Formidable Sec Pro Forma Requirements

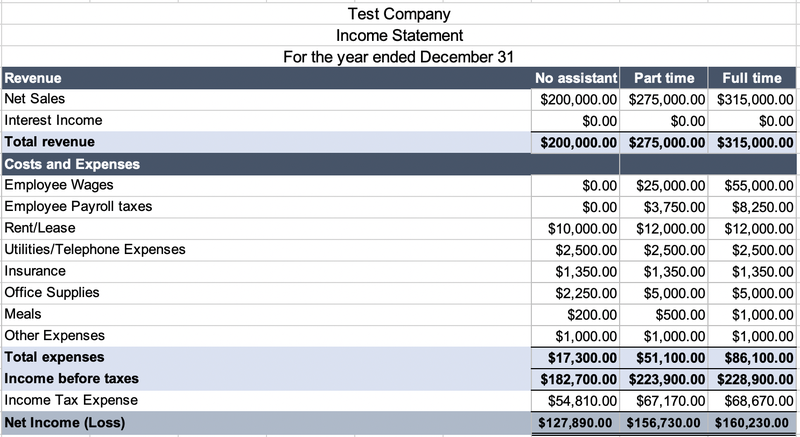

Pro Forma Financial Information To Measure Significance Currently significance determinations generally are required to be made by comparing the most recent annual financial statements of the target to those of the registrant prior to the date of the acquisition.

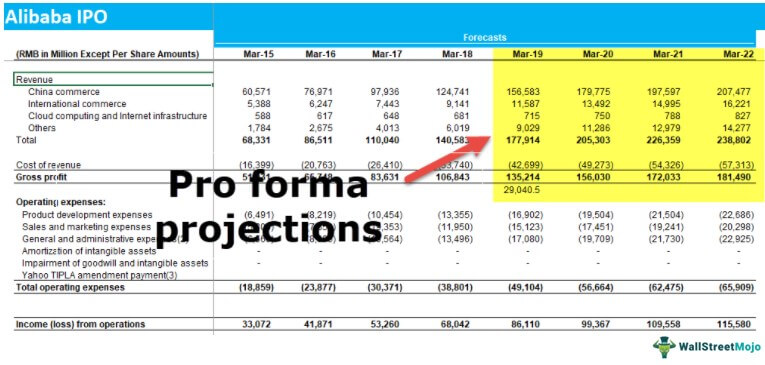

Sec pro forma requirements. A Pro forma financial information must be filed when any of the following conditions exist. In May 2020 the SEC amended its requirements for registrants to provide information about significant. This guide provides a high-level summary of the SECs pro forma financial information requirements for significant business acquisitions and is based on the SECs latest rule amendments that become effective on January 1 2021 but may be voluntarily applied earlier.

