Top Notch Trial Balance Is Commonly Prepared Given The Following Year 12 Balance Sheet

The balance sheet can.

Trial balance is commonly prepared given the following year 12 balance sheet. By looking at our trial balance we can immediately see our bank balance our loan balance our owners. Which of the following is correct regarding a work sheet. Prepare Trial Balance as on 31032012 from the following balances of Ms.

At the end of an accounting period During 2013 the first year of operations Nicos bakery had revenues of 60000 and expenses of 33000. Also give journal entries for adjustments. A trial balance is an important step in the accounting process because it helps identify any computational errors throughout the first three steps in the cycle.

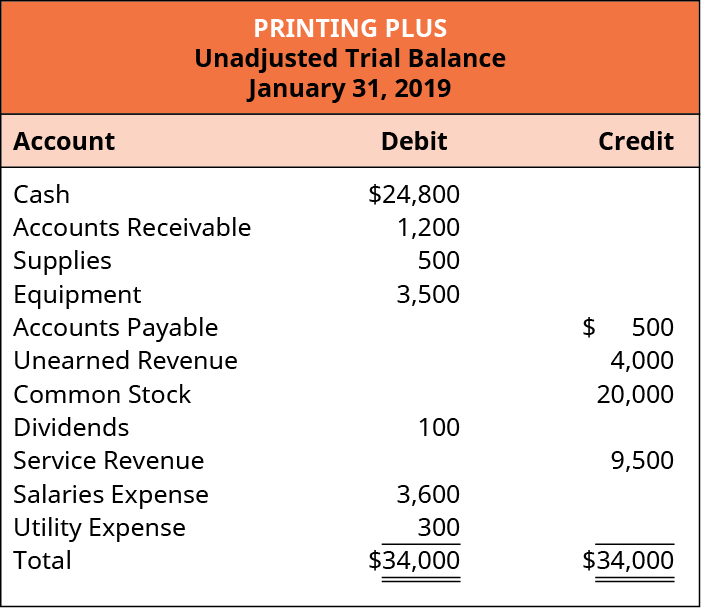

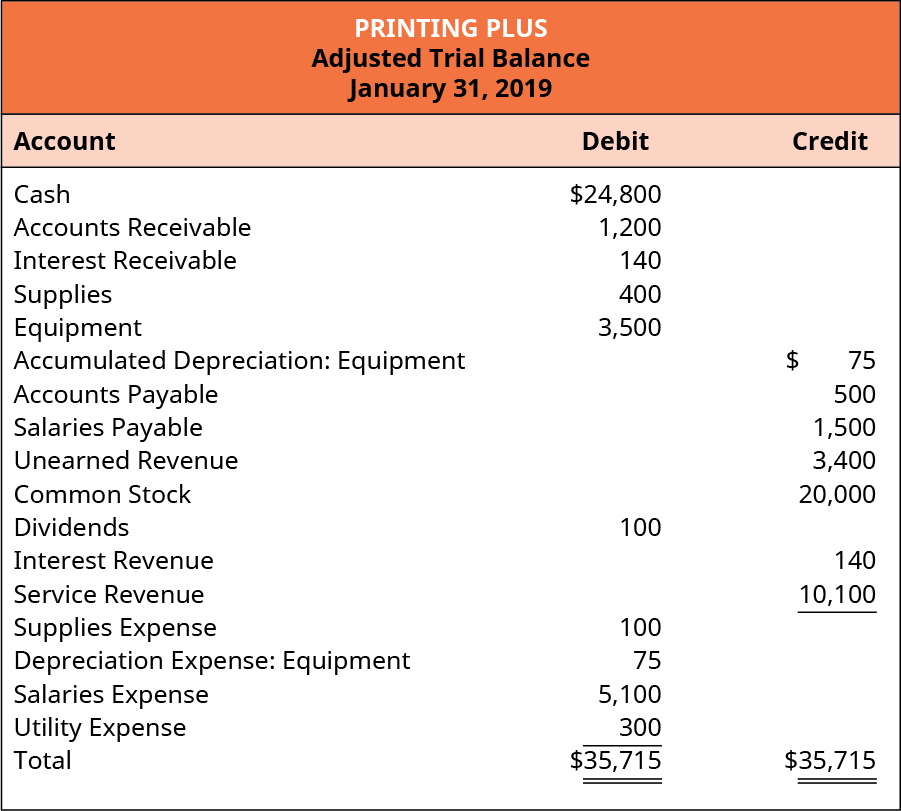

WILSON TRUCKING COMPANY Balance Sheet December 31 Assets 9600 Current assets Cash Accounts receivable Office supplies 20500 7040 37140 171000 35226 135774 Total current assets Plant assets Trucks Accumulated. Note that for this step we are considering our trial balance. The five column sets are the trial balance adjustments adjusted trial balance income statement and the balance sheet.

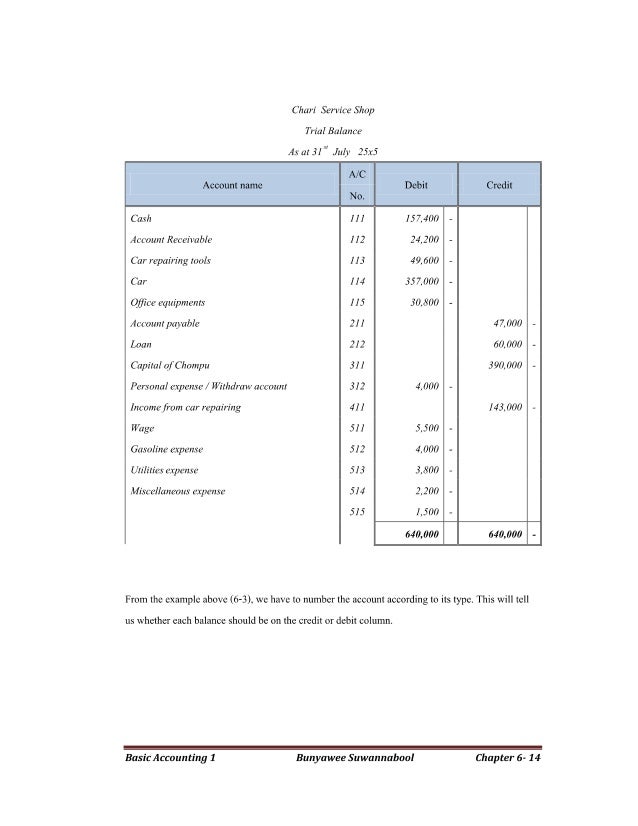

Adjusted Trial balance 12312018. 295700 Stock 1042011 Rs. The Trial Balance is as the name suggests is a table where we lay out all our debit accounts and all our credit accounts to see if they balance or not.

Trial Balance as on 31 s t March 2019. One column should be the names of each ledger. The entries made in a ledger can be verified by getting a NIL balance on summing up all the ledger.

The key difference between Trial Balance vs Balance sheet is that Trial Balance is the report of accounting in which ending balances of different General ledger General Ledger A general ledger is a book of accounts that records the everyday business transactions in separate ledger accounts. Prepare the trial balance worksheet. After a company posts its day-to-day journal entries it can begin transferring that information to the trial balance columns of the 10-column worksheet.