Recommendation Petty Cash Debit Or Credit In Trial Balance

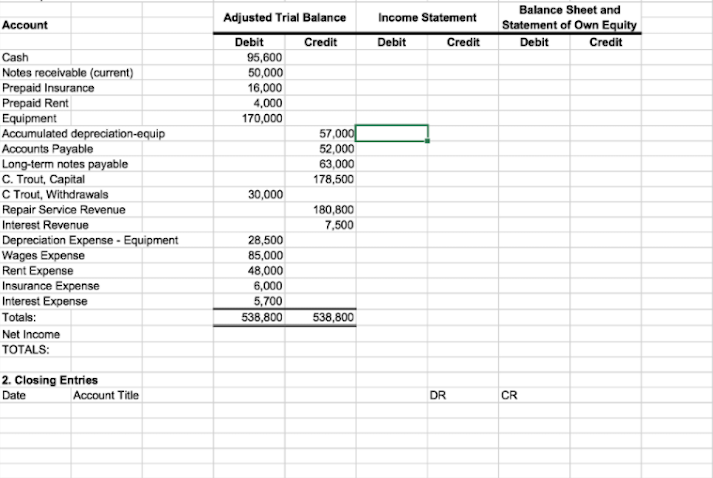

To determine which accounts to debit an employee summarizes the petty cash vouchers according to the reasons for expenditure.

Petty cash debit or credit in trial balance. All asset accounts appear as debits. The journal entry to record replenishing the fund would debit the various accounts indicated by the summary and credit Cash. For example assume the 100 petty cash fund currently has a money balance of 740.

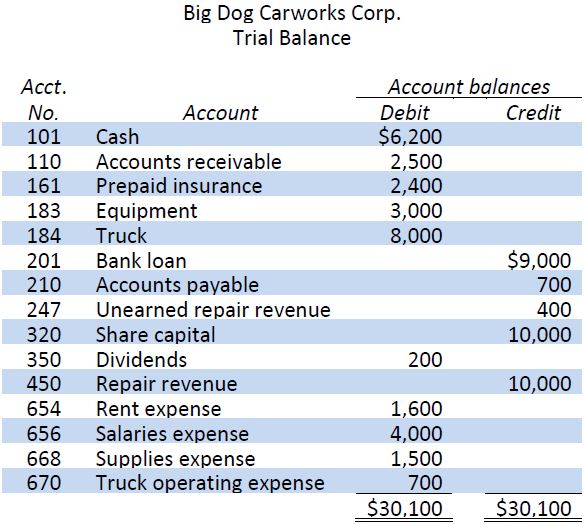

There are two sides of it- the left-hand side Debit and the right-hand side Credit. Petty Cash Replenishment Bookkeeping Entries Explained. This is because line items in the balance sheet are sorted in their order of liquidity.

INSTRUCTIONS Prepare the journal entries required to establish the petty cash. The trading profit and loss statement and balance. DR Petty Cash CR Bank account This is the process of withdrawing cash to top-up the petty cash tin.

The cash is given to the petty cashier either on ordinary system or imprest system which are briefly explained below. It is prepared periodically usually while reporting the financial statements. The petty cash custodian then disburses petty cash from the fund in exchange for receipts related to whatever the expenditure may be.

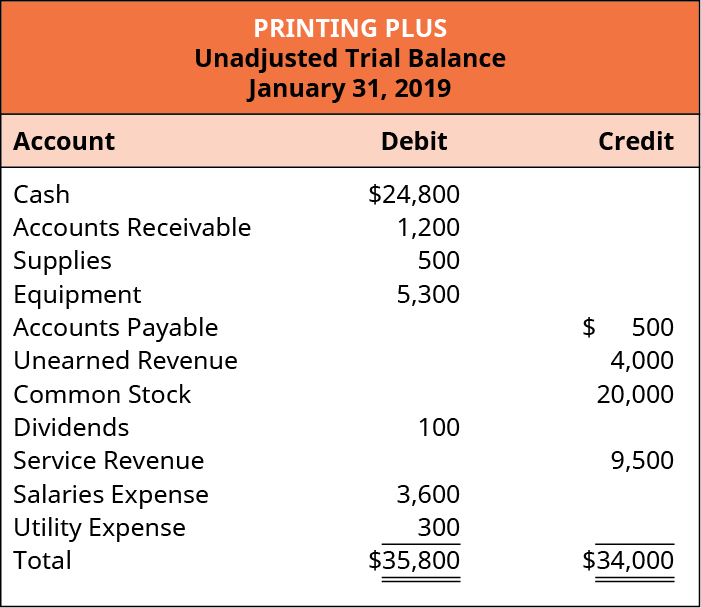

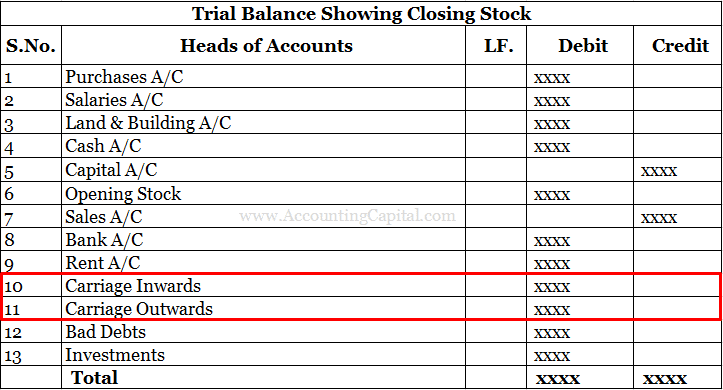

The totals of these two sides should be equal. Items that appear on the debit side of trial balance. Supplies and postage are recorded as expenses of the business.

Petty cash appears within the current assets section of the balance sheet. Where petty cash appears in the balance sheet. The balance of petty cash book is an asset and not income.