Fine Beautiful Final S Corp Return Balance Sheet

The IRS accepts a final short-year return on 2020 forms.

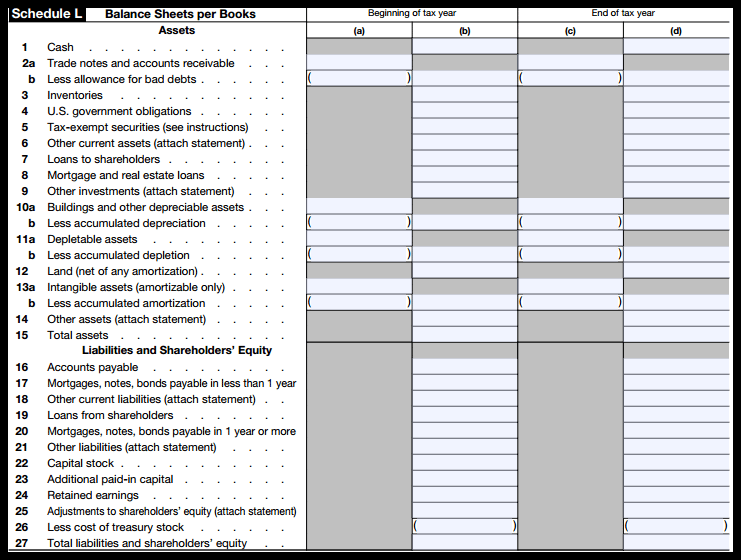

Final s corp return balance sheet. The beginning balances of the assets liabilities and equity are the ending reported balances from the prior years tax return. You can enter your beginning balances on the tax return but only use 01012017 where it asks for any dates. The beginning balances of the assets liabilities and equity are the ending reported balances from the prior years tax return.

Note that some states require a balance sheet regardless of gross income or assets. Your corporations balance sheet will include all fixed and intangible assets. If you enter dates prior to 2017 it could create problems.

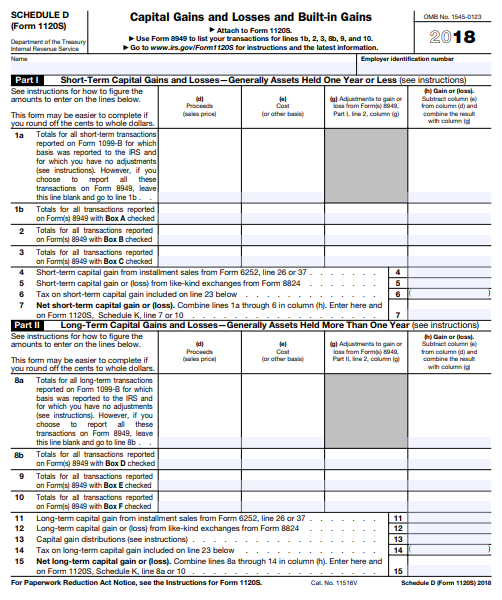

An S corp balance sheet includes a detailed list of your companys assets and liabilities. At this point the bal sheet shows 70 cash 30 RE and 100 in OE. If an assets FMV exceeds its depreciated adjustedbasis you will unfortunately need to show a gain on the distribution of the asset to you on the final corporate tax return.

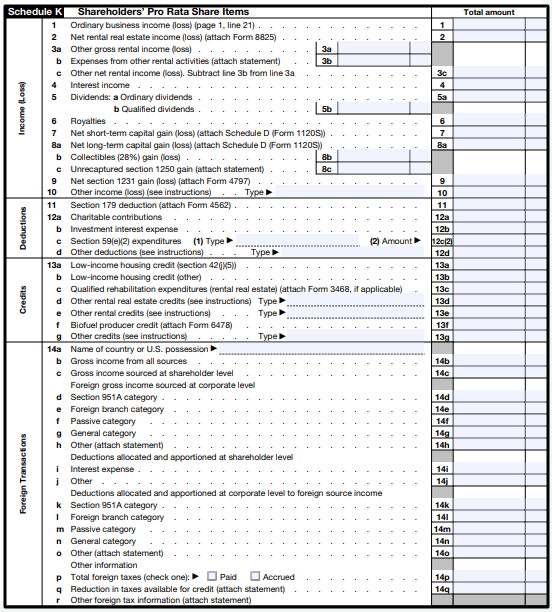

AAA balance on Final S Corp Return. This indicates that you are closing the business and intend to pay whatever tax is due. The K-1 flows to your personal income tax return.

Ending inventory may have been entered on screen A line 7. Taxpayer loaned S-corp 22000 over a two year period which funded the losses--15000 in year. In general the final tax return for a C Corporation is due on the 15th day of the 4th month after the end of its tax year or the date it was dissolved or liquidated.

4 balance sheet reporting or M-1 or M-2. These sheets are required by the IRS in addition to profit and loss statements. Checking the final-return box is a smart move but zeroing out your account balances on your balance sheet provides further notice that youve ended your business.

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)