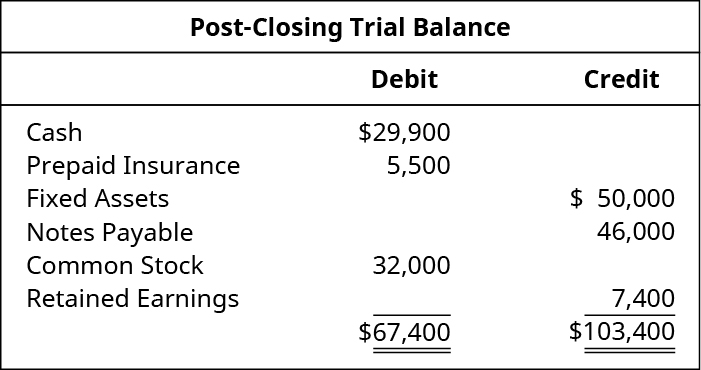

Casual Post Closing Trial Balance Shows

Zero balances for all accounts.

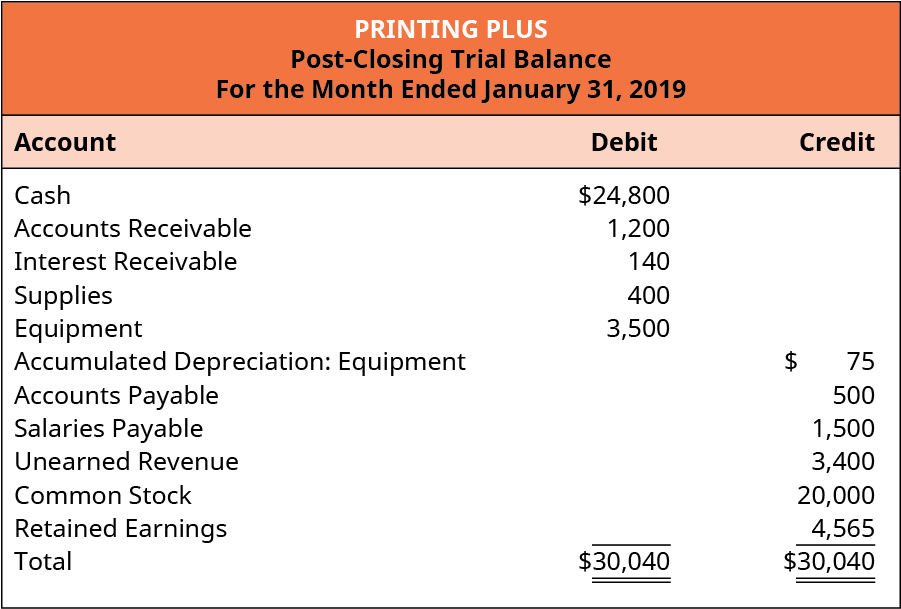

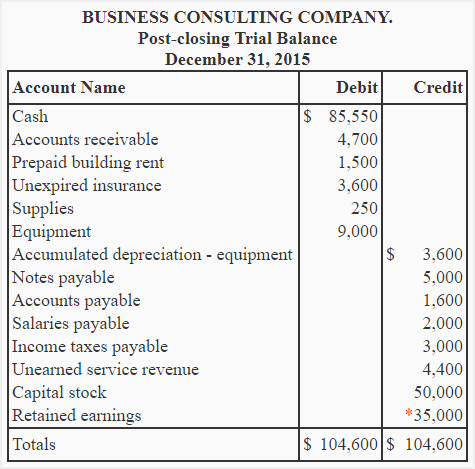

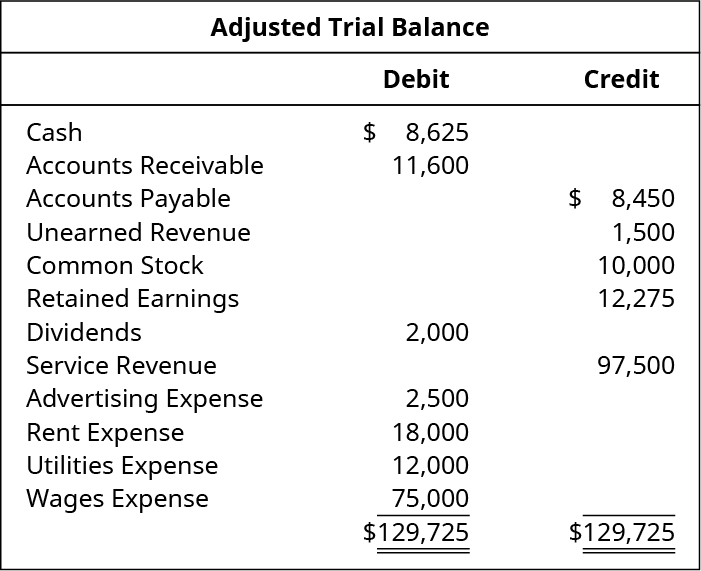

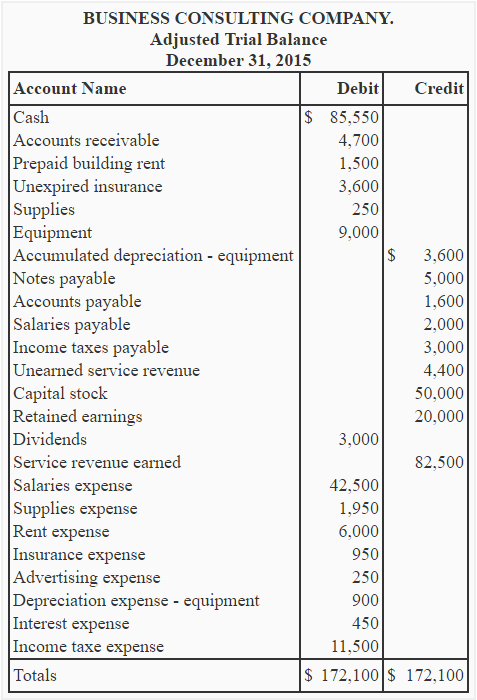

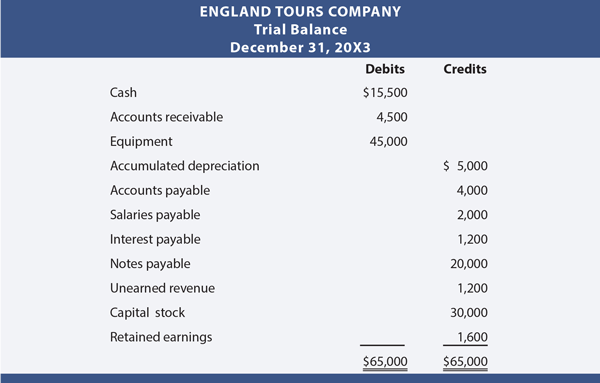

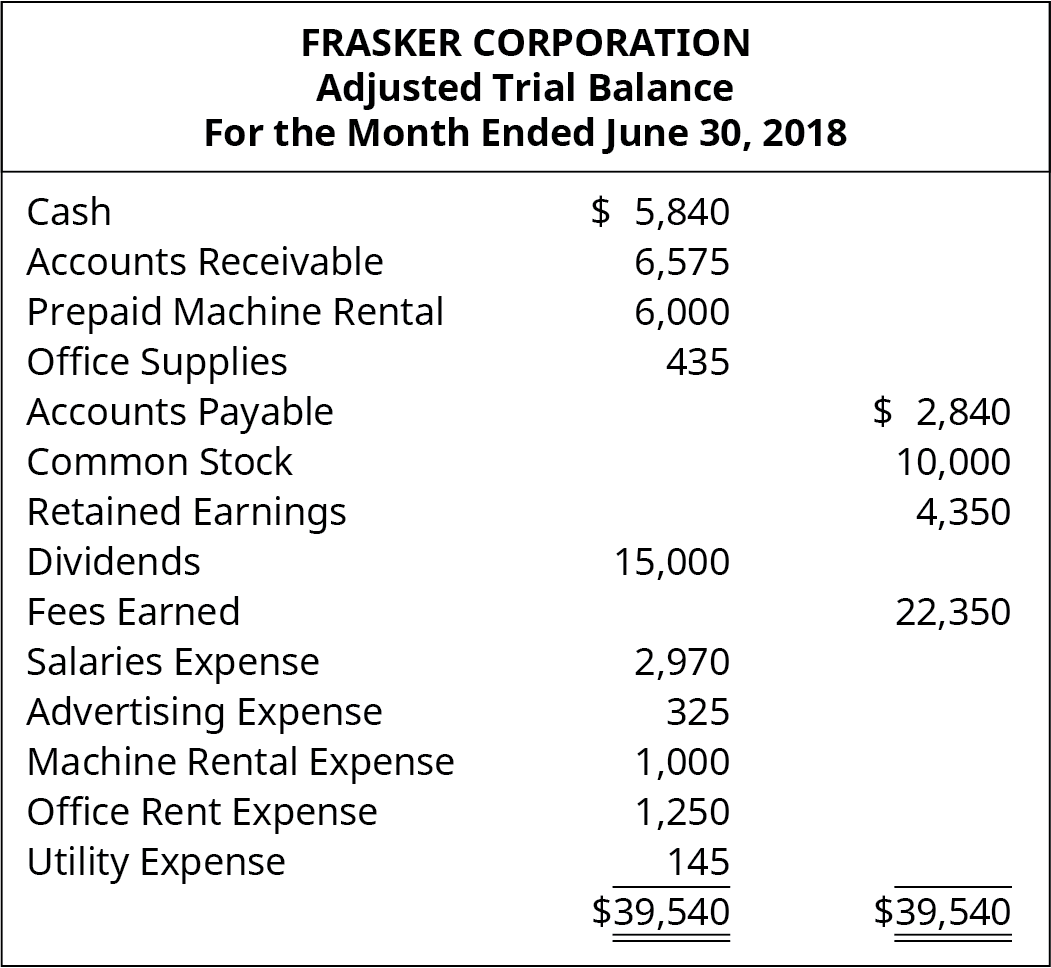

Post closing trial balance shows. The post-closing trial balance also known as after-closing trial balance is the last step of accounting cycle and is prepared after making and posting all necessary closing entries to relevant ledger