Favorite Throughput Costing Income Statement

Variable non-manufacturing costs 200 per unit sold.

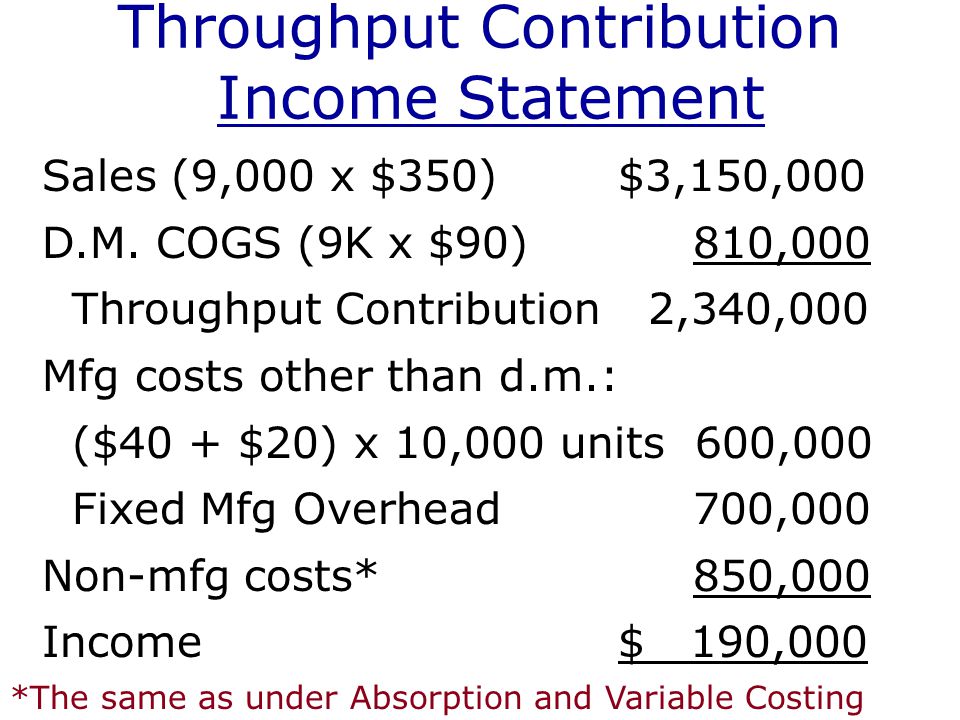

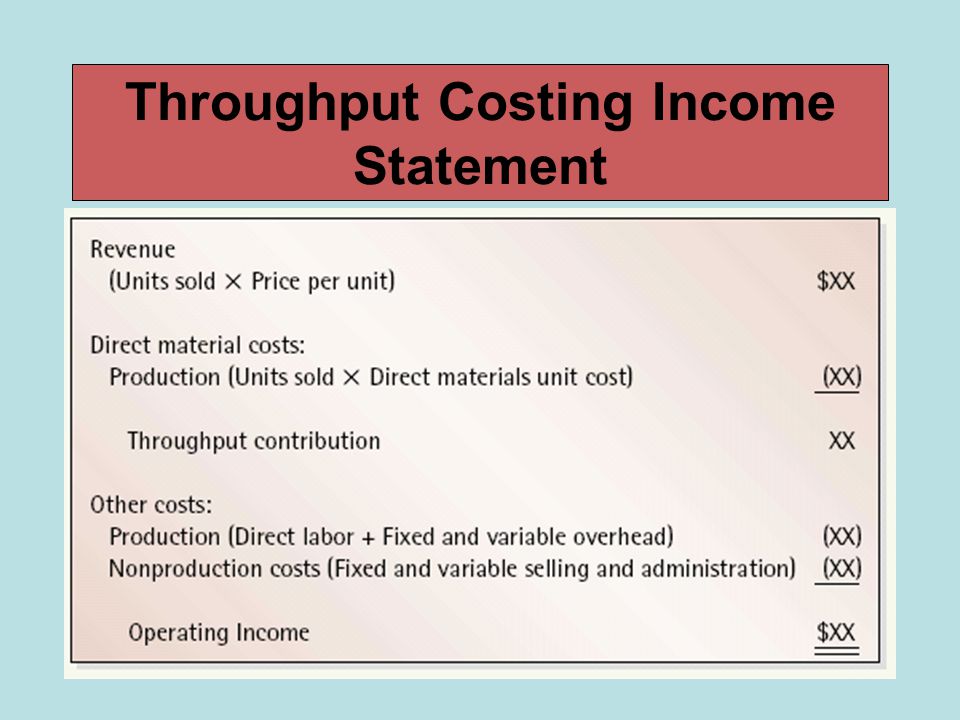

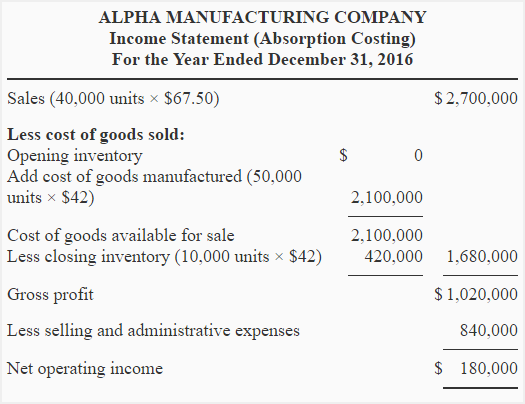

