Casual Accounting For Increase In Ownership Of Subsidiaries

Accounting for Increase in Ownership of Subsidiary.

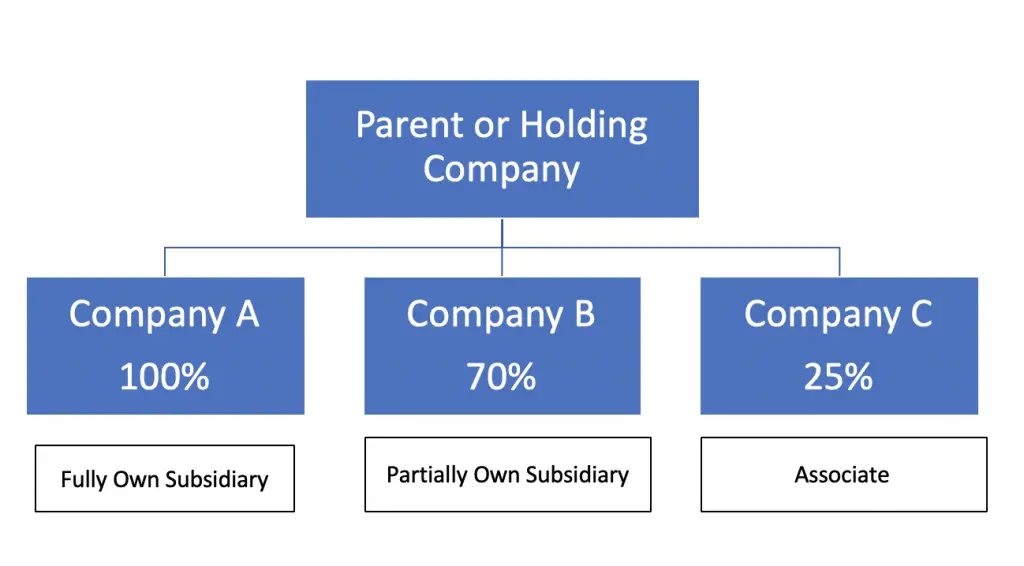

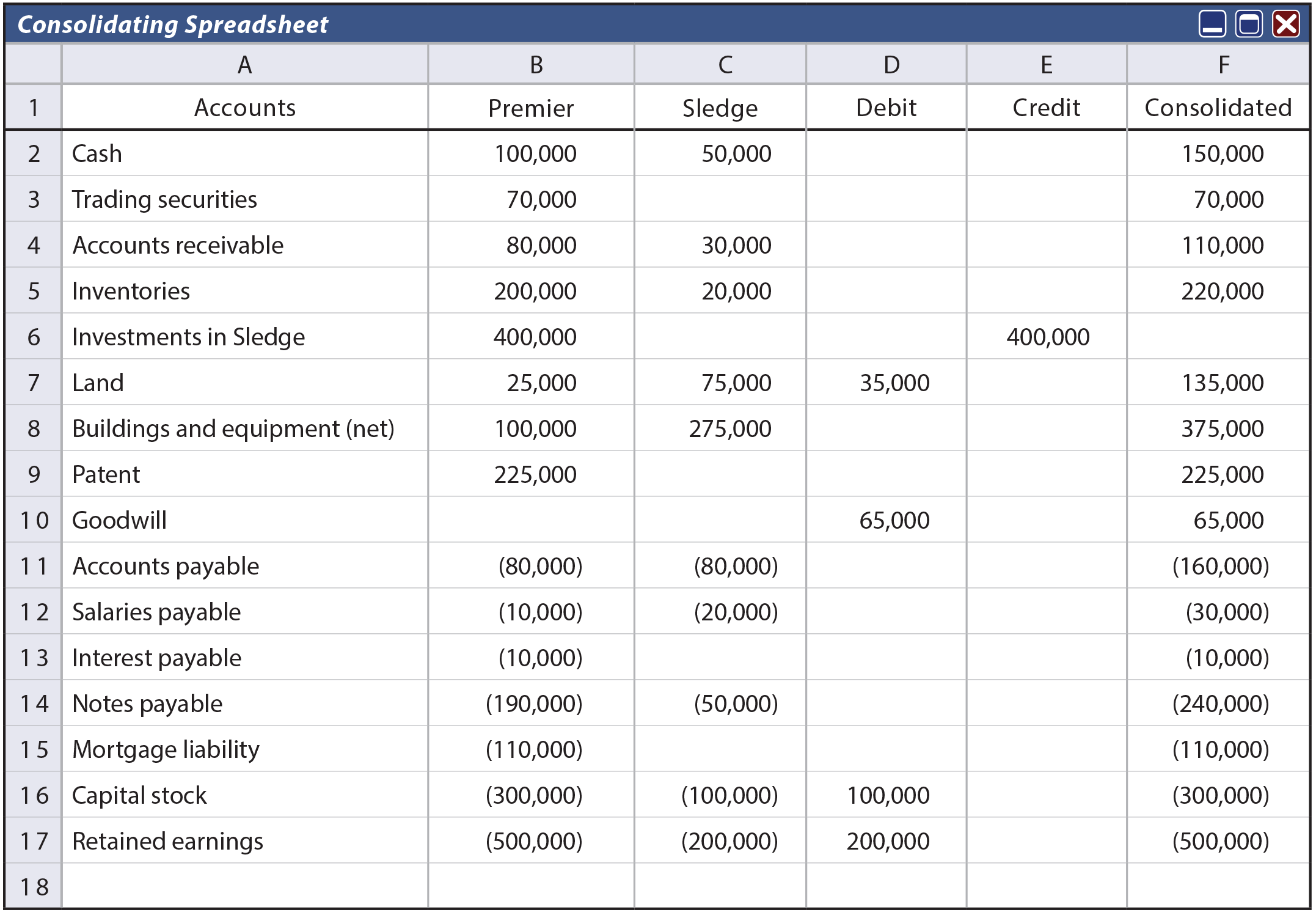

Accounting for increase in ownership of subsidiaries. The NCIs value changes due to the subsidiarys profits and losses. For example if the parent bought 50000 worth of a subsidiarys stock it would debit Intercorporate Investment for 50000 to reflect the new asset and credit cash for 50000 to reflect the cash outflow. FRS 2 Accounting for subsidiary undertakings FRS 102 T he identifiable assets and liabilities of that subsidiary undertaking should be revalued to fair value and goodwill arising on the increase in interest should be calculated by reference to those fair values.

A subsidiary is a company that is controlled by its parent company. Partial disposal of an investment in a subsidiary that results in loss of control. This equity treatment for the gain is consistent with the economic unit notion that as long as control is maintained payments received from owners of the firm are considered contributions of capital.

Or the parent loses control of the subsidiary. Partial disposal of an investment in a subsidiary while control is retained. This is accounted for as an equity transaction with owners and gain or loss is not recognised.