accounts. The post-closing trial balance shows the total balance of permanent accounts at the end of the reporting period. What is a Post-Closing Trial Balance.

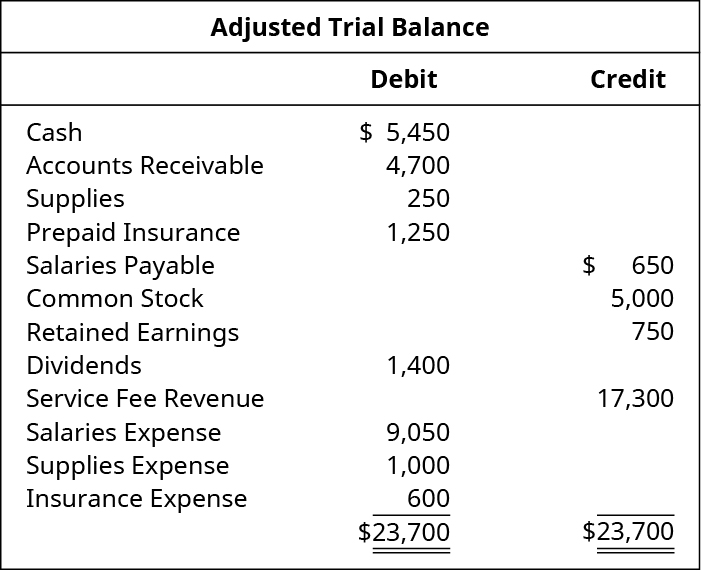

Edit with Office GoogleDocs iWork etc. The amount of net income or loss for the period. Edit with Office GoogleDocs iWork etc.

Only permanent account balances should appear on the post-closing trial balance. When all accounts have been recorded total each column and verify the columns equal each other. B All ledger accounts with a balance none of which can be real accounts.

See full answer below. Prove the equality of the income statement account balances that are carried forward into the next accounting period. Zero balances for all accounts.

Write titles of all general ledger accounts with balances in the Account Title column. A post-closing trial balance is a listing of all balance sheet accounts containing non-zero balances at the end of a reporting period. Download Template Fill in the Blanks Job Done.

The post-closing trial balance is used to verify that the total of all debit balances equals the total of all credit balances which should net to zero. 4 6 8 4. Compare the two column totals.