Outrageous Unusual Expense General Fund Balance Sheet Example

The exception is Accumulated Depreciation which as noted above is a contra asset against asset account that tracks.

Unusual expense general fund balance sheet example. An enterprise fund. Money in this fund may also. The Non-profit organizations do not use the term Capital.

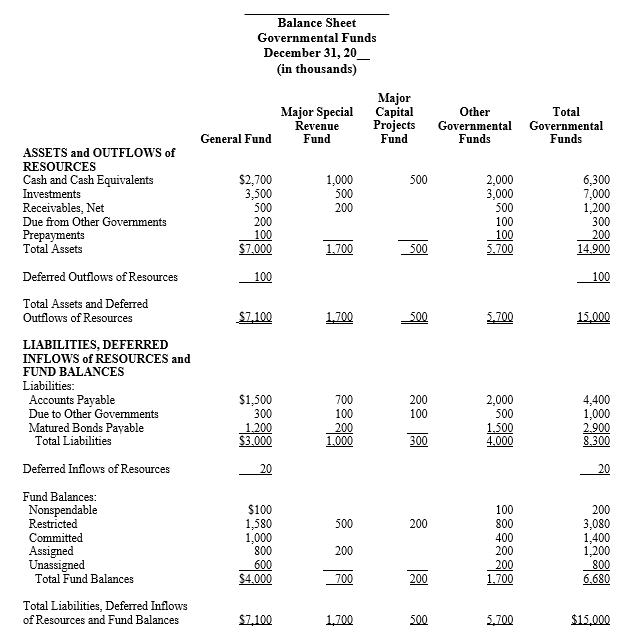

Depreciation of all exhaustible fixed assets used by the proprietary fund is charged as an expense against its operations. The statement of revenues expenditures and changes in fund balances is the income statement prepared by governmental organizations which tracks in the inflow and outflow of funds or resources. GENERAL FUND Balance Sheet June 30 1996.

Total fund balance in the general fund in excess of nonspendable restricted committed and assigned fund balance ie surplus. The General Fund is always considered a major fund. Governmental Fund Balance Sheet Accounts.

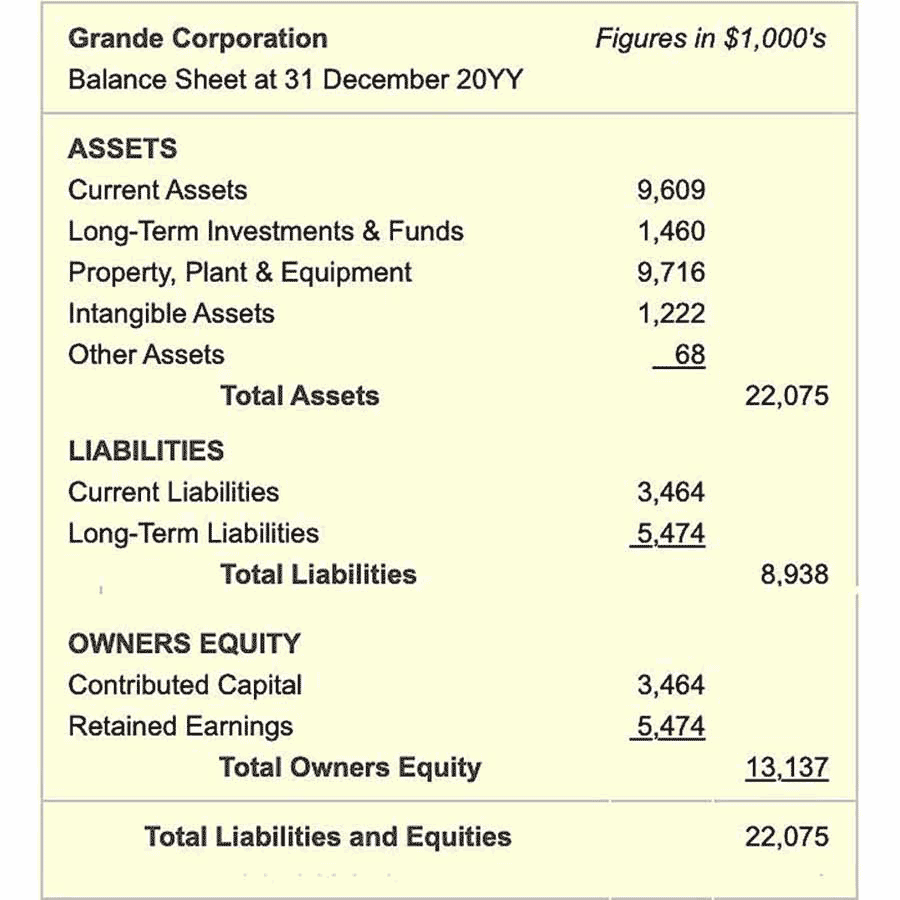

If placed in Required Supplementary Information RSI. Balance sheet of the fund net of accumulated depreciation. Fund balance and net assets are the difference between fund assets and liabilities reflected on the balance sheet or statement of net assets.

The balance sheet functions under the. That may be either unusual in nature or infrequent in. Restricted fund balance externally enforceable.

Student loans receivable. Although less than 5 percent of the designated fund balance of the general funds of the respondents to the GASBs preparer survey was unspecified the proportion rose to 56 percent of. Other governmental funds are considered major when both of the following conditions exist.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)