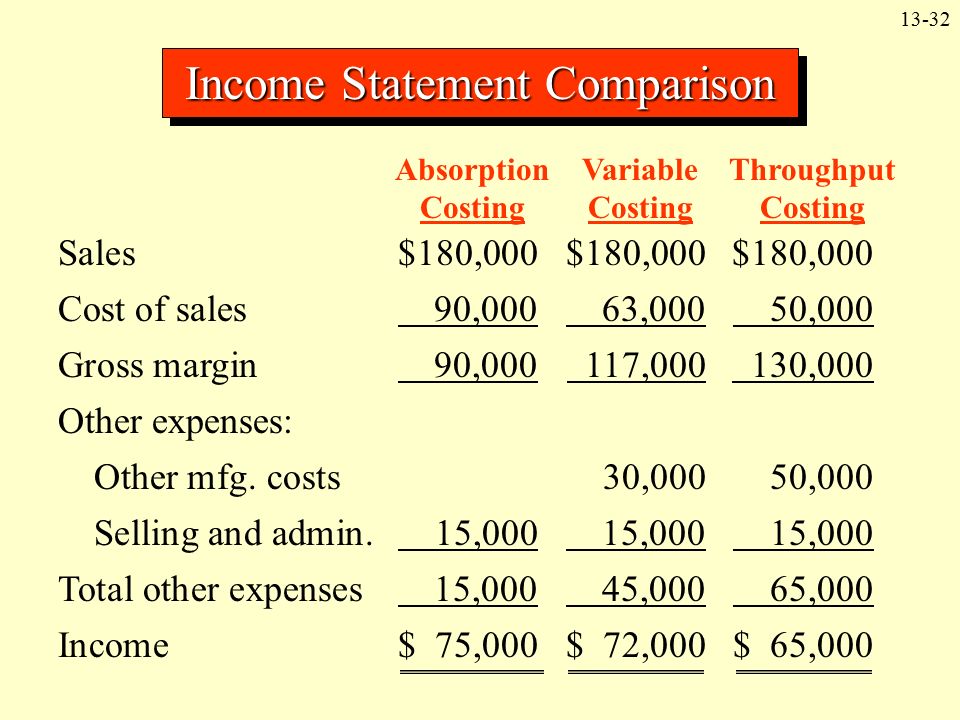

Throughput costing income statement. What is Throughput Analysis. Direct Material 22000 units x 40 880000 GROSS MARGIN. There are three accounting approaches used to assign costs for income statement reporting purposes.

