Exemplary Restatement Note Disclosure

These notes are inserted within the relevant section or note.

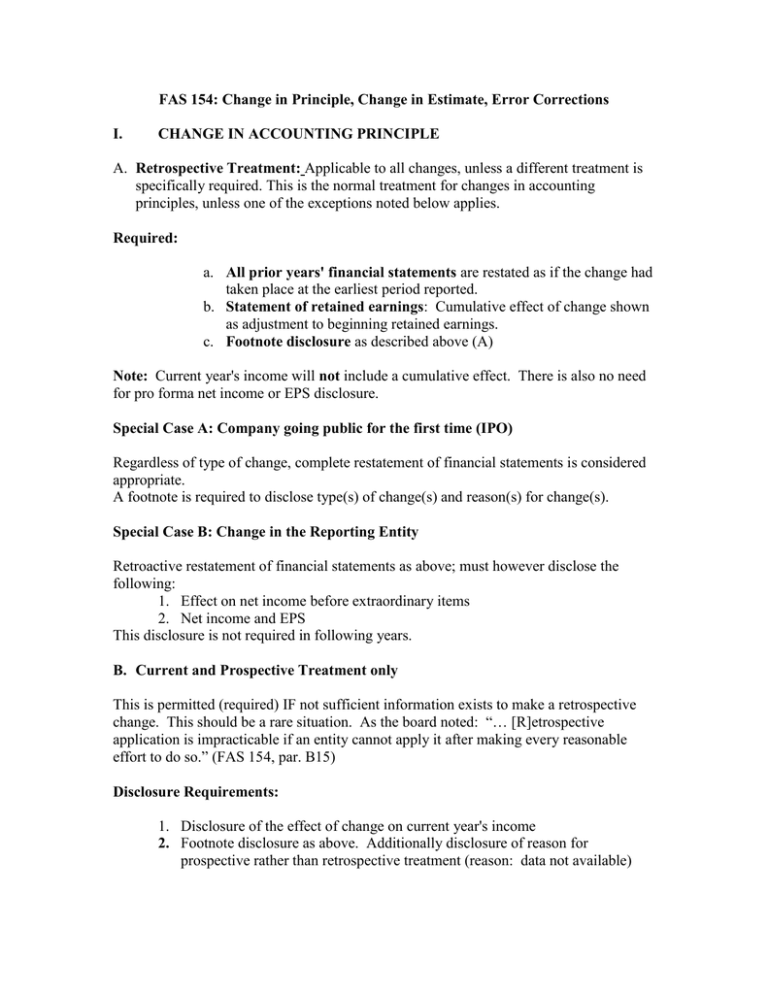

Restatement note disclosure. The nature of prior period errors corrected during the period. In terms of the SEBI ICDR Regulations 2018 the company. Guidance notes Direct references to the source of disclosure requirements are included in the reference column on each page of the illustrative financial statements.

Guidance notes Direct references to the source of disclosure requirements are included in the reference column on each page of the illustrative financial statements. If the Company changes its name during the financial year the change shall be disclosed. ACCOUNTING AND TAX IMPACT The general principle in all the applicable standards is that an entity must to the extent.

Operating Segmentsdoes not specify the disclosure requirements for a discontinued operation. These notes are inserted within the relevant section or note. Therefore an agency with a change in an accounting estimate should refer to Note 3.

With effect from effective date of change the name of the Company was changed from XYZ Pte Ltd to ZYX Pte Ltd FRS 1138a FRS 1138b DV DV FRS 151a. L This publication is intended as an illustrative guide rather than a definitive statement. Related notes should be prepared for the current period and prior period.

The ordering of notes to the financial statements how the disclosures should be tailored to reflect the reporting entitys specific circumstances and the relevance of disclosures considering the needs of the users. A Restating the comparative amounts for the prior period s presented in which the error occurred. L While the IFS contain most of the usual disclosures typically found in the financial statements of.

Need for judgement Specific guidance on materiality and its application to the financial statements is. A suggested disclosure is as follows. Restatement of the income statements for the financial year ended 30 September 2009 The following table discloses the adjustments that have been made in accordance with the change in accounting policy to each of the line items in the Group and Companys income statement for the financial year ended 30 September 2009 and reclassification of prior years comparatives to conform with.