Impressive Fair Value Adjustment Consolidation

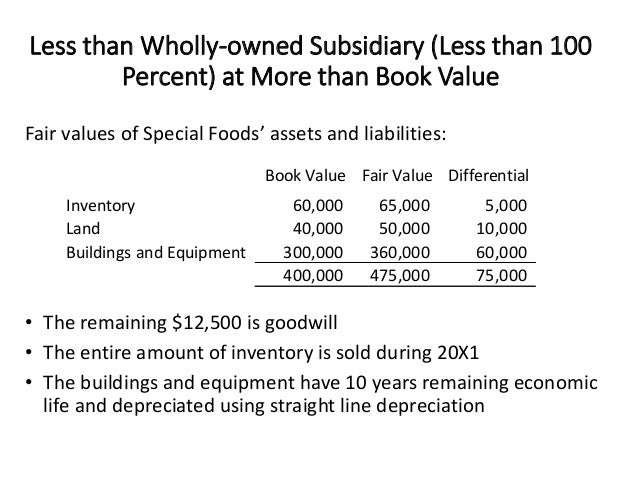

Book Value Fair Value Buildings 10-year life 10000 8000 Equipment 4-year life 14000 18000 Land 5000 12000 Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years.

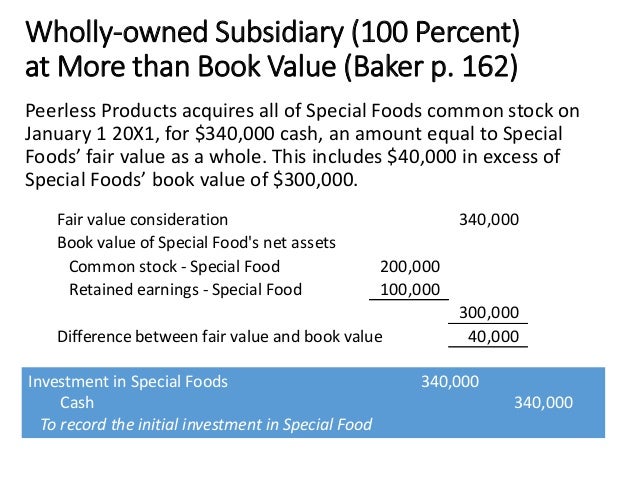

Fair value adjustment consolidation. Fair value adjustments should be recorded at subsidiary level. This will ensure that the fair value of net assets is carried through to the goodwill and non-controlling interest calculations. Fair value measurement clause added by Investment Entities.

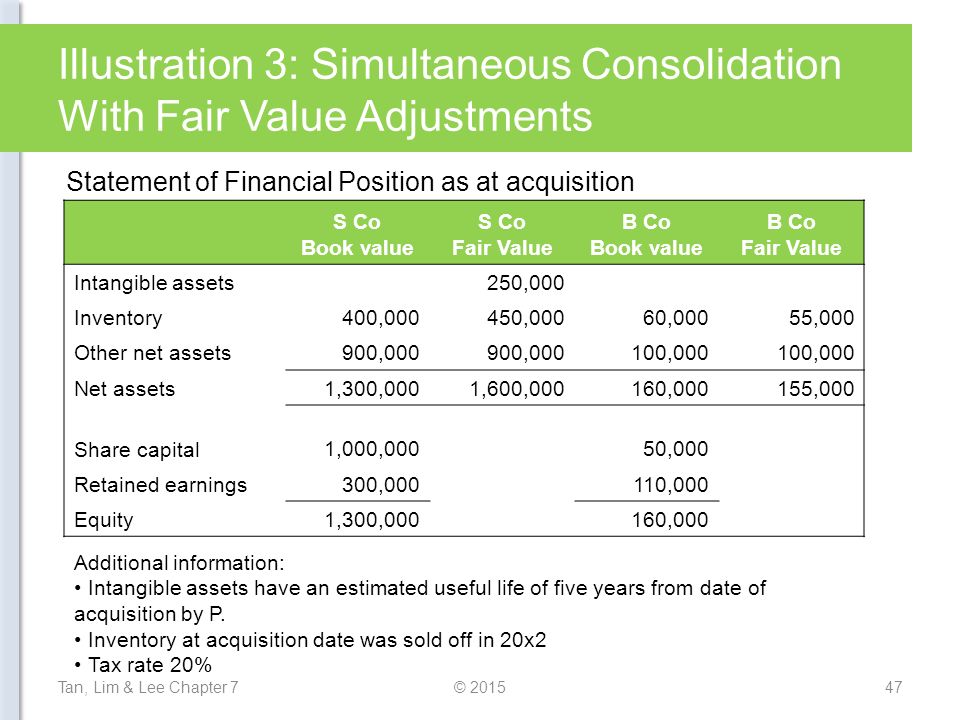

There is only one way to adjust for a fair value adjustment it can however be presented differently depending on which approach is used. CIMA F2 Fair value adjustments Free lectures for the CIMA F2 Advanced Financial Reporting Exams. It shows the individual book values of both companies the necessary adjustments and eliminations and the final consolidated values.

Investment entities are prohibited from consolidating particular subsidiaries see further information below. Any further adjustment to fair value subsequent to acquisition will affect post acquisition retained earnings reserves. Basically the subsidiaries books will basically be converted from a book value to a fair value at the point of purchase during the consolidation process.

The carrying value or book value is an asset value based on the companys balance sheet which takes the cost of the asset and subtracts its depreciation over timeThe fair value. Candidates will only be required to plug in the non-controlling interest in the above adjustment journal entry with its fair value at the acquisition date. In consolidation at December 31 2019 what net adjustment is necessary for Hogans Patent account.

The parent company buys an interest in a. However during the consolidation process a revaluation surplus is not created. This article illustrates how consolidation adjustment journal entries in a comprehensive case setting should be prepared using an.

How to include fair values in consolidation workings 1 Adjust both columns of W2 to bring the net assets to fair value at acquisition and reporting date. Fair value is also used in a consolidation when a subsidiary companys financial statements are combined or consolidated with those of a parent company. Fair value adjustments at date of acquisition will affect the goodwill calculation.