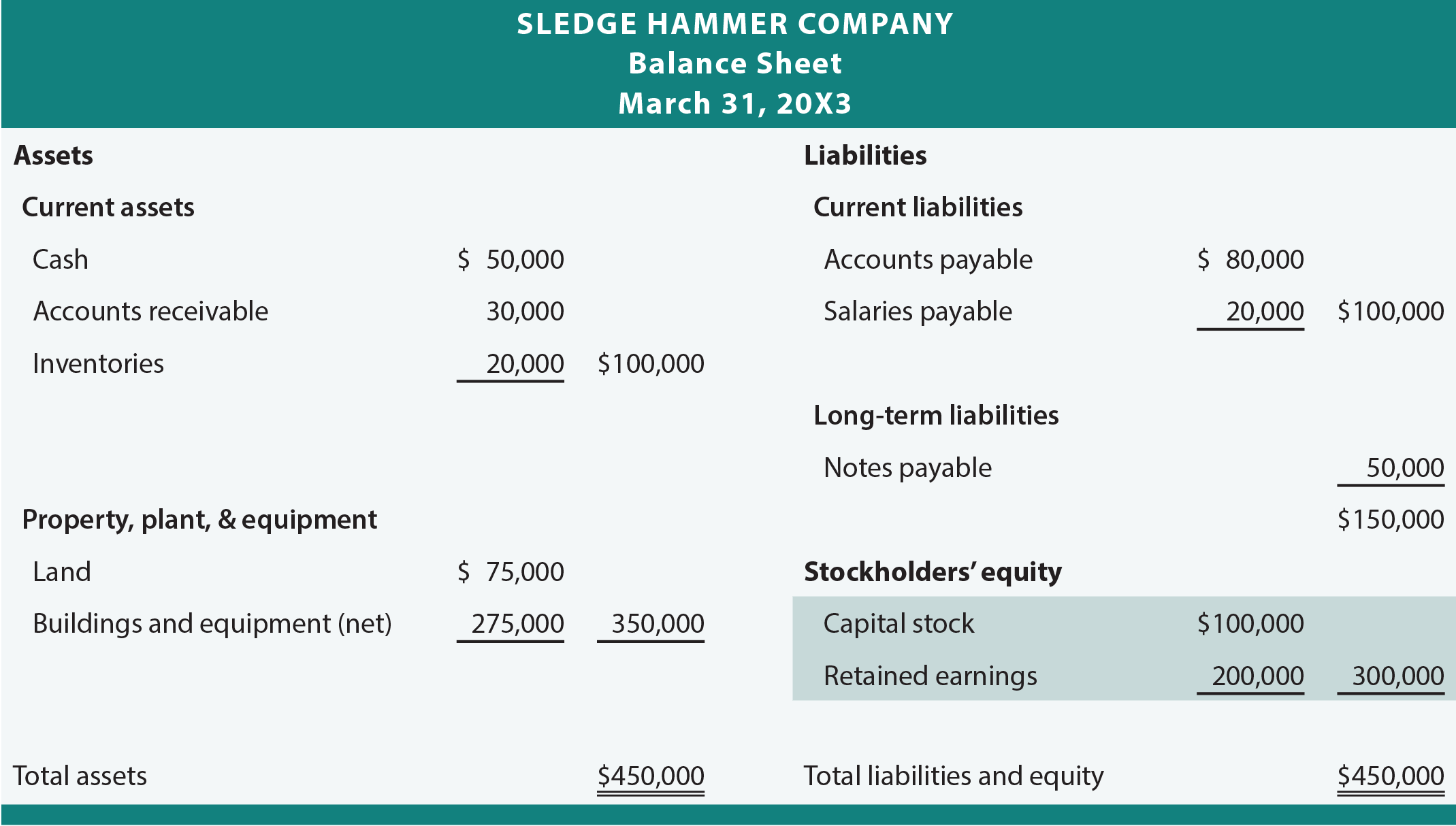

Accounting for subsequent activities Changes in the amount of investment of the subsidiary such as the parent purchasing additional shares of ownership or divesting some of their ownership are accounted for by adjusting the investment asset. Business combinations with no transfer of consideration 107 131 Accounting requirement and examples 107 132 Combinations by contract alone 107 1321 Example of a dual listed structure 107 1322 Accounting for a combination by contract 108. The resulting excess of subsidiary fair value over book value is assigned to franchises and amortized at the rate of 10000 per year.

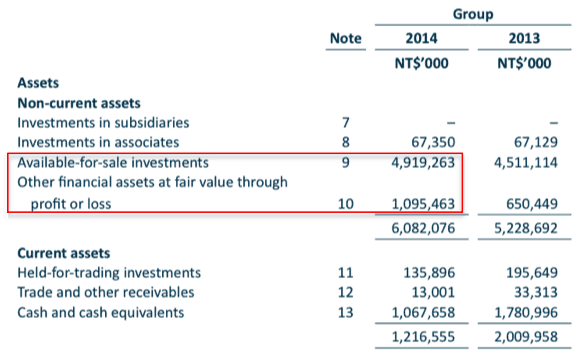

This blog post aims to provide an insight into the accounting treatment for Subsidiaries and Associates which is definitely a crucial area in F1 and can be highly applicable to Thomas Fines Tea TFT. This alert provides guidance on accounting for items of other comprehensive income OCI that relate to subsidiaries in the following circumstances. There is a non-controlling interest in the subsidiary.

The parents ownership interest increases or decreases without loss of control. The parent company can. 56 Change in Level of Ownership or Degree of Influence 140 561 Increase in Level of Ownership or Degree of Influence Control Initially Obtained Equity Method to Consolidation 141 562 Increase in Level of Ownership or Degree of Influence Significant Influence.

:max_bytes(150000):strip_icc()/dotdash_Final_Subsidiary_Jul_2020-01-5cb00a7e65ed43618112f2f94829fc03.jpg)

/dotdash_Final_Subsidiary_Jul_2020-01-5cb00a7e65ed43618112f2f94829fc03.jpg)

/dotdash_Final_Subsidiary_Jul_2020-01-5cb00a7e65ed43618112f2f94829fc03.jpg)

/dotdash_Final_Subsidiary_Jul_2020-01-5cb00a7e65ed43618112f2f94829fc03.jpg)