Fine Beautiful Write The Basic Sources Of Cash Flow Risk

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash is going out of your business in the form of payments for expenses like rent or a mortgage in monthly loan payments and in payments for taxes and other accounts payable.

Write the basic sources of cash flow risk. How the Sources and Uses of Cash Schedule is Set Up. Short-term financing is also named as working capital financing. Here are four steps to help you create your own cash flow statement.

The model is simply a forecast of a companys unlevered free cash flow. This is a more instantaneous way for businesses to fulfill cash flow needs. Calculating the Purchase Price to acquire a target business or asset is the first step in determining how much cash is needed and where it can be obtained from.

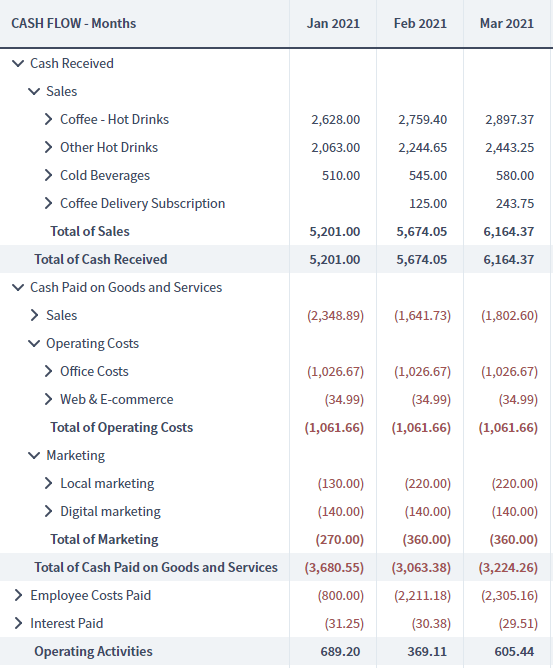

For the first month start with the total amount of cash your business has in its bank accounts. It can include cash sales receivables collections payments received from money youve loaned out etc. This is all of the money you have coming in each month.

The records may be supplemented and complemented by information from outside sources. Sometimes a company can. This is where the bank lends you money using your expected cash flow as collateral for the loan.

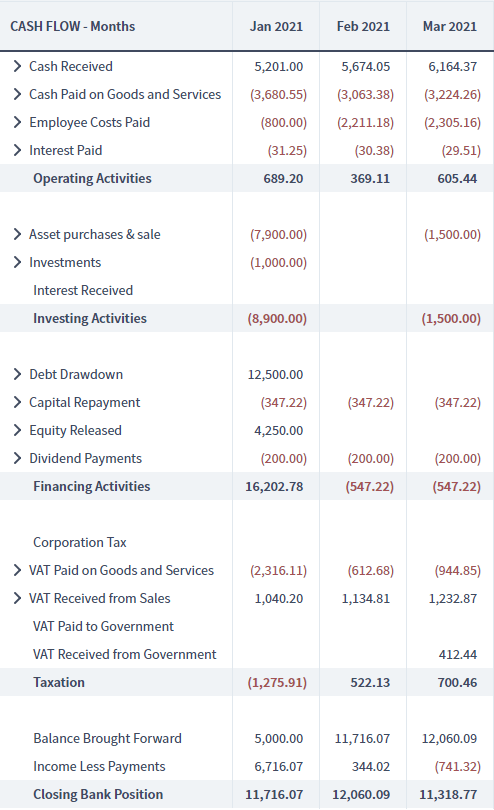

This is every expense your business may incur including payroll payments to vendors utilities rent loan payments etc. Obligations are as a percentage of total cash flow the less able the business is to assume risk. Cash flow from financing activities is the third component.

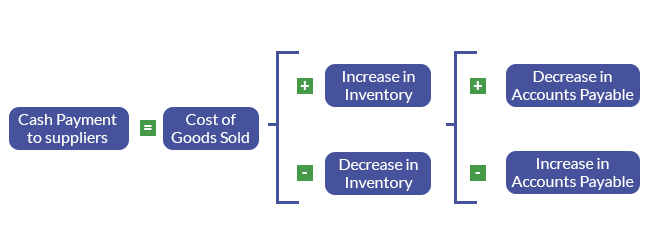

Operating cash flows are generated from the normal operations of a business including money taken in from sales and money spent on cost of goods sold COGS and other operational expenses such as. Thus financing activities mainly involves cash inflows for a business. Sources and Uses of Funds Statement A sources and uses of funds statement now replaced by the cash flow statement shows the flows in and out of the business that causes a net.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)