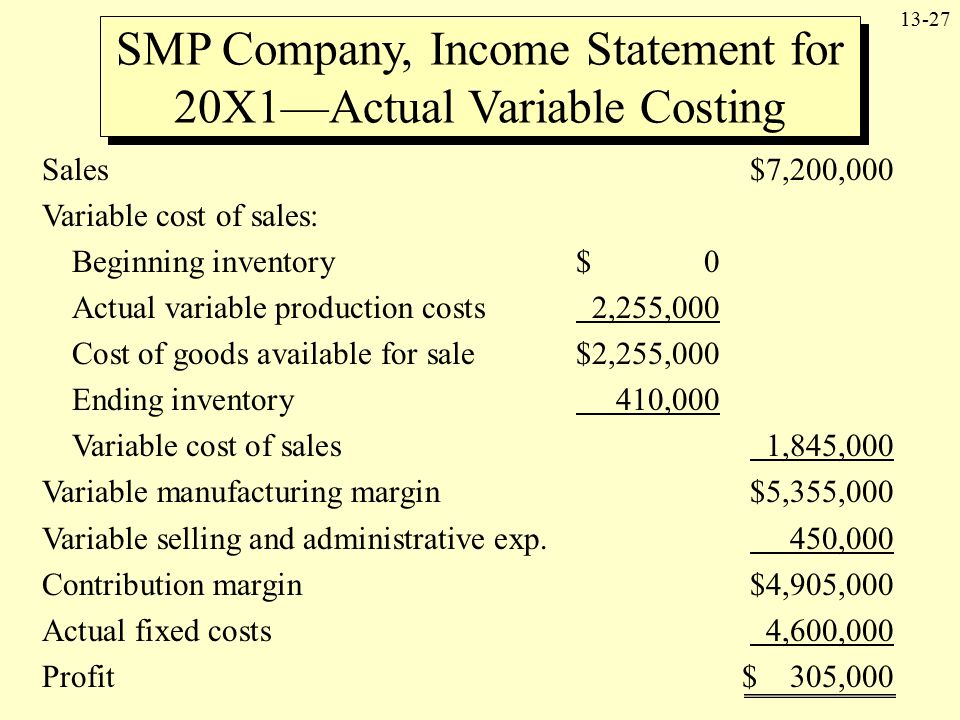

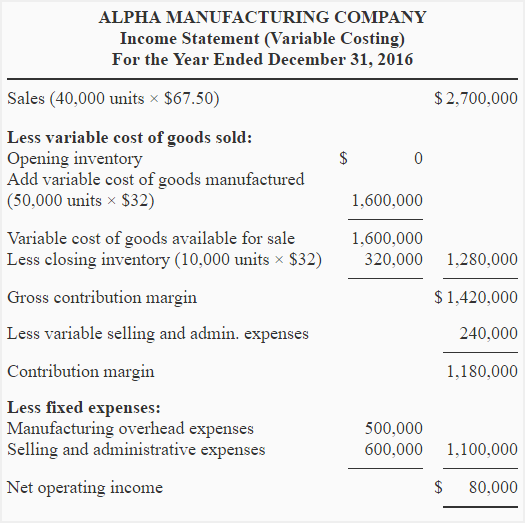

Prepare an income statement under throughput costing for the year ended December 31 2017 for Garvis Company. A variable-costing income statement discloses a firms contribution margin. The term is often used in the context of a companys rate of.

