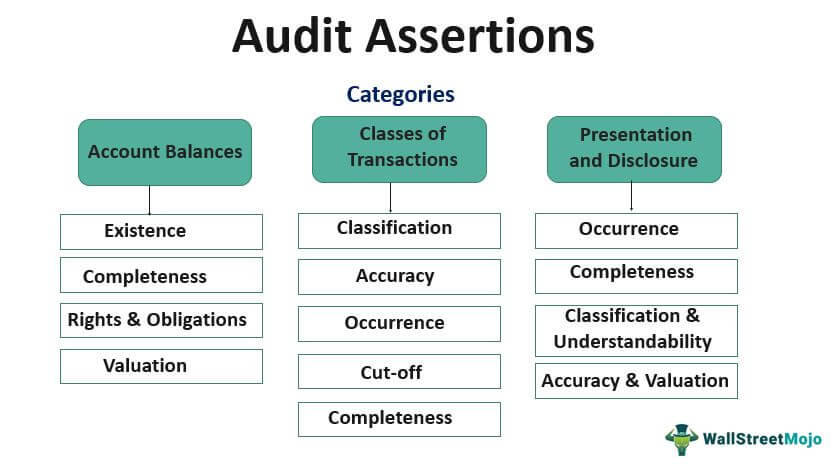

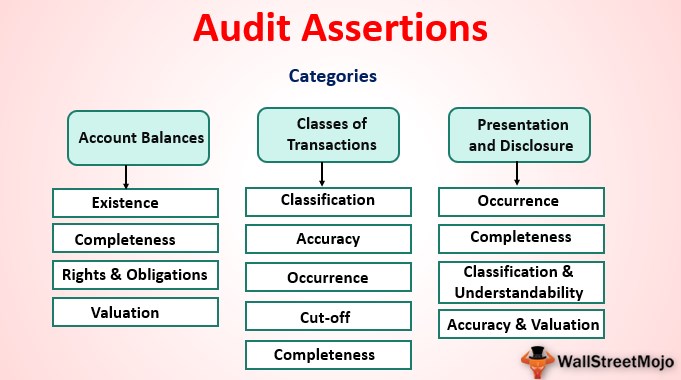

Assertions are an important aspect of auditing. Audit Assertions are the implicit or explicit claims and representations made by the management responsible for the preparation of financial statements regarding the appropriateness of the various elements of financial statements and disclosures. Having obtained and documented an understanding of the entity including its internal control the auditor is now in a position to identify and assess the risks of material misstatement which should be done at the financial statement level and at the assertion level for classes of transactions account balances and disclosures.

Collectively all classes of transactions account balances and their related disclosures make up the financial statements. Risk of revenue overstatement due to cut-off assertion error. Risk of understatement of trade payables due to unrecorded purchase invoices completeness assertion.