Glory Coca Cola Financial Analysis 2018

Its gross profit also fell by 9 coming down to 20 billion in 2018 from 2215 billion previous year.

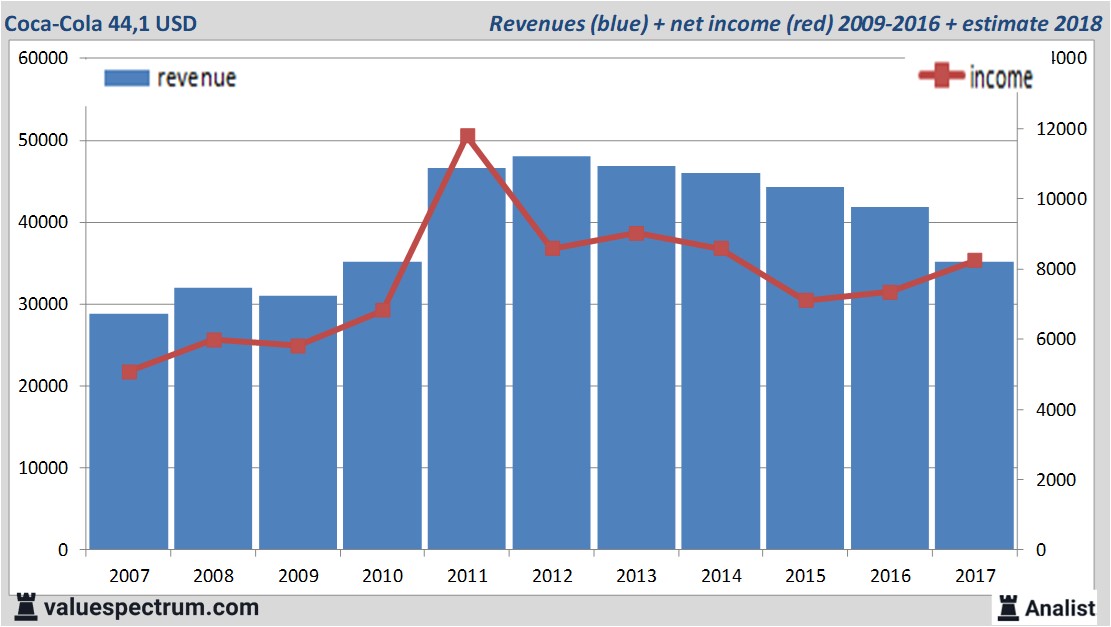

Coca cola financial analysis 2018. Income from continuing operations before income taxes Amount of income loss from continuing operations including income loss from equity method investments before deduction of income tax expense benefit and income loss attributable to. Three-Component Disaggregation of ROE. In 2016 Coke had revenues of approximately 418 billion.

The financial condition of Coca-Cola Company The in 2020 is about the same as the financial condition typical of the companies engaged in the activity Beverages. EPS Declined 19 to 052. According to The Coca-Cola Company in their income statement.

Distribution technique Financial Analysis of the Coca Cola company 2018 Coca Cola Company operates around the world in North America Africa Asia and the. Coca Cola experienced a 10 decline in its net revenue in 2018 as compared to 2017. 2018 November 12 2018.

The tax reform act includes net tax expense of 3610 million primarily related to our reasonable estimate of the one-time transition tax. Cokes total market value of debt and equity is primarily made up of equity 904. For that reason in comparison with all businesses the Company has a higher result.

The structure of the report is as follows. After each line item is defined and discussed I finally offer a summary analysis of Coca Colas important income statement line item trends for the last 5 years in most cases. Financial Statement Analysis is way more than just reviewing and evaluating Coca-Cola prevailing accounting reports to predict its past.

32 rows 2018 2017 2016 2015 2014 2013 2012 2011. Coca-Cola Cos operating income increased from 2018 to 2019 but then slightly decreased from 2019 to 2020 not reaching 2018 level. Comparable EPS Non-GAAP Grew 8 to 055.