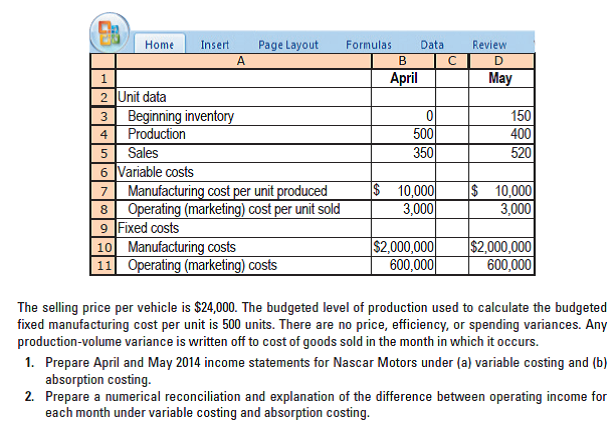

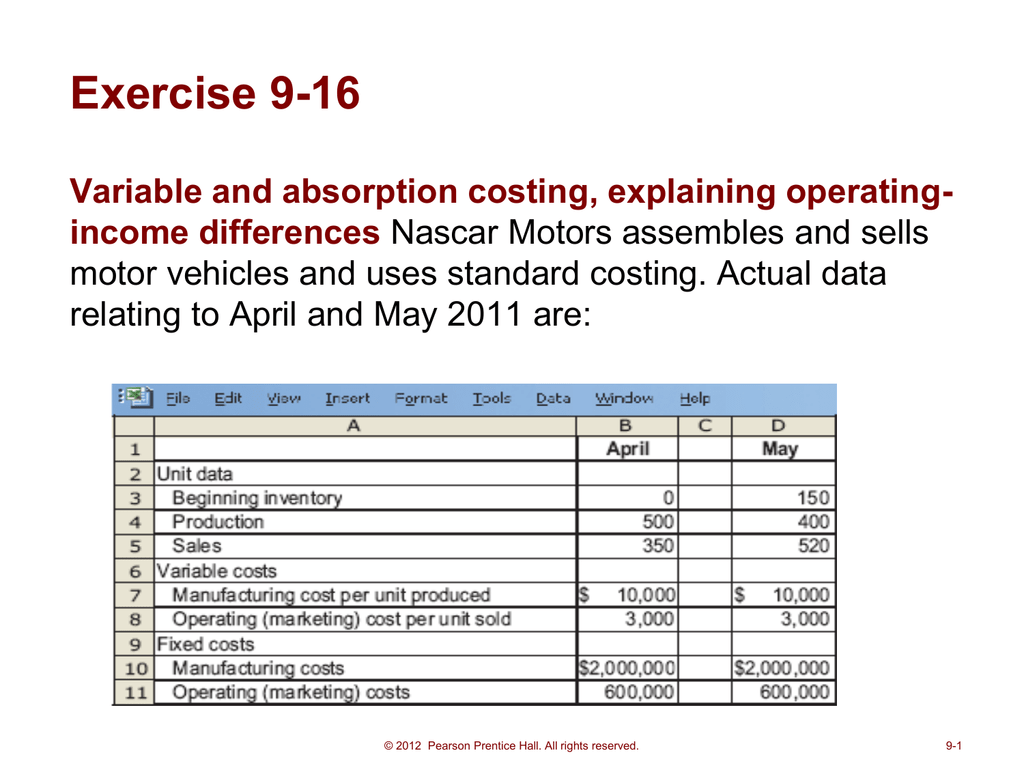

The system view is based on the fact that most production costs do not vary at the level of the individual unit produced. Throughput can also be defined by examining the relationship between the two components that represent Throughput Revenues and Totally Variable Costs TVCs or also called Truly Variable Costs. Prepare income statement for CC in January February and March 2014 under throughput costing.

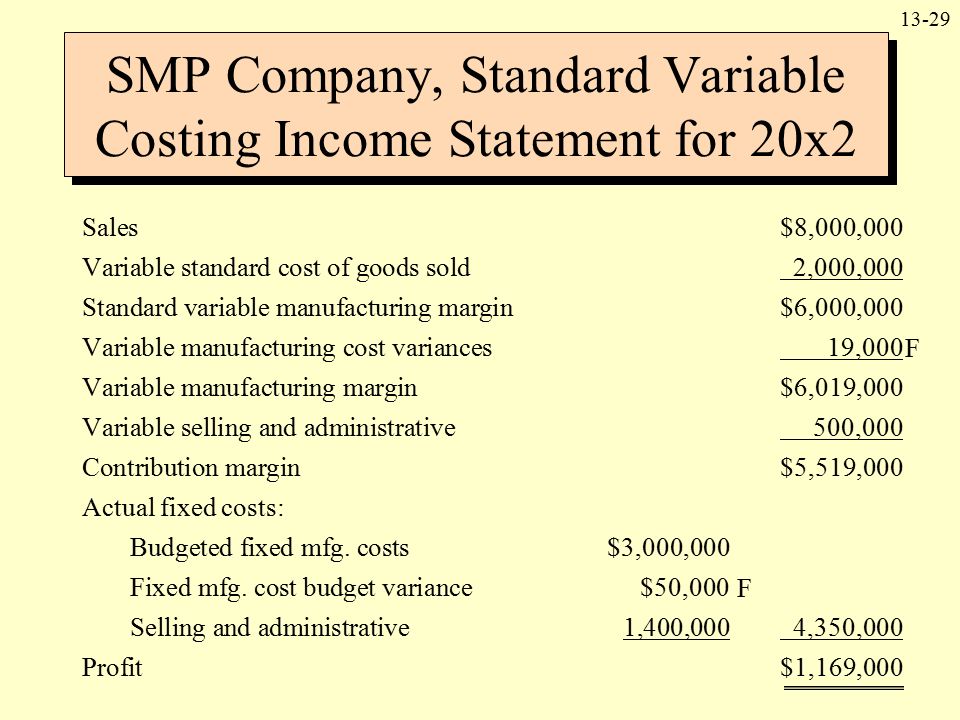

Revenue minus cost of goods sold gives us throughput margin. Total budgeted and actual fixed production costs are 52000 normal capacity of 13000 units. Sales 22000 units x 130 2860000.

Cost of goods sold on an absorption-costing income statement includes fixed costs. Cost of Goods Sold. COGS 9K x 90 Throughput Contribution Mfg costs other than dm.

The primary concept underpinning throughput analysis is that you should look at investment decisions in terms of their impact on the entire system rather than on the specific area in which an investment is contemplated. These methods are differently used for external and internal reporting purposes. Throughput is the amount of a product or service that a company can produce and deliver to a client within a specified period of time.