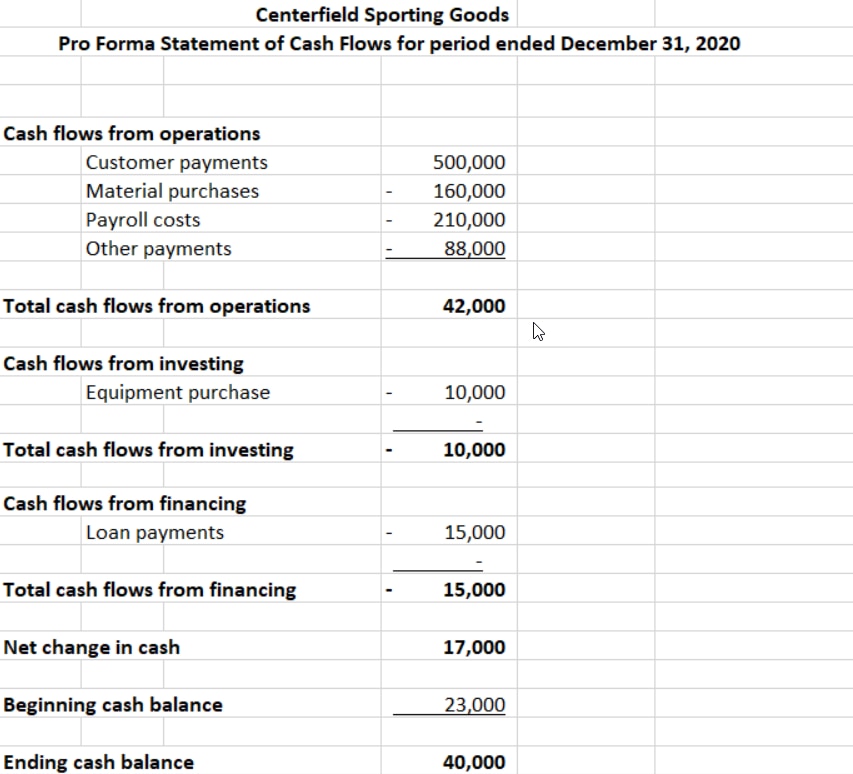

The SEC also streamlined the requirements related to pro forma financial information and allowed registrants to voluntarily include certain forward-looking adjustments. Registrants may be required under SEC rules to file the acquirees separate annual and interim preacquisition financial statements along with the related pro forma financial information. 10202014 For discontinued operations ASC 205-20 that are not yet reflected in the annual historical statements.

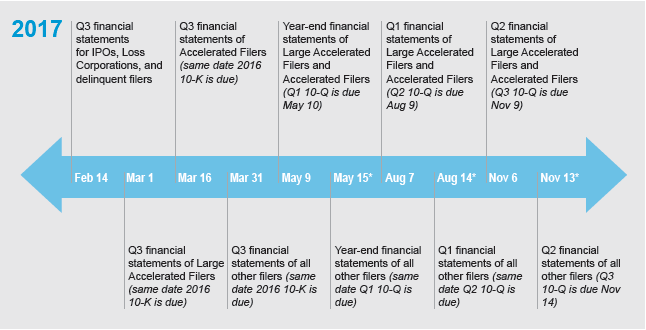

Pro Forma Condensed Statement of Comprehensive. For inquiries and feedback please contact our. The new rules are generally effective no later than the beginning of the registrants fiscal year beginning after December 31 2020.

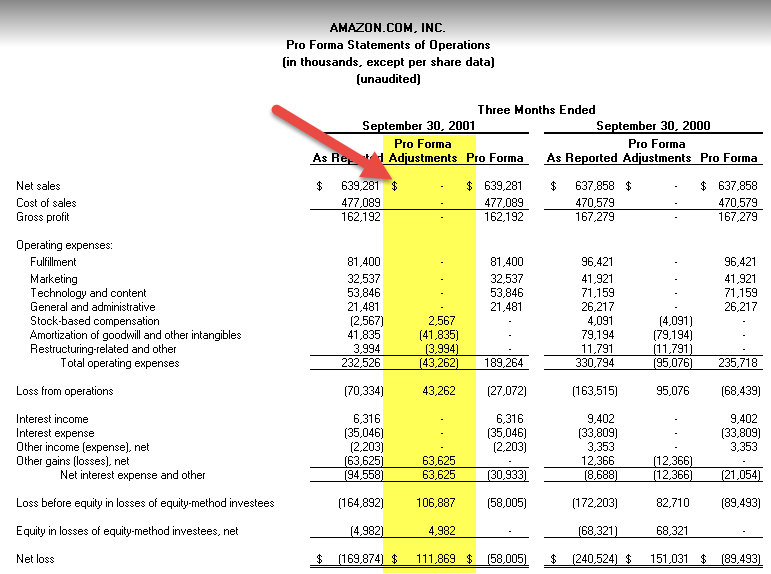

The amendments require registrants to provide separate columns in their pro forma financial information for 1 historical financial information 2 transaction accounting adjustments and 3 autonomous entity adjustments as well as a pro forma total. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. 1105 Pro Forma Financial Statement Requirements for an Acquired Interest in a Joint Venture 109 1106 Performing the Significance Tests for an Acquired or to Be Acquired Interest in a Joint Venture 110 111 Age of Financial Statements 112 1111 SEC Reporting Considerations Regarding Age of Financial Statements for an Acquired or.

Pro Forma Condensed Balance Sheet Guidance - If the historical financial statements of the acquired business are full financial statements see Section 20651 the pro forma balance sheet should include adjustments to remove assets and liabilities that were not acquired or assumed provided the criteria described in Section 32203 are met. The new rules allow a company to measure significance for dispositions as well as acquisitions using filed pro forma financial information if the company has made a significant acquisition. 1 During the most recent fiscal year or subsequent interim period for which a balance sheet is required by 2103-01 a significant business acquisition has occurred for purposes of this section this.

Article 11 of Regulation S-X Pro forma financial information describes the requirements of the Securities and Exchange Commission SEC for registrants to provide pro formas. In May 2020 the SEC amended the pro forma presentation requirements of Article 11. The SEC eliminated the prescriptive legacy criteria for making pro forma adjustments and required two categories of adjustments.

/pro-forma-invoice--1053078376-3fb3269f97f84b93832c203f105ac972.jpg)